E-commerce continues to grow rapidly, offering consumers more and more opportunities to shop online. However, despite the wide range of products and convenient delivery options, many businesses face a serious problem: losing potential customers just before they complete a transaction. Why does this happen?

Research shows that one of the key factors in abandoning a purchase is inconvenience or lack of trust in the payment method. Customers want to be able to choose between different payment methods, complete transactions quickly, and feel confident that their financial data is secure.

That is why integrating a reliable payment gateway is becoming a critical task for any modern online business. The right solution not only reduces the number of abandoned shopping carts but also significantly increases audience loyalty.

Billblend recommends approaching the selection and configuration of this service with the utmost responsibility, as this element directly shapes your brand image and the customer’s impression of their interaction with your resource. We will take a detailed look at the technical aspects of connecting the Billblend payment gateway, provide step-by-step instructions for each stage of setup, and offer practical advice on ensuring secure and efficient operation.

By following our recommendations, you will be able to confidently integrate the gateway into your resource and significantly increase the efficiency of your business in the competitive e-commerce environment.

What is a payment gateway

A payment gateway is a specialised service used by companies to process and authorise digital payments from customers on the Internet. Essentially, it is a virtual copy of a bank terminal. The customer enters the details, the service verifies them, and then decides whether to approve the transaction or not. Depending on the payment method, you may be asked to perform an additional action to confirm the transaction.

In addition to directly confirming the transaction, the service performs important additional functions, such as communicating with the bank, encrypting and protecting personal data, and protecting the seller from fraud. The main goal of such a solution for businesses is to make purchasing goods simple, fast, and secure.

In addition to the basic payment processing functionality, modern services often have additional features such as support for various payment methods (not only cards, but also mobile apps and cryptocurrency wallets), transaction analytics, fraud prevention tools, and much more. Some major market players even allow large sellers to customise their service terms, offering unique rates and options tailored to the specifics of their business.

The Billblend platform is an example of a multifunctional payment gateway that supports a huge number of payment methods, covering international markets and various types of financial instruments. For example, Billblend offers customers a wide range of features, including:

- acceptance of multiple payment types (bank cards, e-wallets, cryptocurrency);

- automatic payment routing mechanisms to optimise fees;

- risk analysis and fraud prevention tools;

- easy online payment gateway integration via API and ready-made modules for different platforms;

- low transaction costs and transparent pricing policy.

These features allow businesses to minimise settlement costs and create a comfortable environment for buyers.

How is a payment gateway different from a payment system?

Many users often confuse the concepts of ‘payment gateway’ and ‘payment system.’ Let’s take a closer look at the key differences between these two important components of modern e-commerce.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

What is a payment system?

It is an infrastructure that facilitates the exchange of funds between market participants. Such systems include well-known brands such as Visa, MasterCard, and American Express. Their main task is to establish uniform standards and rules that banks, merchants, and customers follow when conducting transactions.

The role of a payment gateway

It acts as a link between the merchant’s website and the banking infrastructure. It is through the gateway that purchase data passes, ensuring the transfer of transaction information and protecting users’ personal data. The gateway guarantees the security of the payment process and simplifies interaction between all parties to the transaction.

Why both elements are important

These two components are closely interrelated and interdependent. Without a reliable system, it is impossible to process money transfers, and without a properly configured gateway, it is difficult to make online payments. Only a harmonious combination of both technologies ensures comfort and security for end users and the success of the business as a whole.

How a payment gateway works

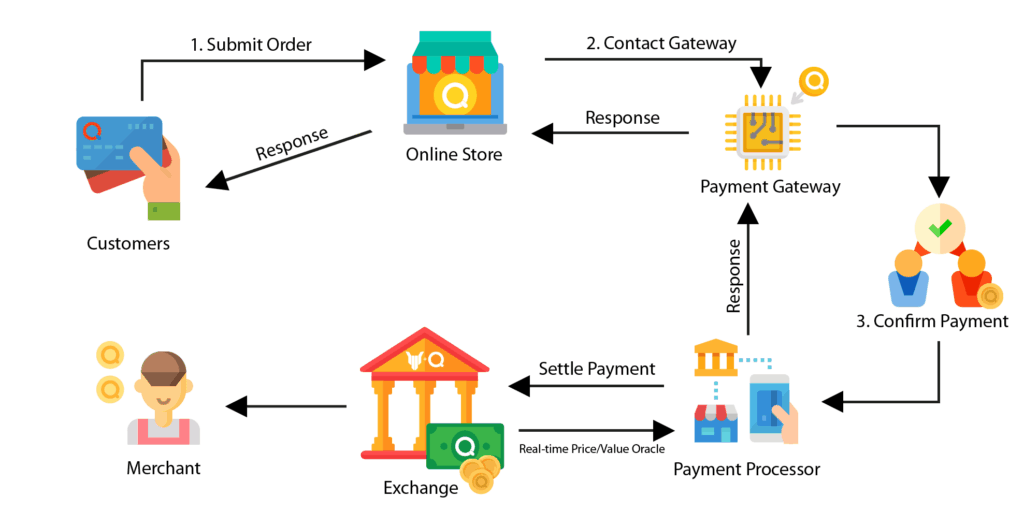

Let’s take a step-by-step look at how a transaction is processed through a payment gateway:

- The buyer selects a product. When the buyer adds a product to their cart and proceeds to checkout, they are taken to a page where they can enter their card or e-wallet details.

