What Is P2P Payment?

Imagine settling a dinner bill with friends without having to clumsily pool cash together, sending a birthday gift to someone on the other side of the country in an instant or paying your freelancer without any hassle – all with just a few taps on your phone. This is the world made possible by P2P payments, now a technology that has transitioned from niche curiosity to a financial staple.

P2P Payments Overview

Peer-to-peer (P2P) payments, sometimes referred to as person-to-person payments, make it possible for people to transfer digital money directly to each other without using banks as intermediaries – digital cash for the internet. The growth is mind-boggling: the worldwide P2P payment market which was worth around $2.21 trillion in 2022, will grow to nearly $11.62 trillion by 2032 driven by speed, convenience and financial inclusion.

P2P (person-to-person) payment solutions can no longer be considered optional for businesses or individuals – understanding them is essential for navigating modern finance. This guide is designed to clarify how these transfers work, what they mean for everyday use, and where they may be headed next.

A Brief History: From PayPal to Mainstream Adoption

The journey of P2P pay began not with smartphones, but with the dawn of e-commerce.

The Pioneer Era (Late 1990s - Early 2000s)

PayPal, founded in 1998, was the trailblazer. It solved a core problem for early eBay users: how to pay strangers online safely. Its model of using email as a payment gateway laid the groundwork for all future digital money transfers.

The Mobile Revolution (2010s)

The launch of the iPhone and Venmo (2009) changed everything. Payments became social, mobile-first, and integrated into daily life. Banks responded with Zelle (2017), leveraging existing networks for instant real-time transactions.

The Modern Ecosystem (2020s - Present)

P2P is now ubiquitous, with around 84% of people in the U.S. using these services. The market has expanded beyond simple transfers to include features like investment, crypto trading, and international P2P. Trends like blockchain P2P networks and fraud detection AI are shaping the next frontier.

How Do P2P Payments Work? A Technical and User-Friendly View

At its core, a P2P payment solution acts as a secure intermediary. Here’s the step-by-step journey of your money:

Step 1: Initiation & Linking

You open an app (e.g., Cash App, Venmo) and link a funding source – a bank account (via ACH transfers), debit card, or credit card. The platform verifies this through micro-deposits.

Step 2: The Request

To send money, you need a recipient identifier: their phone number, email, username, or a unique QR code. You enter the amount and add a note (e.g., “For the concert tickets!”).

Step 3: Security & Authorization

This is where P2P security encryption shines. The platform uses two-factor authentication (a PIN, biometrics, or one-time code) to confirm it’s you. Your request is encrypted and sent securely.

Step 4: The Transfer Mechanics (The "Plumbing")

This happens behind the scenes via one of two primary systems:

- ACH Network

The workhorse for apps like PayPal (standard transfers). It’s batch-processed, making it cost-effective but slower (1-3 business days). The app often fronts you the money instantly.

- Real-Time Payments (RTP) Network

Used by Zelle and for “instant” options. This system moves money between banks in seconds, 24/7, providing immediate confirmation and access to funds.

Step 5: Completion & Access

The recipient gets a notification. Funds appear in their app balance immediately. They can spend it in-app, transfer it to their bank (free in 1-3 days, or instantly for a fee), or hold it as a digital balance.

Key Benefits and Everyday Use Cases

Why people love P2P payments:

- Speed & Convenience: Transfers can happen in seconds or minutes, eliminating the need for checks or ATM visits.

- No Cash Needed: Solves the "I'll pay you back later" problem effortlessly.

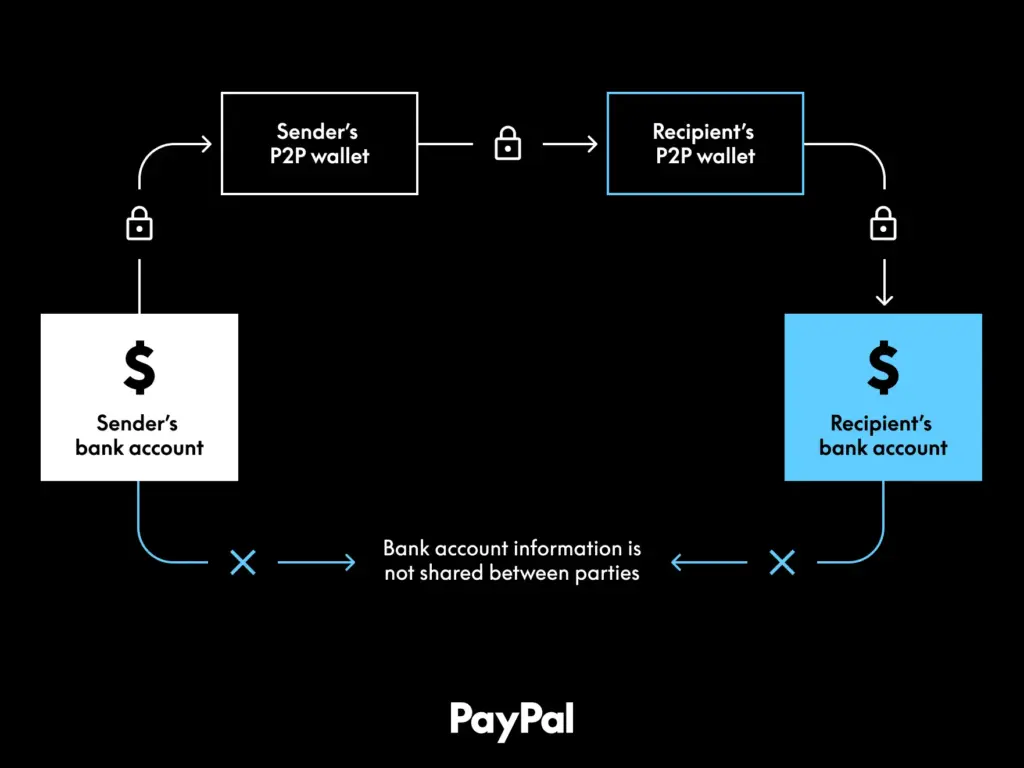

- Privacy: Your bank account or card number is never shared with the other party; platforms use tokens and encrypted data.

