Smartphones in the modern world have ceased to play the role of only a means of communication. These are full-fledged gadgets that allow you to communicate with friends on social networks, work, and make purchases. Websites and applications that support online payment for goods are becoming increasingly popular. They are chosen for the opportunity to purchase goods without leaving home, and the built-in transaction acceptance system improves the user experience.

- In 2025, mobile sales are expected to grow to $2.51 trillion, with an average annual growth rate of 17%.

- One in five shoppers leaves a website or app when faced with a lengthy checkout process.

Thus, having a reliable and convenient payment gateway is becoming a prerequisite for the success of any business operating in the e-commerce sector.

Given the latest trends in e-commerce, business owners and mobile app developers are faced with an important question: how to properly organise in-app payments? The answer is simple – mobile app payment gateway integration. Let’s take a look at how to do this and how Billblend can help you.

How does paying for goods from a phone work?

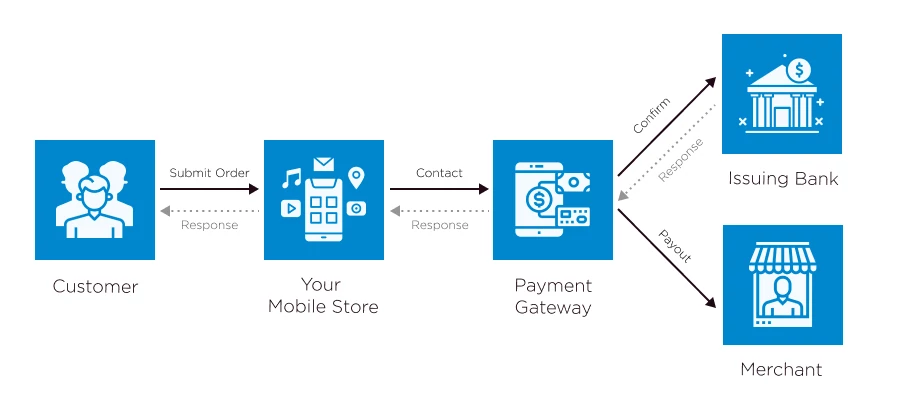

A payment gateway is a specialized service that acts as an intermediary between the customer and the seller. The service processes the payment data and transmits it to the bank, and receives a response to confirm the purchase or not.They function similarly to EFTPOS terminals, processing information about the buyer and transmitting it to the bank.

The schematic principle of operation of a mobile payment gateway is presented below.:

- the user selects an item and sends it to the shopping cart, after which they proceed to pay for it.;

- the client enters the bank card data and transmits it to the processor through the gateway.;

- the information is checked by the bank that issued the card;

- after verification, the response comes – to approve the transaction or not.

This acts as a bridge between the various parties to the transaction: the store itself, the buyer, the acquiring bank, and the customer’s card issuer.

Criteria for choosing a payment gateway

Modern consumers increasingly prefer to make purchases via smartphones. According to the latest data, the number of mobile purchases users has exceeded 6 billion worldwide. Payment gateway integration in mobile applications allows you to offer customers a convenient payment method, increase sales conversion and strengthen trust in your brand.

Below, we will discuss what is important to consider when working with payment gateway integration mobile apps, including for businesses that specialise in high risks.

Target audience

Make sure that the payment gateway you choose supports the regions where your customers are located. Check the coverage of countries supported by service providers. Billblend is available in Europe, Asia, America, and Africa. The geography is extensive, so you can connect the gateway while in any of these continents.

Payment methods

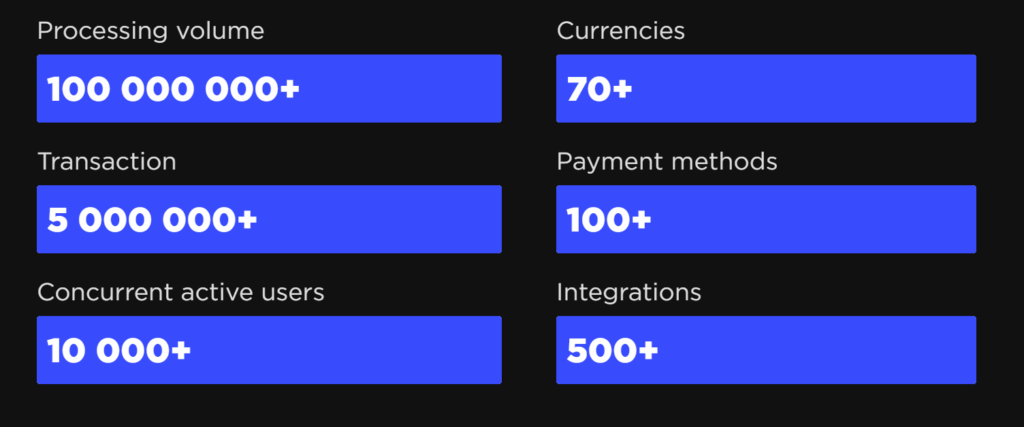

Offer your customers a variety of ways to pay, such as bank cards, e-wallets, and mobile platforms (Apple Pay, Google Pay). Research shows that almost half of users prefer to choose from a variety of options. Billblend offers more than 70 options that meet the needs of most customers from all over the world.

