Brazil ranks first in Latin America in terms of GDP. With a population of 215 million, the country is actively developing, and the growing popularity of e-commerce is having a particular impact. In 2025, the legalisation of betting also contributed to the increase in demand for online payments. This led to an increase in demand for payment gateway services that support local and international payment methods and work with high-risk businesses.

In this article, we will look at the online payment methods available in Brazil, how the market will develop in the coming years, and why choosing a high-quality provider is important for developing a business in the e-commerce sector.

What is an online payment system?

The online payment system is a special set of technical solutions that allow you to process financial transactions over the Internet. The system itself consists of several elements that work together – a payment method, a gateway for data transfer, and accounts where funds are stored. The transaction processing process takes place remotely, allowing customers to shop from home.

Among the most popular payment methods in Brazil are:

- Credit and debit cards. Traditionally popular among consumers, credit cards allow you to buy goods using borrowed funds. The interest-free period means you don't overpay for services. Debit cards are different in that the customer only uses their own funds.

- PIX. An innovative payment system from the Central Bank of Brazil that provides instant transactions 24 hours a day.

- Boleto Bancário. A traditional method of paying bills through banks and self-service terminals.

- Digital wallets. Convenient solutions for storing virtual funds and simplifying the money transfer process.

- BNPL (Buy Now, Pay Later). The ability to purchase goods with subsequent payment in small instalments.

The right choice of payment methods Brazil can significantly increase sales and improve customer retention rates.

To successfully accept payments on a website or in an app, you need a special payment gateway, such as Billblend. Its task is to act as a link between the customer and the payment system. It is the gateway that receives purchase data from the user, processes it, and sends a request for verification. If the information is correct, the funds are debited; otherwise, the transaction is declined. Without such a gateway, it is impossible to make a purchase, as it is responsible for the entire data processing process.

How do online payment systems work?

The online transaction mechanism involves a series of sequential steps:

- Product selection. The buyer adds the item to the basket and initiates the order.

- Selection of Brazil online payment methods. The convenient payment method offered by the store is determined.

- Data processing. The information is transmitted through a secure payment gateway that interacts with banks and authentication systems.

- Authorisation. The bank confirms that there are sufficient funds and authorises the transaction.

- Final crediting. The funds are debited from the buyer's current account and credited to the seller's account in accordance with the terms of the contract.

This process takes only a few seconds, ensuring the smooth operation of the trading platform and the satisfaction of customer requests.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Key features of online payment services

Most popular payment methods in Brazil work in conjunction with a provider that processes the data. When choosing an intermediary, it is important to consider its functionality and reputation. Below are the most important features to consider.

Security

Customer data security should be a priority for any service. Reliable providers use data encryption, two-factor authentication, and fraud protection.

Billblend uses various methods to protect customer data. Advanced encryption algorithms and PCI DSS compliance make the payment process safe and reliable. The gateway also takes care of business security. It has its own machine learning algorithm designed to detect fraudulent transactions.

Efficiency

Fast payment processing and minimal errors are important indicators of service quality. High-speed payment gateways can reduce delays in the delivery of goods and increase overall customer satisfaction.

Support for multiple payment methods

By offering a variety of payment methods, businesses increase the likelihood of completing a transaction. Popular methods include bank cards, e-wallets, mobile apps, and even cryptocurrency.

