Home page » Global Payment Solution » Payment Gateway in Uganda

Instant transfers

Low fees

Business integration

24/7 Support

Security first

Global capabilities

WE OFFER

Instant transfers

Low fees

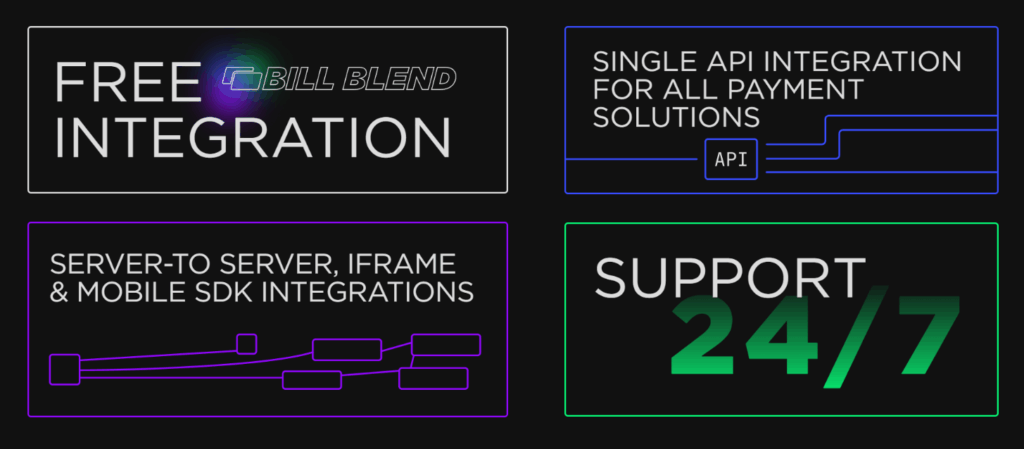

Business Integration

24/7 Support

Security First

Global capabilities

Join BillBlend and discover a new level of convenience and reliability in managing your finances!

The country’s payment solutions market is characterised by a wide choice and variety of offers. Below are the most popular online payment methods in Uganda:

Answer 5 questions and find out the cost

By clicking on the button, you agree to the data protection policy

Reviews

Сreate a customized solution for the specifics of your business

Angelina, Key Account Manager

Our solutions

Additional information

The world is becoming increasingly interconnected, and borders are no longer a barrier to business. Companies seeking to open new markets and expand their trade turnover face the need for fast and secure payment processing in different countries.

BillBlend does not have a fixed rate. All rates are discussed individually, taking into account the specifics of the business and its turnover.