- Reading time: Reading time: 8 min min.

How to Stop Recurring Payments: All Ways in 2026

We’ve all been there. You check your bank statement and spot a charge for that streaming service you forgot about, the fitness app you never use, or a subscription you thought you’d already canceled. It’s frustrating, but you’re not alone – and more importantly, you’re not without options.Recurring payments, also known as automatic payments, are designed to make life easier. They power the subscription model that so many services rely on today, from entertainment and software to wellness and utilities. But when you no longer need a service, stopping those charges shouldn’t feel like solving a puzzle.In this post, let’s go through every sensible way to cancel recurring payments in 2026 – whether it’s connected to your debit card, credit card, PayPal account or bank account or a mobile app. We’ll also give recommendations for what to do if things don’t go well, and how to protect yourself in the future. What Are Recurring Payments & How Do They Work? Recurring payments are auto-charges that occur come through periodically – daily, weekly, monthly or yearly. They are a favorite tool among businesses that work on subscription models, like: Streaming platforms (Netflix, Spotify) Membership services (gyms, clubs) Software & app subscriptions Utility and phone bills There are two main types: Fixed payments: The same amount is charged each cycle (e.g. Netflix plan every month). Variable payments: The amount varies, based on usage (e.g., an electricity bill). But, convenient as it is, automatic payments may also become lost in the shuffle. The good news? You have the power to stop them. Why Stopping Recurring Payments Can Be Tricky (And How to Overcome It) Before diving into the “how,” it’s worth understanding why stopping recurring payments isn’t always straightforward. Many companies design their cancellation flows to be less visible than sign-up processes – a practice sometimes called “dark patterns.” You might find the “Cancel” button buried in settings, or be offered a discount instead of an immediate cancellation.And a few give phone cancellations only during business hours or have wait times. Knowing this ahead of time at least helps you prepare: be armed with details from your account, be patient and keep at it. Besides, consumer protection laws in many areas require companies to have a clear and easy way to cancel. How to Stop Recurring Payments: Step-by-Step (2026 Edition) Image link 1. Through the Service Provider (The Direct Approach) The first and cleanest way to stop recurring payments is to cancel directly with the company: Log into your account. Navigate to Settings > Subscriptions or Billing. Select Cancel Subscription or Turn Off Auto-Renew. Save confirmation via email or screenshot. Many providers now offer instant cancellation through their website or app. If not, contact customer service by phone or chat. Be polite but firm, and note the representative’s name and the date of your request. Pro Tip: If you’re canceling because of financial hardship, many companies have retention departments that may offer pauses, discounts, or flexible payment plans. It never hurts to ask. 2. Through Your Bank or Card Issuer If the merchant is unresponsive or you can’t access your account, your bank can help. Credit/Debit Card: Call your card issuer or use their mobile app to revoke authorization for future payments. Do this at least 3 business days before the next charge. Under card network rules (Visa, Mastercard), you have the right to block future recurring charges from a specific merchant. Bank Account (Direct Debit): Contact your bank to issue a “stop payment order.” Some banks charge a small fee, but it prevents further debits. Provide the merchant name, amount, and date of the last transaction. Remember: Stopping recurring payments at the bank level doesn’t cancel your contract. You may still owe money for services already received. Always follow up with the merchant in writing to confirm the cancellation of your subscription. 3. Via PayPal, Apple Pay, and Other Digital Wallets Digital wallets frequently serve as intermediaries and can simplify the management of subscriptions all in one place. PayPal: Navigate to Settings > Payments > Manage Automatic Payments. Choose the merchant and click Cancel.You’ll receive an email confirmation. Apple Pay/Google Pay: Manage your subscriptions through your Apple ID or Google Account settings. On Apple, navigate to Subscriptions in the App Store or iCloud settings. For Google,go to the Payments & Subscriptions section of the Google Play Store. These services may also have a dispute resolution service if you are charged after cancellation. 4. For Mobile Apps & In-App Subscriptions IOS: Go to Settings > [Your Name] > Subscriptions. Android: Launch Google Play > Profile > Payments & Subscriptions. Cancel directly there. If you glance through and any charges are still there, immediately reach out to the app’s or content’s support team. Note: Uninstalling the app will not cancel a subscription. 5. If You’re Under a Contract Some services come with minimum terms (such as annual tiers, gym memberships). Check your agreement: Termination prior to expiry may cost you. You may owe something for the rest of that balance. If service is bad, take a picture (screenshot, email) and argue. Bring up relevant consumer protection laws – in some cases, companies will drop charges rather than risk escalation. Do you have any more questions? Fill out the form and we will contact you *By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy. Special Scenarios: International Subscriptions and Multi-Currency Charges With more people subscribing to global services, you might face charges in foreign currencies. Here’s how to handle them: Notify Your Bank: Inform them of the international merchant to avoid fraud alerts blocking the cancellation. Use Multi-Currency Tools: Some fintech apps (like Revolut or Wise) allow you to freeze virtual cards or set spending limits per merchant. Check Exchange Rates: If disputing a charge, note the exchange rate used on the transaction date. Platforms like BillBlend, which support 70+ currencies, can also help track and manage cross-border subscriptions in one dashboard. Take Back

- Reading time: Reading time: 8 min min.

