How to Stop Recurring Payments: All Ways in 2026

We’ve all been there. You check your bank statement and spot a charge for that streaming service you forgot about, the fitness app you never

Home page » Blog

We’ve all been there. You check your bank statement and spot a charge for that streaming service you forgot about, the fitness app you never

Thinking about using the State Bank of India payment gateway for your business? You’re not alone. As India’s largest public sector bank, SBI’s name carries

Argentina ranks among South America’s leaders in economic scale, digitalisation, and e‑commerce. The online payment market has been growing fast lately. Local analysts say about

When it comes to transferring money and placing bets online, bankroll management (money) is one issue you’ll have to address for sure. Choosing the right

Modern user support is undergoing a profound transformation thanks to AI in customer service. The use of modern technologies makes it possible to solve common

The speed of transactions is becoming a key advantage in the calculations of international companies. Now Instant cross border payments is no longer a luxury

The speed and security of financial transactions come to the fore in business development. Instant card payment has become a solution that allows companies and

Online payments have long ceased to be just a way of paying — they are now an integral part of everyday life for billions of

Recurring payments are becoming more and more in demand in the modern economy. In 2025, the market is estimated at $158.54 billion and its growth

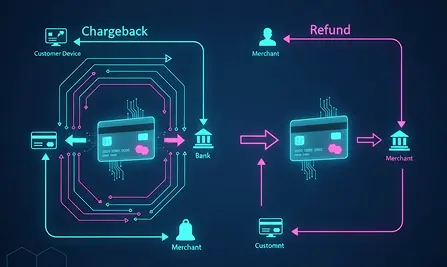

Recurring card payments on debit: guide to setup and benefits Buyers often don’t see the difference between chargeback and refund. They use both mechanisms to

In today’s digital world, subscriptions are becoming an integral part of everyday life. According to recent research, the number of BNPL users will reach 91.5

In the era of digital transformation, speed and convenience of payments are becoming competitive advantages. SEPA is a revolutionary step in the evolution of European

Indonesia is a country of islands. Bali is considered one of the main islands. It is a tourist and economic center of the country. For

Portugal is rapidly moving towards new financial realities, transforming itself into a country where digital payments have become an integral part of everyday life. Here,

Businesses are increasingly paying attention to the Indonesian market. The country ranks first in Southeast Asia in terms of GDP. The country is actively developing,

We are accustomed to fast domestic transfers. A delay of several minutes in crediting funds can cause discomfort. For businesses, transaction processing speed is also

We are used to receiving money immediately after a transfer and goods after payment at the checkout or in an online store. Modern businesses with

Smartphones in the modern world have ceased to play the role of only a means of communication. These are full-fledged gadgets that allow you to

Modern online payment methods such as A2A transfers, digital wallets, cryptocurrency, and ‘buy now, pay later’ are actively developing, but in e-commerce, one cannot forget

In today’s online dating world, payment convenience and security play a key role in the success of any service. With the growing popularity of online

Imagine this situation: your customer is about to make a long-awaited purchase on your website. A few clicks of the mouse – and it’s done!

E-commerce continues to grow rapidly, offering consumers more and more opportunities to shop online. However, despite the wide range of products and convenient delivery options,

Modern businesses in Turkey are facing a rapidly changing digital environment where traditional payment methods are rapidly losing popularity. Until recently, credit cards dominated online

In Italy, as in many European countries, cash payments have long held the lead, not inferior to non-cash payments. But in recent years, the situation