Payment processor

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Home page » Без рубрики

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

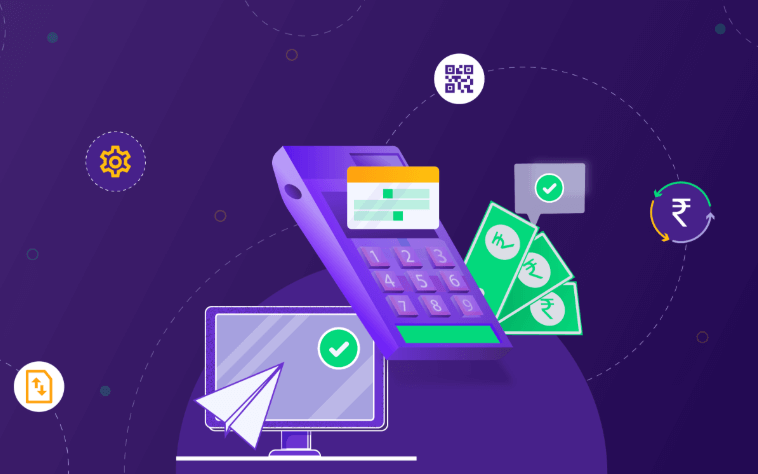

End-to-end payment processing is a process that encompasses all stages of payment processing, from the moment a customer enters their payment details to the receipt

Online payments have made shopping more convenient and faster, but for entrepreneurs an important question arises: how to efficiently organise payment acceptance?

Payments are an integral part of modern online business. Customers can use them to pay for services and goods or top up their balance in

The world is becoming increasingly interconnected, and borders are no longer a barrier to business. Companies seeking to open new markets and expand their trade

A card payment processor is an integral part of the modern financial ecosystem, acting as a link between banks and businesses that accept credit and

Singapore is one of the most technologically advanced countries in the world, where electronic payments have become an integral part of everyday life.

Today’s e-commerce market is growing rapidly and global online sales are expected to reach $9.4 trillion by 2026.

Every modern business strives to optimise its financial operations. Business-to-Business (B2B) payments play an important role in the success of any company.

Crypto Payment Gateway for High Risk Business is a secure payment processor that effectively serves risky businesses.

The e-commerce industry is changing rapidly. New trends come and go, new audiences emerge, and customer expectations change.

An electronic payment facilitator (PayFac) is a financial intermediary or organisation that simplifies payment processing for small merchants or businesses.

A payment service provider is a company that helps businesses make various money transfers. Payments can be made using debit or credit cards, e-wallets, fast

PaaS stands for Payments as a Service. It is a universal solution for business, represented by a virtual server that allows to receive and process

Billblend processes thousands of financial transactions of its partners on a daily basis. In our work, we clearly see how automated payment systems are changing

Payment gateway fraud is fraudulent activity that targets payment gateways, which serve as the technological infrastructure for secure online payments.

A forex payment gateway for forex brokers is a kind of secure bridge between the consumer and the business. They are used to process financial

As part of bank card services, issuers are obliged to guarantee the safety of customers’ funds. This affects the reputation of the credit organisation, so

P2P payments are one of the most popular ways to deposit and withdraw money from exchanges and crypto wallets, which makes many people have questions

All services are provided by Fin&Pay Partners OÜ

(Harju maakond, Tallinn, Kesklinna linnaosa, Juhkentali tn 8, 10132; Registry code: 16757225)

BillBlend acts as a payment brand for Fin&Pay Partners OÜ

ALL RIGHTS RESERVED © 2025 by «BillBlend»

Main page