State Bank of India Payment Gateway: Review 2026

Thinking about using the State Bank of India payment gateway for your business? You’re not alone. As India’s largest public sector bank, SBI’s name carries trust and reach. But does its digital payment solution live up to the expectations of modern businesses in 2026? Let’s break it down together – no jargon, just real talk. First Impressions: The Legacy of Trust When you hear “State Bank of India,” you think of security, stability, and a branch in almost every pin code. That’s the biggest strength of the SBI bank payment gateway – instant credibility. If your customers are familiar with SBI, they might feel more comfortable seeing its name at checkout. It’s like having a veteran guard at your digital doorstep. How It Works & Who It’s For The payment gateway of SBI bank, called SBIePay, is designed primarily for Indian businesses that already bank with SBI. The setup is straightforward if you’re an existing customer. You get access to a merchant portal where you can track transactions, which settle within a reliable T+2 working days cycle. For small local shops or service providers who want to start accepting online payments without switching banks, this can be a convenient first step. Pricing and Charges Understanding the cost structure of a payment solution is crucial for any business. Below is an overview of typical charges associated with SBIePay, based on publicly available information. Please note that fees are subject to change and may vary based on your business category, transaction volume, and negotiated terms with the bank. Always confirm the final pricing with an SBI representative. Fee Type Typical Charge/Details Setup Fee Often waived for existing SBI customers; may apply for specific premium packages. Annual Maintenance Fee (AMC) Can range from ₹1,000 to ₹10,000+ per annum, depending on the plan and features. Transaction Fee (Domestic) A common model is a % of transaction value + GST. Rates typically range from 1.8% to 2.5% for cards (credit/debit) and net banking. Transaction Fee (International) Generally higher, often in the range of 3.5% to 4.5% + GST. Settlement Period Standard is T+2 working days (transaction day + 2 business days). Refund Charges A processing fee per refund transaction may apply, or the initial transaction fee might not be refunded. Chargeback Fee A significant penalty fee (e.g., ₹500–₹1000 per instance) is typically charged if a customer disputes a transaction. SBIePay vs. Other Popular Payment Solutions While SBIePay offers the trust of a national bank, modern businesses often evaluate it against other agile and feature-rich gateways. Here’s a comparative look at key players in the Indian market, including BillBlend, to help you choose the right fit. Feature / Aspect SBIePay (SBI Bank Gateway) Razorpay Paytm Payment Gateway BillBlend Core Identity Legacy banking institution’s gateway. Modern, developer-first fintech. Ecosystem giant (payments to commerce). Global subscription & billing specialist. Best For Existing SBI customers, traditional businesses seeking brand trust. Startups, tech companies, online businesses needing seamless integration. Businesses targeting mass Indian consumers, leveraging Paytm’s vast user base. Businesses with global customers, SaaS, subscriptions, and recurring revenue models. Key Strength Perceived trust & stability, direct settlement to SBI account. Excellent UX/UI, wide range of APIs, extensive documentation, quick onboarding. High consumer recognition, integrated with Paytm wallet & UPI. Unified dashboard for 70+ currencies & 100+ payment methods, deep subscription management tools. Integration Standard integration; may feel less modern. Highly developer-friendly with SDKs, plugins, and APIs. Plugins for major platforms; strong UPI focus. APIs focused on recurring billing, invoicing, and global payment orchestration. Pricing Model Slab-based, often negotiable for high volume. Transparent, published pricing; competitive rates (e.g., ~2% per transaction). Competitive, often bundled with other Paytm services. Value-based, tailored for subscription businesses; includes advanced billing features. Global Reach Primarily focused on domestic (INR) transactions. Supports international cards but not a core strength. Domestic-first, with some international payment support. Very domestic-focused (India). Built for global: collections, payouts, and multi-currency subscription management are core. Unique Offering The security and relationship backing of India’s largest bank. Payment pages, payment links, subscription suite (Razorpay Capital for loans). Paytm Postpaid (BNPL), QR code ecosystem. Holistic platform to manage the entire customer billing lifecycle globally, reducing financial ops complexity. Final Takeaway:Choosing a payment gateway depends on your business model. SBIePay is a solid, trustworthy choice for traditional businesses deeply embedded in the SBI ecosystem. For digital-native brands, Razorpay offers agility. To capture the mass Indian market, Paytm provides immense reach. If your business runs on subscriptions and serves customers worldwide, BillBlend is purpose-built to handle the complexity of recurring revenue, foreign exchange, and unified financial operations, turning global payments from a challenge into a competitive advantage. Image link The Strengths: Where SBI Excels Security and Trust of a Legacy BankSBI isn’t just a bank; it’s an institution woven into India’s financial fabric. For many customers, especially those cautious about online payments, seeing the SBI logo at checkout is like spotting a familiar face in a new place – a signal that says, “This is legitimate.” This trust is backed by standard security certifications, encryption, and mandatory two-factor authentication for cards. In short, SBIePay is a conservative but deeply reliable choice. Transparent and Predictable FeesIn a world where fees are often buried in fine print, SBI offers a clear pricing structure. This helps businesses budget without unpleasant surprises. For instance, net banking and IMPS transactions here have traditionally been affordable – a fixed fee per transaction. For companies that are already SBI customers, card processing rates are often among the most competitive on the market. That said, it’s always best to confirm exact figures with your bank manager, as they can vary based on your business volume. Seamless Fit for Existing CustomersIf your current account is already with SBI, integrating their payment gateway feels like the most natural step. You’re dealing with a familiar bank, familiar managers, and minimal new paperwork. Most importantly, all customer payments settle directly into your primary SBI account on a predictable schedule (typically transaction day + 2 working days). There’s no

- Reading time: Reading time: 9 min. min.

Online payment methods in Argentina

Argentina ranks among South America’s leaders in economic scale, digitalisation, and e‑commerce. The online payment market has been growing fast lately. Local analysts say about 85 % of internet users have bought something online at least once – and electronic payments keep gaining ground each year.But this progress has its own peculiarities. Argentina’s economy and consumer habits add a few twists to the story. For years, the country has dealt with: high inflation; strict currency controls; limits on international transactions. predictable revenue. These hurdles pushed people to look for alternatives – from local e‑wallets to mobile apps letting them pay without traditional banks.Nevertheless, cash has not lost its popularity. Older folks and people in small towns still trust it most. So today’s market is a mix of payment methods: classic card payments; interbank transfers; cash payments via intermediaries payment in cryptocurrency; digital wallets with QR codes. This variety makes Argentina’s market especially appealing – both for locals and international businesses eyeing a foothold here. Popular online payment methods in Argentina The main online payment methods in Argentina. Credit and debit cards Mastercard and Visa are traditional international systems that are widely used in Argentina. They are accepted by most online retailers and offline stores.Key features: Widespread use. More than 80% of online retailers support card payments. Security. EMV chip technology and 3D Secure protocols protect transactions. Flexibility. Consumers can use credit, debit or prepaid cards. Despite their popularity, card payments face limitations due to currency controls and high acquiring fees, which some merchants pass on to customers. MercadoPago MercadoPago is a popular electronic payment system in Argentina, occupying about 65% of the market. It is integrated with almost all major merchants and supports payments via cards, bank accounts and cash.Key advantages: Seamless integration with MercadoLibre, Argentina’s largest e-commerce platform. QR code payments in offline stores. Installment plans for expensive goods. Low fees for merchants. These criteria will help you choose the best way to accept recurring transactions. Rapipago and Pago Fácil These cash payment networks cover more than 9,000 locations (petrol stations, shops, pharmacies, etc.), allowing customers without bank cards or accounts to make transactions.Key advantages: Accessibility. They operate in remote areas. Finality. Payments are irreversible (no chargebacks). Simplicity. Customers receive a voucher to pay for online orders in cash. These systems are especially popular in regions where there are problems with traditional banking methods. Approximately 15% of the country’s population has limited access. International e-wallets Skrill, Neteller, MuchBetter and Payz e-wallets are very popular in Argentina. They are chosen for quick registration, the ability to pay without identification, and simple verification to increase limits. Electronic wallets are used for international transactions, replenishment of accounts in casinos and bookmakers, payments in online games and settlements with freelancers. Local digital wallets and mobile apps New fintech solutions such as Uala, Lemon Cash, and Buenos Aires Wallet are gaining popularity. These apps offer: instant P2P transfers; bill payments; integration with cryptocurrencies (e.g., stablecoins to protect against inflation); loyalty programmes. For example, Uala has over 5 million active users and partners with major retailers. Crypto Payments Argentina Payment in cryptocurrency is becoming more popular in Argentina.This is due to high inflation in the country and the popularity of shopping abroad in Argentina. The use of stablecoins such as USDT and USDC allows for international trade, as well as the use of crypto payments for purchases within the country.Key factors of popularity growth: Protection against inflation. Argentines use cryptocurrencies to preserve their purchasing power amid the rapid devaluation of the Argentine peso. Cross-border transfers. Cryptocurrency allows you to send money transfers and make international payments quickly and with low fees without the involvement of traditional banking intermediaries. Financial accessibility. Digital assets open up access to financial services for people without bank accounts or with limited access to banking services. E-commerce. Some online merchants accept cryptocurrencies to avoid high card payment processing fees and currency restrictions. Crypto payments are positioned as a viable alternative in Argentina’s changing financial landscape — especially for those seeking protection from inflation and the ability to conduct cross-border transactions. Regulatory environment and compliance Argentina’s economy landscape is shaped by strict regulations. The Central Bank of Argentina (BCRA) controls all financial transactions. Exchange controls restrict foreign currency transactions. Tax reporting is mandatory for companies with a turnover of more than 100,000 Argentine pesos per month.Recent changes: Mandatory use of electronic invoices (CFDI) for all online sales Tighter AML (anti-money laundering) checks for cross-border payments Do you have any more questions? Fill out the form and we will contact you *By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy. Payment gateways in Argentina Payment gateways ensure transaction security using advanced data protection technologies. They use: Encryption to protect card data and personal information; Tokenisation to replace sensitive data with unique identifiers; Fraud detection algorithms to prevent unauthorised access. The leading gateways in Argentina are BillBlend, MercadoPago Checkout, Pagomío, Red Pagos, and PayU Latam. These gateways act as intermediaries between banks, merchants, and consumers, reducing the risk of financial fraud. Optimise your finances with BillBlend: get a personalised solution for your business today. Trends and prospects When planning to open or expand a business, it is important to assess the development prospects and trends in payment methods in Argentina. Expansion of QR code payments More and more retailers are implementing QR codes for contactless payments thanks to MercadoPago and local banks. Acceptance of cryptocurrencies Stablecoins (e.g., USDT) are increasingly being used for cross-border transfers and inflation protection. Open banking The BCRA is testing an open banking API that could allow third-party fintech companies to securely access banking data. Biometric authentication Facial recognition and fingerprint scanning are being tested for high-risk transactions. Cross-border payments New partnerships with global providers (e.g., Wise, PayPal) could simplify international transfers. Statistics on payment methods in Argentina As of 2025, bank cards remain the main means of payment. They account for 54% of all transactions. Local cards occupy a