- The data is sent to the server. The information entered by the customer is immediately encrypted and transmitted to the payment gateway server. This procedure protects personal information from being intercepted by malicious parties.

- The request is sent to the payment system. The payment gateway redirects the received data to the payment system corresponding to the card type (Visa, MasterCard, etc.).

- Verification by the issuing bank. The request is sent via the payment system to the issuing bank that issued the buyer's card. There, the account is checked for sufficient funds and suspicious activity.

- Decision to make the payment. If the verification is successful, the bank confirms the transaction and sends a positive notification back through the payment system and gateway.

- The transaction is complete. The buyer receives a message confirming that the payment has been completed, and the seller receives confirmation of the purchase.

- Financial settlement. Within a few business days, the money is transferred to the seller's account, bypassing any intermediary structures.

This multi-step process is automated using special technologies and security systems, making it fast and reliable.

Detailed process of integrating a payment gateway into your website

The payment integration gateway for website guide is designed to improve the reliability and convenience of online transactions. We will look at the key steps, using the example of the Billblend payment gateway, which offers extensive options for implementing and configuring a payment system.

Stage 1 – choosing a payment gateway

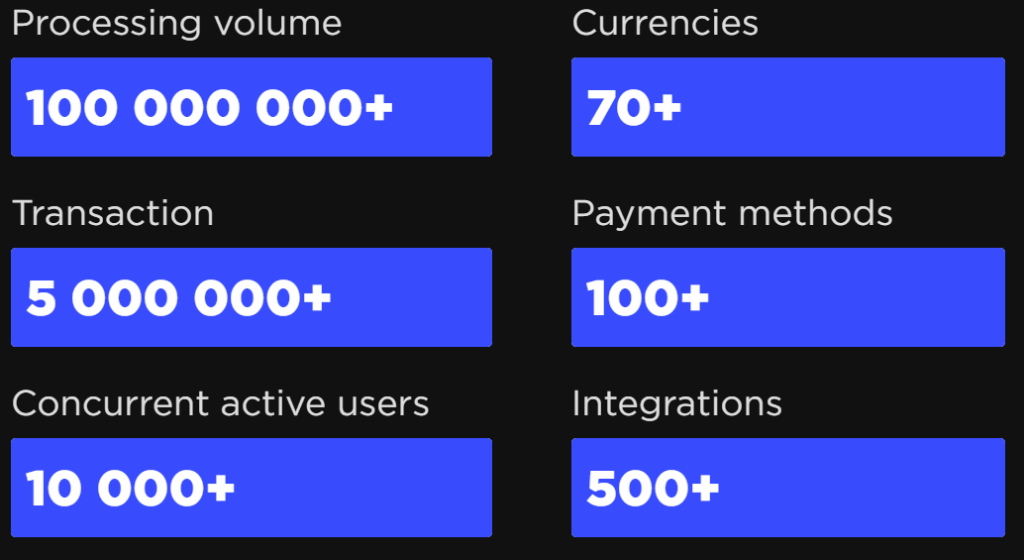

First, select a suitable payment gateway, considering factors such as transaction fees, variety of payment methods, support for the required currency, and interface languages. Billblend offers a high degree of customisation for specific regions and types of businesses, including international payments and support for a large number of alternative payment methods.

Key selection criteria:

- the cost of each transaction and additional fees;

- a variety of currencies, cryptocurrencies, and support for modern payment methods;

- security and anti-virus measures;

- ease of integration and availability of technical support.

Billblend supports a wide range of payments, including VISA, MasterCard, UPI, Mobile Payments and many others, providing security and flexibility for different regions of the world.

Stage 2 – Create a merchant account

To work with any gateway, you will need a settlement account to which transfers from customers will be sent. BillBlend supports customers every step of the way. After receiving advice from our specialists, you will be provided with instructions on how to open an account and what you need to do to connect it to the service.

Step 3 – Learn the API and SDK

Review the API documentation and toolkit (SDK) for your chosen payment gateway. Learn the data transfer specifications, request formats, and response formats. Most payment systems provide detailed documentation and code samples to facilitate integration.