Commission fees

Most payment gateways charge a fixed fee for each transaction plus a small additional amount ($0.30+2.9%). It is important to consider additional account maintenance costs and possible hidden fees. We offer customised terms and conditions tailored to the specifics of your business, such as your field of activity, turnover, and region. Request a free consultation to find out how much it will cost to integrate the Billblend mobile gateway into your application.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Scalability and customisation

Choose solutions that allow you to adapt to business growth and expand the range of services you offer. Make sure that the payment gateway integrates easily with your existing systems and is capable of processing regular transactions.

Security and certification

Give preference to services that comply with PCI DSS standards and other security requirements. Reliable data protection will ensure customer trust and reduce the risk of fraud.

Mobile payment gateway integration Billblend gives your business:

- increased customer trust thanks to secure transactions;

- faster order processing and fewer abandoned shopping carts;

- the ability to expand your sales geography by supporting international payments;

- analytical information about your customers' purchasing behaviour.

Step-by-step instructions for integrating the payment gateway

Below are the steps you need to take to connect the system to your business.

The first stage is selecting a partner. Study the market and compare the services of different providers. Pay attention to the level of protection offered by the gateway, the commission structure available, and how convenient the gateway is for mobile buyers.

It is equally important to consider whether the interface can be customised to match your brand, whether the gateway supports subscription and recurring payments, as well as international payments and various types of bank cards.

The second step is to create a merchant account. This is a special account designed to store funds until they are transferred to the company’s bank account.

The third step is to configure the service. You will need to set the necessary parameters, payment methods, and card brands available to customers.

The fourth step is integration into the application. The gateway can be connected either manually (by writing your own code) or automatically (using ready-made SDK libraries or simple payment widgets).

The fifth step is testing and launch. Test the service in test mode, eliminating any errors that arise. Then launch the system into full operation.

By following these recommendations, you can create a comfortable and secure shopping experience for your customers, helping to increase conversion and revenue.

Billblend offers comprehensive solutions for integrating payment gateways into mobile applications. We help our clients choose the best payment services, configure payment processes, and ensure maximum transaction security.

Our specialists are ready to accompany you at every stage of integration, ensuring successful implementation and stable operation of the payment infrastructure.

Payment gateway connection: cost and features

Providers that provide payment services do not work for free. Before connecting a gateway for accepting transfers, it is important to figure out how much it will cost. Below we will talk about the main criteria that affect the cost of providing services.

Transaction fee

Providers charge a certain percentage for each completed transaction. The commission is usually 1-3%, but there may be other conditions. This approach ensures payment only for completed transfers.However, there may be additional charges, such as connection fees, monthly fees, and others.

Subscription fees

Some services require a monthly or annual subscription fee, regardless of the number of transactions made. This approach is often used by companies targeting small and medium-sized businesses, offering attractive rates for low turnover.

Technical support costs

There are additional costs associated with self-integration, especially if your application requires special adaptation or complex configuration. The costs of supporting and updating the infrastructure depend on the service you choose and the complexity of the project.

In addition to the financial aspects, the technical aspects of integration are an important factor in the successful implementation of a transaction acceptance solution:

- API interfaces. Many providers offer convenient APIs that facilitate integration and interaction with the system. However, developing your own implementation requires deep technical expertise.

- Security settings. A key requirement for any payment solution is a high level of data security. Check that the gateway you are considering meets current security standards (e.g. PCI DSS).

- Scalability. Your platform should be able to grow along with your traffic and transaction volume. Choose a gateway that can handle high loads.

Billblend's role in payment solution integration

Billblend specialises in providing comprehensive solutions for integrating payment gateways into mobile applications. Billblend’s experts have in-depth knowledge and extensive experience in mobile commerce, enabling them to effectively handle any technical and organisational tasks.

Why choose Billblend:

- individual approach to each project;

- full technical support at all stages of integration;

- optimised rates and transparent terms of cooperation;

- guaranteed security and compliance with the legislation of the country in which the business is registered.

Billblend’s specialists will help you choose the best rate, carry out high-quality integration and ensure the continued stability of your application’s payment infrastructure.

Conclusion

Integrating a payment gateway into a mobile application is a strategically important decision that opens up broad prospects for the growth of your business. A well-organised payment system can significantly increase revenue, simplify life for users and strengthen your brand’s position in the market.

By turning to the professionals at Billblend, you get a reliable partner who is ready to provide comprehensive assistance at all stages of integration and support for your application’s payment infrastructure.

Want to take your business to the next level? Contact the Billblend team right now and get a free consultation on payment solution integration.

FAQ

How much does payment gateway integration cost?

The cost varies depending on the provider you choose, the volume of transactions, and the complexity of the project. Many providers charge a percentage of the transaction amount, as well as a monthly service fee.

Can I customise the appearance of the payment gateway to match my brand's corporate style?

Yes, most modern services allow you to customise the interface design while maintaining the look and feel of your application.

What is the most convenient and fastest integration method?

The simplest method is to use ready-made SDKs (Software Development Kits) from providers.

This approach speeds up development and facilitates technical support.

This approach speeds up development and facilitates technical support.

Do I need to register separately for each payment method?

No, most modern solutions support multi-currency and multi-platform accounts, allowing you to process different types of payments in a single space.