- Reading time: Reading time: 15 min. min.

Safe and fast payment methods for online betting sites

When it comes to transferring money and placing bets online, bankroll management (money) is one issue you’ll have to address for sure. Choosing the right online betting payment methods is not just about convenience – it’s about security, speed, and a seamless gaming experience from your bank account to the sportsbook and back. With a plethora of payment options, whether you’re with the classic credit card or all aboard the cutting edge crypto train, finding the right fit can be daunting.This post will take you through the world of betting payment methods in 2025. We’ll weigh the advantages and disadvantages of each choice, reveal the quickest ways to receive your winnings, and arm you with the info you need to make a good decision with respect to landing on that one payment method that, in addition to giving you peace of mind for having made a sound financial move, will ensure your money remains at arms’ reach. Introduction to Betting Payment Methods At its core, a payment method for betting sites is simply a bridge between your personal funds and your gaming account. But this bridge varies greatly. Some are superhighways (instant eWallet deposits), while others are scenic routes (bank transfers that take days). The best online betting platforms offer a diverse menu of these options because they understand that one size does not fit all. Your choice affects everything from transaction speed and privacy to eligibility for bonuses and even which sites you can play on. Understanding the variety of sports betting payment methods is the first step to a seamless experience. How Payment Gateways Work You might not see them, but payment gateways are the essential engines processing every transaction. When you click “deposit,” the gateway securely encrypts your financial data, authorizes the transaction with your bank or eWallet, and confirms the funds have moved to the sports betting operator. Think of them as the trusted, digital cashier. A reliable gateway ensures this process is not only fast but also fortified with layers of security like encryption and fraud screening, protecting your sensitive details from start to finish. Popular Payment Providers and Methods Let’s break down the most common families of payment methods you’ll encounter on betting sites, exploring the unique traits of each. Debit and Credit Cards The old reliables. Visa and MasterCard debit cards are almost universally accepted for both deposits and withdrawals. They’re familiar, straightforward, and transactions are usually instant. Credit cards, however, are on shakier ground. Many regions, including several U.S. states, have restrictions on using credit for online betting due to responsible gambling concerns. Even where accepted, credit card withdrawals are rare – you’ll typically need another method to cash out. eWallets These digital wallets act as a middleman, shielding your bank details from the betting sites. PayPal is a giant here, known for its robust buyer protection and speed. Skrill and Neteller are also staples in the gaming industry, especially in Europe. They offer instant deposits, relatively fast withdrawals, and their own prepaid card options. For many, the extra layer of privacy and control makes eWallets a top choice. Pay by Mobile This method charges your deposit directly to your monthly phone bill or prepaid balance. It’s incredibly convenient for small, quick deposits. However, limits are usually low, and it’s rarely available for withdrawals. It’s perfect for topping up your account on the go without reaching for your wallet. Prepaid Cards and Vouchers Paysafecard is the champion in this category. You buy a voucher with cash at a retail store and use the unique PIN to fund your account. It’s the ultimate tool for anonymity and strict budgeting, as you can only spend what you’ve pre-purchased. Other options like Play+ are reloadable prepaid cards specifically branded for the gaming industry, offering a good blend of control and convenience. Bank Transfers The direct approach. Bank transfers like ACH (in the US) or SEPA (in the EU) are trusted for moving larger sums securely. They are a direct line from your bank to your betting account. The trade-off is speed: deposits can take hours, and withdrawals often take 3-5 business days. They are a go-to for high rollers who prioritize security over immediacy. Cryptocurrency Payments This is the frontier. Using crypto payment gateways like NOWPayments, betting platforms can accept Bitcoin, Ethereum, and hundreds of other digital currencies. The advantages are compelling: transactions are pseudonymous, incredibly fast (often within minutes), and come with very low fees. For tech-savvy bettors who value privacy and modern finance, crypto is becoming a preferred payment method. Advantages and Disadvantages of Payment Methods Cards: — Pros: Universal, instant deposits. — Cons: Credit cards often restricted; withdrawals to debit can be slow. eWallets: — Pros: Fast, secure, great for privacy. — Cons: May have fees for currency conversion or transactions. Mobile Billing: — Pros: Ultimate convenience. — Cons: Low limits, no withdrawal option. Prepaid Cards/Vouchers: — Pros: Excellent for anonymity and budget control. — Cons: Often cannot be used for withdrawals; can be less widely available. Bank Transfers: — Pros: High security, high limits. — Cons: Slow processing times. Cryptocurrency:— Pros: Top-tier speed, low fees, enhanced privacy. — Cons: Price volatility, learning curve for new users. Fees and Limits for Popular Payment Methods Always check the fine print! While many deposits are free, some eWallets and bank transfers may incur small fees. Withdrawals are more commonly subject to fees, especially for expedited options. Limits also vary wildly: mobile and voucher methods may cap deposits at a few hundred dollars, while bank transfers can accommodate tens of thousands. Your chosen betting site will have a dedicated banking page outlining all specifics. Regional Availability of Betting Payment Options Where you live dictates what you can use. PayPal is dominant in the UK and US, while Skrill and Neteller are European favorites. Paysafecard is huge in Germany and Austria. In some parts of Asia and Latin America, localized eWallets and even cash-based options reign supreme. Cryptocurrency is borderless by nature, making it a

- Reading time: Reading time: 12 min. min.