Billblend offers a simple API and ready-made solutions for quick integration, helping to reduce development time and implementation complexity.

Step 4 – Installation and configuration

Use the SDK or API to payment gateway integration for website. There are two options here:

- ready-made plugins and modules for popular platforms (WordPress, WooCommerce, Magento)4

- manual installation via API if your platform is unique or requires special settings

For example, to integrate a payment gateway into a website, simply follow the instructions in the documentation, install the required packages, and configure the appropriate settings. Our representative will support you at every stage.

Stage 5 – Test the integration

After completing the configuration of transaction processing methods, testing is required. This allows you to evaluate the process itself and determine whether adjustments are necessary.

When testing, pay attention to the following aspects:

- transaction processing time;

- error handling and message clarity;

- user interface and ease of navigation;

- supported payment methods and currencies.

If there are no errors in any of the parameters, you can proceed to using the gateway to receive all transfers from clients.

Stage 6 – launch and monitoring

Once testing is complete, Billblend assists with full integration into your website. Special attention is paid to payment security, so SSL certificates and additional measures to protect customer data and minimise fraudulent transfers are added.

The process of adding new payment methods requires attention to detail, so BillBlend supports customers at every stage. It all starts with a free consultation, followed by selecting the optimal tariff, configuration, testing, and launch.

Advantages and disadvantages

Advantages

- Convenience for customers. The service offers a wide range of payment methods. Customers can be sure that they will be able to pay for their purchases using a bank card, e-wallet or cryptocurrency. This increases user loyalty.

- Support for different currencies. Large payment gateways, such as Billblend, support multiple currencies, allowing you to attract an international audience and grow your business globally.

- Fast payment processing. All transactions are processed in real time and without delays. Customers do not spend much time making a purchase; they enter their details and receive a response almost instantly.

- Increased conversion. Convenient payment options, fast request processing and a user-friendly interface increase customer loyalty, which leads to repeat purchases and, consequently, increased profits.

- Anti-fraud and security. Modern gateways are equipped with fraud detection and prevention tools, providing an additional level of protection for business owners and customers.

Disadvantages:

- Commission fees. Each payment is subject to a commission fee, the amount of which varies depending on the terms of the agreement. Over time, the amount of fees can significantly affect the profitability of the business.

- Maintenance requirements. To keep the payment gateway running smoothly, you'll need to do regular updates, bug fixes, and keep an eye on data security. This takes time and money.

- Restrictions in some markets. International platforms sometimes run into regulatory issues, tax requirements, and legal barriers, which can limit their ability to operate in certain regions.

- Risk of payment failure. There are situations when transactions are declined due to insufficient balance, card blocking or suspected fraud. Such cases reduce the quality of service and cause customer dissatisfaction.

Conclusion

User convenience is paramount when developing e-commerce projects. This applies to all areas of business, including high-risk sectors, which is Billblend’s speciality. Integrating payment gateway in website is key to increasing conversion rates and expanding your geographical reach, thanks to support for over 70 currencies. When you choose a reliable provider, you get fraud protection and competitive rates tailored to your business needs.

FAQ

What is a payment gateway?

It is a specialised service that processes customer requests for purchases or other financial transactions. It receives a request, transfers the data to the bank, receives a response and carries out the transaction if the bank approves it. An example is Billblend, which supports multiple payment methods and international coverage.

What functions does the payment gateway perform?

The main task of the service is to process financial transactions. The gateway not only transfers data, but also protects it and allows businesses to improve their website performance. This includes reducing the number of fraudulent transactions and increasing customer loyalty.

How much does it cost to use a payment gateway?

The cost depends on the gateway you choose and the pricing plan. Most providers charge a percentage of each transaction plus a small fixed fee. For example, Billblend offers transparent pricing and a low commission threshold, which sets it apart from its competitors.

How difficult is it to integrate a payment gateway into a website?

The complexity of payment gateway integration depends on the complexity of your website and the gateway you choose. Most often, ready-made plugins or API integrations are used for this purpose. The Billblend platform is known for its ease of integration and detailed documentation, which speeds up the process and saves resources.

Can I use multiple payment gateways at the same time?

Yes, you can integrate multiple payment gateways, allowing you to offer your customers more payment options and protect yourself from technical failures of one of the providers. For example, Billblend works well with other gateways, giving you the freedom to choose the best solution.

Can I refund a buyer through a payment gateway?

Most payment gateways support refunds. The refund procedure is standardised and regulated by the terms and conditions of the specific platform. Billblend provides a clear refund algorithm that is easy to manage through your personal account.

How can I protect my data when using a payment gateway?

To protect your data, we recommend using TLS encryption (SSL certificate), ensuring compliance with security standards (PCI DSS), and trusting only verified payment operators. Billblend applies the strictest security standards to ensure reliable protection of your customers’ information.