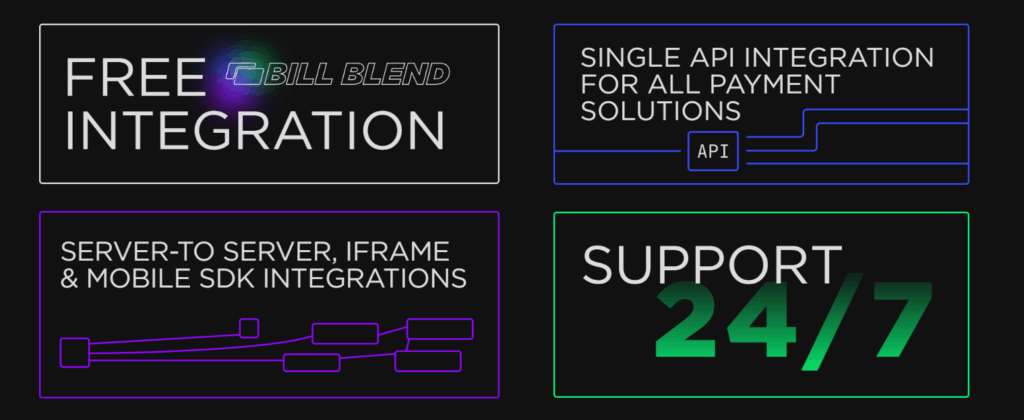

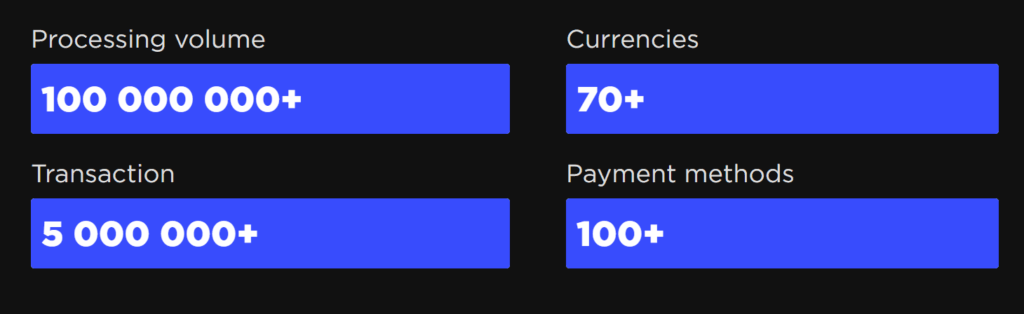

Billblend supports a wide range of payment methods. These include both local and international methods, including cryptocurrency. In total, the gateway supports over 100 payment options. This allows you to accept transfers not only from customers in Brazil, but also from other countries.

Effective reporting and support

Regular submission of detailed reports on transactions helps to identify problems in a timely manner and prevent potential losses. High-quality technical support guarantees quick resolution of any issues and troubleshooting.

Multi-currency

For international trade, the ability to process different currencies is becoming a prerequisite for success. Platforms such as Billblend provide automated currency conversion, ensuring a comfortable experience when working with international buyers.

By using the Billblend platform, your business will be able to maximise the benefits of high-quality payment processing, ensured by these key factors.

Who can benefit from online payments?

Virtually any company that sells goods or services online can benefit from the introduction of modern online payment methods in Brazil. It is important to note that successful implementation requires taking into account the preferences of a specific audience, as Brazilian consumers differ from European or American consumers.

Below are the categories of businesses that will benefit most from switching to advanced payment methods:

- online stores;

- travel agencies;

- educational institutions;

- financial advisors;

- restaurants and cafes;

- logistics and transport companies;

- bookmakers, online casinos;

- financial organisations;

- adult goods businesses.

All of these sectors can significantly increase their revenues and strengthen their position in the local market by implementing effective payment methods in Brazil.

The best payment methods in Brazil

Buyers in Brazil differ from customers in Europe or the United States. To enter the local market, you need to take into account the specifics of customer behaviour and their preferences in online stores. Let’s take a look at the most effective and most popular payment methods in Brazil.

Debit and credit cards

Credit cards traditionally occupy a leading position among Brazilian consumers, despite the rapid spread of alternative methods. The main advantage of credit cards is the ability to split the cost of a purchase into monthly payments without interest. Brazil has a local Elo operator, but international systems such as VISA and MasterCard are also popular.

Digital wallets

Digital wallets such as PicPay and MercadoPago have gained widespread recognition for their ease of use and reliability. Their advantage lies in fast payment processing and the fact that card details do not need to be entered for each purchase. Shoppers in Brazil also choose international digital wallets such as Skrill, PayPal, Google Pay and others.