AI in customer service: benefits, examples and use cases

Modern user support is undergoing a profound transformation thanks to AI in customer service. The use of modern technologies makes it possible to solve common problems in the work of technical support. Neural networks make it possible to respond quickly and around the clock, constantly analyze user requests and look for patterns in them. Using AI in customer service is becoming a necessity rather than following a popular trend. We will discuss the real benefits, specific examples of implementation, and strategies for the effective use of AI in customer service. What is AI in customer service? Artificial intelligence in the client service allows using modern technologies to communicate with users. User support services use machine learning, natural language processing, automation, and generative AI to study a query and select an answer to it. The main task is to speed up the speed of responses and improve their accuracy.The most common forms of AI application are: Chatbots and virtual assistants. They respond to typical customer requests, reduce the burden on specialized specialists, which increases the efficiency of the support service. Predictive analytics. Analyzes customer behavior and looks for patterns in it.This allows you to predict possible problems and take measures to solve them in advance. Automation of work processes. Speeding up routine tasks. This can be updating CRM records, sending notifications, maintaining customer communication reports, and other tasks. Sentiment and behavioural pattern analysis. Helps to better understand customer emotions and preferences, forming the basis for effective communication. Modern AI goes beyond simple programming and learns from every interaction, adapting to unique scenarios and individual customer characteristics. Advantages of AI in customer service The popularity of AI in working with clients is based on the advantages that businesses receive. Speed and continuity of support 24/7 availability. AI services operate around the clock, eliminating delays and ensuring immediate responses to requests.Minimisation of waiting time. Automating the first steps of request resolution reduces the average processing time by 30-50%.Quick response to spikes in activity. AI is easily scalable, supporting high volumes of requests without increasing staff numbers. Cost efficiency Reduced operating costs. Automating simple tasks frees you from hiring additional staff. This can result in up to 30% savings on labor costs.Budget optimisation. Reducing operating costs frees up funds for business development, closing current debts and increasing profitability. Improved customer experience Personalization. AI analytics makes it possible to analyze previous customer requests and offer personalized suggestions. This increases the conversion rate, as users get what they were previously interested in.Increased satisfaction. Personalised support increases CSAT by 15–20%.Empathetic approach. Modern AI models can determine the customer’s emotional state and adapt their communication style accordingly. Operator optimisation Freedom from routine. Automating standard procedures allows specialists to focus on complex and creative tasks.Support in decision-making. AI suggestions and prompts speed up request processing and reduce the likelihood of errors.Professional development. Employees have more time for self-development and learning new skills. Analytics and forecasting Identifying hidden trends. AI analytics detects patterns invisible to the human eye, allowing you to prepare for changes in demand in advance.Evaluating campaign effectiveness. Analyses the success of marketing initiatives and adjusts strategy in real time.Risk management. Warns of potential problems and failures, allowing proactive measures to be taken. Examples of artificial intelligence in customer service Let’s look at some examples of AI in customer service: Chatbots and virtual assistants. Answer frequently asked questions such as ‘Where is my order?’ and ‘How do I return an item?’ They route complex requests to the appropriate specialists. They integrate with CRM for access to customer data. Predictive analytics. Predicts customer churn based on behaviour patterns. Recommends products: ‘Customers who bought this item also bought…’. Assesses the likelihood of cross-selling success. Natural language processing. Analyses the tone of reviews: highlights negative comments for urgent response. Automatically tags requests: ‘complaint,’ ‘delivery question.’ Translates texts in real time for multilingual support. Workflow automation. Fills out refund forms. Generates responses based on a knowledge base. Updates order statuses in systems. Voice AI assistants. Interactive voice menus: ‘Say “balance” to find out your balance.’ Speech recognition in call centres: transcribing conversations, highlighting key phrases. Voice assistants for booking services: table reservations, doctor’s appointments. These examples of artificial intelligence in customer service show how widely the technology has been adopted and how it simplifies customer interactions. Cases of AI use in customer service International experience shows that artificial intelligence has become an integral part of customer service in various sectors of the economy. Below are some striking examples of the successful implementation of AI technologies in foreign companies. E-commerce One of the world’s leading e-commerce companies, Amazon, has implemented an AI-based personalisation mechanism called Amazon Personalise. This technology has revolutionised product recommendations by using generative AI to create a unique user experience. As a result, the company increased its sales by up to 35% compared to organisations that do not use such personalisation.The American company US Foods Inc., which is engaged in wholesale food distribution, has successfully applied AI to optimise its e-commerce. As a result, sales grew by 6.4% compared to the previous year, reaching $37.877 billion in 2024. Telecommunications Telecommunications giant Verizon has implemented an AI assistant, developed based on Google models, to support its customer service employees.This has resulted in a significant reduction in the length of phone calls and freed up staff time for active sales. In just one year, sales through the customer service department have grown by almost 40%. Spanish telecommunications company Telefónica has implemented its own project called Kernel, using Next Best Action AI Brain technology, which analyses customer behaviour and offers personalised recommendations.This innovation resulted in an increase in sales of almost 20% and a growth in the conversion rate of approximately 30%. Financial sector The well-known American financial conglomerate JPMorgan Chase has successfully used artificial intelligence tools to maintain sales volumes to its wealthy clients even during periods of serious economic turmoil. Mary Erdoes, CEO of the division, emphasised that advanced AI tools helped financial advisors respond quickly to market changes and

- Reading time: Reading time: 9 min. min.

Instant cross border payments

The speed of transactions is becoming a key advantage in the calculations of international companies. Now Instant cross border payments is no longer a luxury – it is a necessity that changes business processes and allows businesses to compete in new markets. What are instant cross-border payments? Cross-border payments are financial transactions carried out between parties located in different countries. These transactions include a wide range of settlements: payment for goods and services to foreign suppliers; receiving cash inflows from foreign buyers; transferring salaries to employees working abroad; private transfers to relatives living outside the sender’s country of residence. Until recently, such settlements were carried out mainly through traditional banking infrastructure, such as correspondent networks and the SWIFT system. This method was characterised by significant time costs (usually 3–5 business days), high commissions, and the need to go through numerous stages of control and currency conversion.However, the development of digital technologies has led to the emergence of a fundamentally new format: cross-border instant payments. Today, such transfers are made in a matter of minutes, often even around the clock, opening up completely new horizons for businesses of all sizes. Technologies shaping the future of financial flows Modern solutions are based on cutting-edge technologies: API integration: allows you to instantly connect payment instruments to your internal management systems. Blockchain and distributed ledgers: guarantee security, transparency and high transaction processing speeds. Artificial intelligence: automates compliance checks (KYC/AML), minimising the human factor and speeding up procedures. Local payment infrastructures: integration of national systems speeds up payments and reduces fees. Advantages of instant cross-border payments for businesses The use of innovative instruments brings tangible benefits to businesses in a number of areas. The use of innovative instruments brings tangible benefits to businesses in a number of areas. The ability to respond quickly to suppliers’ needs, which helps to obtain early payment discounts in a timely manner. Reduction in the time it takes to receive sales revenue, improvement in liquidity indicators. Significant reduction in dependence on credit lines and overdrafts. Expansion of geographical presence Small and medium-sized businesses get the chance to enter the international market without significant initial investment. It becomes possible to offer customers a convenient payment method that is familiar to a particular country. Creation of competitive advantages through fast service and favourable terms. Significant reduction in operational risks Losses caused by currency fluctuations during long waits for transfers to be completed are eliminated. The risks of partners failing to fulfil their contractual obligations due to technical delays are minimised. Errors that arise when manually checking large numbers of documents are eliminated. Increased customer satisfaction 24/7 availability of payment services. Immediate feedback on the status of the transaction. Clear fee structure and no hidden costs. Support for multiple currencies and payment methods. Popular modern solutions for instant cross-border payments Today, there are a number of effective tools that allow businesses to take advantage of immediate transfers: SWIFT gpi (Global Payments Innovation) – an improved version of the classic SWIFT system, providing real-time payment tracking and fast crediting of funds on most routes. National instant payment systems – such as the British Faster Payments, Brazilian PIX, Indian UPI and others, which combine the efforts of local regulators and commercial organisations. FinTech company platforms – specialised services that use the latest technologies to reduce fees and increase transaction speeds. Stablecoins and cryptocurrencies – digital assets backed by real currencies, allowing for almost instant transfers without the involvement of traditional banking infrastructure. Visa Direct and Mastercard Send card payment system services – provide fast transfers of funds directly to the bank cards of individuals and legal entities around the world. Industries that benefit most from instant payments Some areas of activity are particularly susceptible to changes in cross-border transactions: E-commerce. Reduction in the number of uncompleted orders caused by long waits for payment confirmation, fast payment of rewards to affiliates and contractors. International logistics and supply chains. Ability to accurately plan production and delivery of products thanks to guaranteed timely payments. Consulting and professional services. Immediate invoicing and payment for services rendered, strengthening of partnerships. Gig economy and freelancing. Ensuring fair remuneration for contractors regardless of their geographical location. Export and import operations. Simplify document flow and speed up settlements with foreign buyers and suppliers. Want to experience the convenience of instant cross-border payments? Try BillBlend, our API-integrated platform that provides transfers in 70+ currencies with transparent rates and 24/7 support. Sign up for a free consultation to learn how we can simplify your international payments. How to implement instant cross-border payments Step-by-step algorithm: Step 1. Evaluate your needs. Identify transaction volumes, currencies, and target markets. Identify the key requirements – speed, cost, and compliance with regulations. Step 2. Select a provider. Compare the commissions, supported countries, and integration opportunities. Evaluate the security measures – encryption, fraud detection. Check for compliance with AML/KYC and GDPR requirements. Step 3. Integrate API solutions. Work with the IT team or a third‑party developer to integrate the provider’s API into ERP/CRM systems. Test in sandboxes to ensure a smooth data flow. Step 4. Train the staff. Provide training on new workflows, dispute resolution, and fraud prevention. Appoint a compliance officer to monitor regulatory updates. Step 5. Run and monitor it. Start with a pilot program for low-risk transactions. Track key indicators: percentage of successful transactions, average processing time, and customer reviews. Scale up after the integration issues are fixed. Hotels and airlines can issue instant refunds or vouchers, reducing inconvenience for customers. Real implementation cases PayNow‑UPI (Singapore–India). The technology is compatible between Singapore’s PayNow system and India’s Unified Payments Interface (UPI). The advantage is instant transfers by phone number without the need to specify bank details. The effect is a 40-60% reduction in transaction costs compared to traditional methods, and popularity for money transfers and small B2C.IXB (EUR–USD instant payments). The participants are EBA Clearing and SWIFT, more than 25 financial institutions. Using SWIFT and EBA RT1 infrastructure for round–the-clock EUR-USD transfers. Advantage – calculations in seconds with full

- Reading time: Reading time: 11 min. min.

Instant card payment: fast and secure transactions

The speed and security of financial transactions come to the fore in business development. Instant card payment has become a solution that allows companies and individuals to transfer funds in real time. We explain how instant card transfers work, what advantages they offer to users, and how to integrate them into existing business processes. What is instant card payment? Instant transfer by card is a financial transaction mechanism in which funds are credited to the user’s card instantly. The transfer process takes a few seconds. Traditional bank transfers can be processed quickly, but they are based on a processing time of 1-5 business days. This is inconvenient and takes a long time, especially if the funds are needed now. It is for this reason that businesses and users are increasingly choosing cards with instant financial transaction processing. To connect the service and conduct transactions, the technology uses modern payment gateways, APIs for direct interaction with VISA, American Express and other card networks and issuing banks.When a payment is initiated, the system performs the following: When a payment is initiated, the system performs the following: Verification of the recipient’s card details. Checking the validity of the transaction and the available balance. Protect the transaction using encryption and anti-fraud tools. Instant transfer of funds to the card if all checks are successfully completed. Key features and benefits Instant payment cards have advantages that make this payment method beneficial for businesses and users. Real-time payments The main advantage is speed. Whether you are paying a contractor, refunding a customer or transferring funds to a friend, instant card payments ensure that the recipient sees the money almost immediately. Global coverage and support for multiple currencies Modern real-time payment platforms work with 70+ currencies, enabling cross-border transfers without the delays and high fees associated with SWIFT. Companies can pay foreign partners or employees in local currency with minimal conversion costs. Easy integration APIs and SDKs allow instant card payments to be embedded directly into applications, websites or ERP systems. Compatibility with major card networks such as Visa and Mastercard guarantees reliability and versatility. Enhanced security Teal-time card payments use: end-to-end encryption; tokenisation (replacing card details with unique tokens); 3D Secure 2.0 technology for additional authentication; AI fraud detection systems. Wide range of payment methods Support for 100+ payment methods gives users the opportunity to choose their preferred option: debit, credit or prepaid card, digital wallets or local payment systems. How instant card payments work The basis of instant payments: Payment orchestrators – intermediary software that directs transactions to the optimal payment channel. Card networks (Visa, Mastercard and local systems) process the transaction. Issuing banks verify the validity of the card and the availability of funds. Acquirers/payment providers ensure the transfer of funds from the sender to the recipient. The credit card payment instant process. The system sends a request via API, specifying the recipient’s card number, amount and currency. The payment orchestrator verifies the request and selects the optimal processing path. The card network forwards the request to the issuing bank. The issuing bank approves or declines the transaction based on the card status and available funds. Upon approval, the funds are credited to the recipient’s card account within seconds. Areas of application Real-time transfers have a wide range of uses. E-commerce Instant refunds increase customer loyalty: buyers see the money on their card immediately, rather than after several days. Gig economy Freelancers and on-demand workers receive payments instantly after completing a task, improving cash flow management. Tourism and hospitality Hotels and airlines can issue instant refunds or vouchers, reducing inconvenience for customers. Payroll It is a payroll management system that automates the payroll process for employees. It covers the accounting of time worked, the calculation of salaries, bonuses, deductions and taxes. The calculation can be carried out both internally and with the help of an external provider. B2B supply chains Businesses build supply chains with fast payments. This allows you to plan production, replenish stocks in a timely manner, and control transportation. By reducing costs and improving the visibility of vehicle movement, the efficiency and automation of all processes are increased. Compliance with standards and regulations Immediate card payments must comply with: PSD2 (Europe) – requires strong customer authentication (SCA). PCI DSS – ensures secure card data processing. Local regulations – some countries have specific requirements for reporting cross-border transfers. Providers usually take responsibility for compliance, offering businesses a ready-made solution. Instant card payment trends 2025 The main trends include the expansion of the use of RTP and FedNow systems in the United States, global growth in transaction volume, the development of mobile wallets and Open Banking. Growth in the volume of instant payments According to Juniper Research, the global volume of instant transactions will increase from $22 trillion in 2024 to $58 trillion by 2028, reflecting an increase of 161%. This growth is due to the increased use of account-to-account (A2A) wallets (for example, iDEAL, Twint) and the development of Open Banking, which allow transactions to be carried out directly from bank accounts, bypassing traditional card systems. Development of RTP and FedNow systems in the USA RTP and FedNow are two key immediate payment systems in the USA. RTP is operated by The Clearing House, and FedNow is operated by the Federal Reserve System. As of 2025, about 58% of banks in the United States that support instant transactions use both systems simultaneously, which has become standard practice to ensure sustainability and expand coverage.FedNow processes domestic payments in the United States around the clock, with immediate settlement and instant transfer of funds. The FedNow transaction limit has increased from $25,000 at launch to $10 million by November 2025. RTP supports transactions of up to $1 million and uses the ISO 20022 standard to transfer rich data (for example, account numbers, account references). The growth of Mobile Wallets and Open Banking The mobile wallet segment is expected to grow from $12.85 billion in 2026 to $104.69 billion by 2033, with a compound annual