BNPL (Buy Now, Pay Later)

The BNPL method has become a popular solution for young consumers who prefer to receive a product immediately and pay for it gradually. Successful players in this market include Provu and Pagaleve, which offer a simple instalment plan. Recent studies show that in 2025, the BNPL market turnover in Brazil will reach $4.66 billion. It is estimated that the average annual growth over the next five years will be 9.8%, and in 2030, the market will be approximately $7.43 billion.

QR code payment

QR code payment has become popular thanks to the emergence of the BR Code system, which standardises QR code technology in Brazil. Its simplicity and compatibility with the PIX service have made the QR code a powerful tool for expanding the range of possible formats.

Boleto Bancário

Boleto Bancário is a traditional online payment method in Brazil that allows you to pay in cash or by bank transfer at any bank branch. Despite the emergence of new methods, many residents continue to use this option because of habit and confidence in its reliability.

PIX

PIX, launched by the Central Bank of Brazil in November 2020, has transformed the financial services sector. This tool makes it possible to make instant money transfers 24 hours a day, seven days a week. The rapid adoption of this tool has made it the primary choice for many Brazilian consumers.

Cooperation with Billblend is particularly beneficial, as it offers a simple and effective solution with PIX technology support. Billblend’s Pix payment solution provides extensive customisation options, which greatly simplifies the process of entering the Brazilian market. A fully licensed service provider guarantees the highest level of service and security:

- customised solutions for your business;

- unique implementation of PIX flows, including support for both dynamic and static QR codes;

- advanced fraud prevention system with a separate QR code for each taxpayer;

- maximum transaction security;

- fast and transparent transaction execution;

- excellent payment approval rates;

- exceptional customer support service.

By integrating the solution with the PIX system through the Billblend payment service, you get a powerful and modern tool for attracting customers who use the most popular form of payment in Brazil.

Common problems with online payment processing

Many business owners face a number of difficulties when organising online payments:

- slow data transfer between systems;

- insufficient encryption and security vulnerabilities;

- certain payment methods not working;

- difficulties with refunds for erroneous transactions;

- lengthy registration and verification procedures for sellers.

By turning to industry professionals such as Billblend, you can avoid most of the above problems and focus exclusively on increasing your business’s revenue. Learn more about integrating the gateway into your website or application during a free consultation. Our specialists will answer your questions and provide a personalised solution tailored to the specifics of your business, the number of payment methods, and your current turnover.

The future of online payments in Brazil

Progress in the field of finance will inevitably lead to the following changes in the online payments market:

- widespread adoption of smartphone payment technologies;

- further improvement of the PIX system and a reduction in fraud;

- growth in the share of international trade transactions;

- creation of a transparent financial services ecosystem with a developed infrastructure;

Your business has every chance of taking its rightful place in this market by integrating advanced technologies and adapting to changing consumer needs.

Frequently asked questions

What are the main payment methods used in Brazil?

The PIX direct transfer system is very popular in the region. Credit and debit cards, digital wallets, and installment purchase are also popular.

Why is it important to choose the right payment method?

Proper payment organisation encourages shoppers to complete purchases faster, reduces abandonment rates, and creates a positive brand image.

Which service is best for my business?

It all depends on the specifics of your business and your target audience. Consider partnering with professional providers such as Billblend to ensure quality implementation.

What are the advantages of credit cards?

The main advantage of credit cards is the ability to pay for large purchases gradually without accruing interest. Cards also provide greater flexibility and control over spending.

How convenient and secure is QR code payment?

QR codes are easy to use and protected by modern cryptography methods. Many users choose this method because of its integration with the PIX system.

What is the PIX system?

PIX is an innovative payment system created by the Central Bank of Brazil that allows instant money transfers between any participants in the financial system, regardless of the time of day.

Are there any risks associated with using digital wallets?

The main risk is related to the possible leakage of personal information. Therefore, choose trusted services and take precautions.