- Reading time: Reading time: 13 min. min.

Most popular online payment methods by country

Online payments have long ceased to be just a way of paying — they are now an integral part of everyday life for billions of people around the world. But despite the general digitalisation, approaches to payment vary greatly depending on the region.What is familiar to residents of Europe or North America may not be suitable for users in Asia or Latin America. Therefore, the right choice of payment methods is key to the success of any company planning to enter the international market.Today, we will look at the most popular online payment methods by country and find out what factors influence the choice of one method or another. This will allow us to form a comprehensive picture of the situation on the global market and provide practical recommendations for adapting payment solutions for business. Global trends in online payments Rapid development and constant changes are familiar companions of the modern online payment market. The high dynamics of the industry is influenced by the widespread use of smartphones and mobile devices, the active development of payment infrastructure, and increased confidence in non-bank payment technologies.Among the most popular online payment methods, several groups stand out: Bank cards (credit and debit) remain the leader in Western countries, but are gradually losing ground in the Asian region. Digital wallets (such as Apple Pay, Google Pay, Alipay) are showing impressive growth thanks to their convenience and level of security. Direct bank transfers (SEPA Credit Transfer, Automated Clearing House) are particularly popular in Europe and Latin America. Mobile payments (SMS, QR codes) are gaining recognition mainly in developing countries. Cryptocurrencies remain a niche category, but one that has been actively expanding in recent years. According to forecasts by research company Juniper Research, by 2030, the volume of contactless payments will exceed $18,1 trillion, with digital wallets accounting for about 40% of all online transactions. The most popular credit cards and online payment methods Here are the 10 most popular credit cards and online payment methods worldwide. Visa Visa confidently maintains its leadership position in the global market, covering more than 200 countries and accounting for approximately one-third of the global market. Its advantage lies in its broad geographical coverage and high level of consumer trust. In 67 countries around the world, VISA credit and debit cards remain the market leader in e-commerce. The popularity of these cards is also influenced by their widespread use in everyday life. They can be used to pay in physical stores, receive salaries or make frequent transfers. Mastercard Mastercard is close behind Visa, with similar coverage and a focus on premium products. It is particularly popular among the middle class and the wealthy. The payment system is especially widespread in Europe. Mastercard has a large market share in France, Italy and Germany. UnionPay In 2002, China created its own card payment system, UnionPay. In terms of global popularity, it lags significantly behind VISA and MasterCard, but in the Asian region, the system is very popular.In China, card payments rank second after digital wallet payments, but this share includes not only UnionPay but also other cards. In total, the system serves customers from more than 150 countries, but the main flow of payments is in the domestic market. American Express AmEx is traditionally associated with the premium segment and is highly valued by users in the United States and a number of European countries. Despite its smaller reach, the brand is renowned for its quality of service and exclusive privileges for cardholders.In South America, the operator ranks second in terms of the number of e-commerce transactions, second only to VISA. In North America, Europe, Asia and Oceania, American Express is less popular than VISA and MasterCard, but it is among the top 5 most popular payment methods for online purchases. Discover Discover is mainly prevalent in the United States, while its presence outside the country is limited. Nevertheless, it remains an important player in the American financial market. Discover differs from VISA and other operators in that it issues cards through its own bank, while other operators use partners for this purpose. Alipay Alipay has become a real phenomenon in the Chinese market, bringing together over a billion active users. The uniqueness of the service lies in its deep integration with the QR payment system, which makes it an indispensable tool for local residents. Alipay is owned by the Alibaba Group and is integrated with many popular e-commerce platforms in China. PayPal PayPal has earned a reputation as a reliable digital wallet with an audience of over 400 million users worldwide. It has achieved the greatest recognition in the field of e-commerce and international transfers.PayPal ranks first in Africa, Asia, Europe and Oceania in terms of e-commerce transaction volume. In North and South America, the digital wallet is losing out to card payments. VISA ranks first in the New World, while PayPal ranks third in North America and fourth in South America. PayPal has earned a reputation as a reliable digital wallet with an audience of over 400 million users worldwide. It has achieved the greatest recognition in the field of e-commerce and international transfers. Apple Pay Apple Pay leads in countries with a high proportion of Apple product owners, offering the highest level of security thanks to biometric authentication and data tokenisation.This digital wallet is not among the top five payment methods only in South America. In Europe, Oceania and North America, it ranks fifth, and fourth in Asia. Google Pay Google Pay is gaining momentum in regions where Android devices predominate, constantly improving the user experience and introducing innovative solutions. In the global e-commerce market, Google’s wallet ranks eighth with a 4.3% share. Klarna Installment services are becoming an increasingly important payment method. They allow you to buy goods in instalments, which makes it possible to purchase expensive items without overpaying or taking out loans. According to experts, the ‘buy now, pay later’ market will grow to $167.58 billion in 2032, with an average annual growth rate of

- Reading time: Reading time: 11 min. min.

Best payment processor for recurring

Recurring payments are becoming more and more in demand in the modern economy. In 2025, the market is estimated at $158.54 billion and its growth in the near future will be 7.2% annually. The model with regular write–offs is used by different types of businesses, from streaming services to SaaS platforms. Choosing the best payment processor for recurring payments affects customer retention, conversion rate, and overall business profitability.In this review, we will look at what regular payments are, why it is so important to choose the right provider, and present the top 10 solutions that can optimize the automated debit process. What are recurring payments? Recurring payments are automated periodic debits from a customer’s card or account according to a pre-agreed schedule. They allow you to: eliminate the need for customers to manually pay for their subscription; guarantee a stable cash flow for your business; reduce customer churn; automate subscription billing and reduce operating costs. Typical areas of application include content subscriptions (Netflix, Spotify), SaaS services (CRM, cloud storage), membership fees (fitness clubs, professional associations), and regular deliveries (food boxes, cosmetics). Top 10 processors for recurring payments We analysed the market for recurring payments gateway. Below are the top 10 best recurring payment processors. BillBlend: High risk payment gateway for recurring billing BillBlend is a modern payment gateway designed specifically for high-risk business areas such as online casinos, gambling, travel services and similar sectors. This service is highly adaptable and offers a personalised approach to each client, making it the ideal choice for companies of all sizes.Key features and benefits of BillBlend: Customised pricing. There are no fixed rates, which is particularly beneficial for companies with low turnover. Customers are invited to submit an application on the website, providing the necessary business details, after which specialists will select the optimal terms of cooperation. Wide currency support. The platform supports over 100 currencies, which is ideal for international companies and facilitates cross-border payments. Security and confidentiality. The use of multi-level data encryption and real-time technology to detect fraudulent transactions ensures maximum protection of customers’ personal and financial data. Effective chargeback management. With modern technology and professional advice, BillBlend helps minimise financial losses associated with chargebacks. Professional support service. 24/7 customer support ensures quick resolution of any issues or problems that may arise. BillBlend supports a wide range of methods, including credit and debit cards, e-wallets, and direct bank transfers. Geographically, the service covers a significant portion of the global market, making it convenient for companies operating in different countries and regions.In addition to basic processing functions, best payment processor for subscription businesses 2025 BillBlend offers a number of useful add-ons: Analytics and statistics: Detailed reports on payments and transactions, allowing for deeper analysis of the financial activity of the business. CRM system integration: Simple and convenient integration with popular CRM solutions, facilitating customer accounting and management. Scalability: The platform easily adapts to the needs of a growing business, ensuring a smooth transition from the initial stage to large projects. BillBlend is a powerful and flexible tool for companies operating in high-risk sectors of the economy. With customised rates, broad currency support, and a host of additional features, the service is a reliable partner for businesses seeking to ensure smooth and secure processing of recurring payments. Stripe Stripe is known for its innovative approach to payment processing and offers powerful tools for automating recurring payments. The service is popular among tech startups and fast-growing companies.Advantages Modern API for developers Automated credit card updates Advanced fraud analysis and prevention capabilities Connection to various banking systems Disadvantages: Difficult to set up for unskilled users and relatively high fees for small businesses. FastPays A specialised service for subscription businesses, FastPays offers transparent terms of cooperation and easy setup of regular payments. Ideal for small and medium-sized businesses that value simplicity and reliability. Advantages: Transparent pricing policy Quick integration with accounting systems Minimisation of payment failure risks Good technical support Disadvantages: limited number of supported countries, less developed analytical tools. PayPal: Universal payment service for regular payments PayPal is a world-renowned payment platform that operates in more than 200 countries and allows you to make fast and convenient online transactions. This system is popular among individuals and companies due to its wide range of features and reliable payments.Key features and advantages of PayPal: International availability. The platform covers almost the entire world, making it ideal for companies targeting an international audience. Currency diversity. A huge number of world currencies are supported, which is extremely useful for multi-currency settlements. Ease of use. The interface is intuitive even for beginners, and registration takes a minimum of time. High level of security. Modern encryption and verification methods provide reliable protection for user data. Brand popularity and recognition. Millions of users around the world trust PayPal, which has a positive impact on the image of companies using this platform Subscription management. PayPal has a built-in program that allows you to link and manage subscriptions, update information, track transactions, and change the payment method. Retries for failed payments. You can set the number of debit attempts and the interval between them. PayPal also allows you to fix the debt and add it to new debits. PayPal operates in 200+ countries around the world, which makes it one of the most popular payment methods. PayPal attracts the attention of those companies that enter new markets, as this option is supported in most regions of the world. It is considered a reliable and convenient service for regular write-offs, which is suitable for both small, medium and large businesses. Chargebee Respond to requests immediately. Provide customers with complete information about the status of their orders. Organise convenient customer support for urgent requests.Advantages Ability to test different pricing models Advanced customer retention mechanisms Deep analytics and forecasting Scalability for growing businesses Disadvantages: Quite high cost for small businesses, some lag in support for new technologies. GoCardless GoCardless specialises in automated bank payments, offering a simple and secure way to collect recurring payments directly from

- Reading time: Reading time: 10 min. min.

Difference between chargeback and refund: key distinctions explained

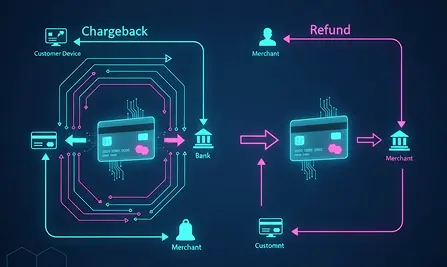

Recurring card payments on debit: guide to setup and benefits Buyers often don’t see the difference between chargeback and refund. They use both mechanisms to refund money on a completed purchase. But for businesses, these concepts are very different, both in terms of return mechanics and legal aspects, including the impact on reputation and attitude on the part of providers. Understanding the chargeback and refund difference will allow entrepreneurs to effectively manage risks, improve customer service, and protect their financial stability. Payment reversal and refund: are they the same thing? Despite having a similar end goal – returning money to the customer – the mechanisms differ fundamentally in terms of who initiates them, the procedure involved, and the consequences. The table below shows the main differences between chargebacks and refunds. Criterion Refund Chargeback Initiator Seller (independently or at the buyer’s request) by agreement from the merchant Buyer (via bank or payment system) Mechanism Voluntary transfer of funds back to the customer’s card Enforced collection of funds via card-issuing bank Deadlines Usually 3–14 days Up to 180 days depending on the payment system and dispute circumstances Commissions No high commissions for the seller High commission ($15–$100+) plus possible penalties Need for bank involvement The acquiring bank is not involved Mandatory involvement of the customer’s card-issuing bank Reason for refund The seller’s internal policy is sufficient Requires proof of transaction illegality (documents, screenshots, call records, etc.) Impact on seller’s reputation Neutral Negative (increase in chargeback rate, risk of account blocking) Possibility of dispute No Possible How does a refund work? A refund is a voluntary return of money by the seller to the customer’s card. This operation takes place as follows: Customer request. The buyer requests a refund from the seller. Reasons may include defective goods, cancelled orders, discrepancies with the stated description, and other circumstances. Seller verification. The company reviews the refund request in accordance with its own refund policy. Sending a request. The seller sends instructions to the payment system or bank regarding the amount and reason for the refund. Refund. The client receives the money back, while the seller sets acceptable deadlines himself. This is usually 3-14 days. The main advantages of refunds for businesses are control over the return process, no penalties or fees, preservation of the company’s positive image, and direct contact with the customer, which helps to strengthen trust. How does a chargeback work? A chargeback is a much more complex procedure initiated by the customer themselves through the card-issuing bank. The mechanism includes the following stages: Customer application. The cardholder contacts their bank with a complaint. For example, in the event of fraud, non-delivery of goods, double debiting, etc. The bank initiates the process. The issuing bank launches the chargeback procedure, debiting the specified amount from the merchant’s account. Seller notification. The payment system notifies the merchant of the dispute. Representment. The seller has the right to present evidence of the legality of the transaction. For example, confirmation of delivery, customer consent, etc. Bank assessment. If the evidence is convincing, the amount is returned to the seller; otherwise, it remains with the customer. The main consequences of chargebacks for businesses are commissions and penalties for the seller, a deterioration in the chargeback rate rating (exceeding the threshold threatens the loss of bank acquiring), the need to collect and provide extensive documentation, and the loss of time and resources to resolve conflicts. Why do buyers choose chargeback instead of refund? Buyers sometimes deliberately resort to chargeback, despite the existence of a simple refund mechanism. Here are the main reasons for this behaviour: Distrust of the seller. If the store ignores requests or deliberately delays the consideration of returns. Lack of transparency in the return policy. Confusing application forms, long processing times, unclear requirements. Lack of communication with the store. Situations where it is impossible to contact the seller – store closure, fraudulent schemes. Desire to speed up the process. Some believe that the bank will handle it faster than the seller. Insufficient understanding of the difference. Many buyers do not know that a chargeback is a last resort, not an alternative to a regular return. It is important to note that sometimes the buyer can receive double reimbursement. For example, they first requested a refund and then initiated a chargeback. This is possible if the buyer decides that the seller has ignored the request. In practice, the funds are not received immediately, but with a delay of 3-14 days. If it happens that I got a chargeback and a refund, then one of the refunds may be disputed by the seller and debited from the customer’s card. Psychological aspects of choosing a chargeback It is important to note that the choice of a chargeback instead of a refund is often due not only to objective reasons, but also to psychological factors: Fear of losing money: the customer fears that the seller will refuse to voluntarily return the funds. Perception of fairness: contacting the bank is perceived as a fairer and more effective way to restore rights. Social approval: there is a widespread belief that chargeback is a simple and quick way to resolve a conflict. These points should be taken into account when developing a customer communication strategy. How can businesses minimise the risks of chargebacks and return issues? Effective risk management requires a comprehensive approach that includes the following steps. Simplify the return process Clearly state the return policy on your website. Provide users with a simple automated application form. Process returns quickly – within 3–5 business days. Improve communication with customers Respond to requests immediately. Provide customers with complete information about the status of their orders. Organise convenient customer support for urgent requests. Document every transaction Keep proof of delivery of goods. Keep records of telephone conversations and correspondence. Record electronic confirmations of customer consent. Work with customers Explain the difference between a refund and a chargeback. Recommend that they first request a regular return. Monitor chargeback metrics Constantly monitor the chargeback rate.

- Reading time: Reading time: 11 min. min.

Recurring card payments on debit: guide to setup and benefits

In today’s digital world, subscriptions are becoming an integral part of everyday life. According to recent research, the number of BNPL users will reach 91.5 million in 2025, and the annual increase in the total volume of regular payments is estimated at 9%. Recurring card payments, which are automated debits of funds according to a set schedule, are becoming increasingly important. Let’s take a closer look at how these payments work, what benefits they bring to businesses and customers, and how to organise their implementation effectively. What are recurring debit card payments? Recurring payments on debit card is the automatic debit of a certain amount at a predetermined time. This model is used in e-commerce, online services, online schools, and businesses where payment for subscriptions or other services is provided.Using regular payments frees customers from having to fill out a form for debiting money every time. It is enough to indicate your details once, familiarize yourself with the schedule and agree to periodic write-off. Using this model, a business can plan a budget and ensure a stable cash flow. How does it work in practice? The recurring payment process consists of a few simple steps: Customer authorisation. The user agrees to repeat charges once, for example, when registering on the platform or purchasing a subscription. Payment token storage. Instead of storing card numbers, tokenisation is used – replacing real data with a unique encrypted identifier that complies with PCI DSS requirements. Automatic debit. On the selected date, the system initiates the payment itself, debiting the required amount from the customer’s card. Funds crediting. The money is credited to the company’s account, and the client receives a notification of the transaction. Regular payment parameters The main parameters that determine the regular payment scheme: Frequency: monthly, weekly, quarterly or annually. Payment amount: fixed or dependent on the volume of services provided. Duration: indefinite (until cancelled) or limited in time. Notifications: automatic alerts to the customer about upcoming debits. Where are recurring payments used? Recurring payments are most common in the following areas: Online services (streaming, cloud storage, subscription software). Telecommunications (internet, television, mobile operators). Educational platforms (online courses, webinars). Fitness clubs and sports apps. Charitable donations. E-commerce (subscription boxes, cosmetics, food). Differences from direct debit There is often confusion between recurring payments from a card and direct debit. Below are the key differences. Criterion Regular payments from a card Direct debit Initiator Company (based on a saved token) Customer’s bank (under a signed mandate) Enrolment period 1–3 working days Up to 5 working days Customer management Via the service interface or bank Only through revocation of the mandate Commission Percentage of the amount, usually 1.5–3.5% Fixed rate + commission Flexibility Easy to change Requires mandate renewal Risk of chargebacks High Low Recurring card payments are ideal for digital products with international users, while direct debit is preferable for local markets with fixed tariffs. Who will be using the subscription model in 2025 Key industries and dynamics: SaaS and cloud services. In 2025, the market is estimated at $578 million. Media and entertainment. Streaming platforms are growing by 18% annually, with 60% of users having 2+ content subscriptions. E-commerce. Subscriptions for essential goods (cosmetics, food) – 35% growth, automation of repeat orders through recurring payments. Fintech. Regular investments and savings – 50% customer growth, micro-subscriptions for financial advice and portfolio analysis. Education. Online courses with monthly payments – 28% growth. Corporate subscriptions for staff training. Health and wellness. Fitness apps and telemedicine – 40% growth, subscription boxes with dietary supplements and vitamins. This growth is driven by the benefits that businesses gain from using the subscription model and implementing regular card payments. Accounting automation Reduction in accounting workload by up to 40%. Reduction in operating costs. Integration with CRM and ERP systems. Stable financial flow 85-90% accuracy in revenue forecasting. 60% reduction in cash gaps. Access to financial instruments for future payments. Business scalability Work with more than 70 currencies. Support for over 100 payment methods. Compliance with international standards (GDPR, PSD2, CCPA). Reduced customer churn Increased customer loyalty (70% stay longer than six months). Personalised notifications and promotions. Audience analytics and segmentation In-depth analysis of consumer behaviour. Testing of various pricing models (A/B testing). Creation of individual tariff plans (‘family’, student and other options). Security and legal transparency Automatic receipts and confirmations. Transaction history for dispute resolution. Compliance with tax obligations. Do you have any more questions? Fill out the form and we will contact you *By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy. Recurring payments vs Direct debit Recurring payments and direct debit are two ways to automate periodic debits, but they have fundamental differences.Direct debit assumes that the recipient initiates repayment from the payer’s account based on a pre-issued order. The payer sets only general conditions, the amount and date of the debit may vary.Periodic payments are pre–programmed repayments for a fixed amount, which the payer sets independently.Advantages of regular pay: Full control of the payer: you set the amount, date and frequency of payment yourself. Transparency: there is no risk of unexpected write–offs – everything is strictly on schedule. Flexibility: it is easy to change or cancel a payment at any time. Security: you do not need to provide access to the account to third parties. Versatility: they work with cards and electronic wallets, do not require a bank mandate. Recurring payments provide more control and predictability, reducing risks for the payer. How to set up recurring payments: step-by-step instructions To successfully implement recurring payments, follow these simple recommendations Step 1. Select a payment provider Evaluate providers based on the following criteria: Support for the necessary currencies and payment methods. Commission rates and terms of cooperation. Availability of a high-quality API for integration. Step 2. Organise card tokenisation Store only tokens, not actual card numbers. Use modern data encryption. Update security certificates in a timely manner. Step 3. Determining the payment schedule Set an appropriate payment frequency.

- Reading time: Reading time: 7 min. min.

SEPA instant payments: understanding SCT inst and EPC schemes