- Social Integration: Features like bill splitting, payment requests, and shared "pools" (e.g., for a group gift) are built-in.

Common examples in action:

- Splitting Bills: After a group meal, one person pays the check. Others instantly reimburse their share via a P2P app, each with a note like "My pasta!"

- Gifting: Sending money for birthdays, graduations, or holidays is as simple as sending a text. Platforms like PayPal even have dedicated "gifting" flows.

- Paying Rent or Utilities: Roommates can send their portion to the leaseholder without writing checks.

- Freelancer & Small Biz Payments: A graphic designer can invoice a client and receive payment via a P2P payment gateway without formal merchant accounts.

- Marketplace Transactions: Buying from a seller on Facebook Marketplace or at a local craft fair.

Security Deep Dive: Understanding the Risks and Protections

P2P platforms deploy robust security: encryption (SSL/TLS), fraud detection AI, and two-factor authentication. However, the design creates unique user-side risks.

The Critical Distinction (The #1 Rule for Safety):

- "Friends and Family" (Personal): For sending money to people you know and trust. It's usually free but offers no purchase protection. It's treated like irreversible cash.

- "Goods and Services" (Commercial): For buying items or services. It includes a small fee (e.g., 2.9% + $0.30) but provides a dispute resolution process and potential refund if you don't receive the item or it's misrepresented.

Major Risks & How to Mitigate Them:

| Risk | Why It Happens | How to Protect Yourself |

|---|---|---|

| Irreversible Transactions | Sending to the wrong person (typo in phone #). P2P services often state that users are solely responsible for entering correct details. | Double, then triple-check recipient details before sending. |

| "Friends & Family" Scams | A scammer insists on this method to avoid fees – and protection. | Never use "Friends & Family" to pay for goods/services. The fee for "Goods and Services" is your insurance. |

| Authorized Push Payment (APP) Fraud | A fraudster impersonates a trusted entity to trick you into sending money willingly. | Verify identities independently for urgent payment requests. |

| Account Takeover | Weak passwords or phishing attacks. In 2024, nearly 1 in 4 consumers have been victims of this. | Use strong, unique passwords and enable two-factor authentication on the payment app. |

Choosing the Right P2P Provider: A Comparative Analysis

The best app depends on your primary need. Here’s a detailed look at the top P2P payment solutions:

| Provider | Best For | Key Feature | Transfer Speed (to Bank) | Int’l Transfers? | Critical Consideration |

|---|---|---|---|---|---|

| Zelle | Instant, bank-integrated transfers (US). | Built into many US banking apps; uses real-time network. | Instant & Free | No | Zero buyer protection. Use only with trusted contacts. |

| Venmo | Social, casual payments (US). | Social feed, easy splitting, owned by PayPal. | 1-3 biz days (Free), Instant (1.75% fee) | No | Privacy settings are public by default – adjust them. Fee for credit card use. |

| Cash App | Versatility (Cash Card, Stocks, Bitcoin). | "Cash Card" debit card, investing in stocks/crypto. | 1-3 biz days (Free), Instant (0.5%-1.75% fee) | US/UK only | Higher fraud risk; great for side hustles. |

| PayPal | Universal acceptance & online shopping. | Vast merchant network, strong purchase protection. | 1-3 biz days (Free), Instant (1.75% fee) | Yes (200+ countries) | Fees and exchange rates for international P2P can be high. |

| Wise/ Remitly | Low-cost international transfers. | Real mid-market exchange rate, transparent fees, multiple delivery options. | 1-2 biz days (Low fee) | Yes | Specializes in cross-border payments, not domestic social payments. |

The Future of P2P: AI, Blockchain, and Beyond

The P2P payment gateway is evolving into a hub for broader financial activity:

- AI and Machine Learning

The P2P payment gateway is evolving into a hub for broader financial activity:

- Blockchain and DeFi Integration

Blockchain P2P networks promise near-zero fees, borderless, and programmable transfers. Stablecoins (crypto pegged to fiat) are already used for international P2P transfers.

- The "Super-App" Model

P2P is becoming one feature within apps offering banking, investing, loans, and budgeting – a one-stop-shop for finance.

- Biometric Authentication & RBA

Fingerprint and facial recognition will become standard for login, while Risk-Based Authentication (RBA) will add security steps only for high-risk transactions, balancing safety and ease.

How to Navigate the P2P Payments Landscape

P2P payment solutions have firmly leveled the playing field and placed on-demand digital money transfers directly into the hands of everybody. Whether making it easier to pay the bills, refilling one’s account, or keeping up with friends and family on social networks, money has its place in the transmission of information, and our economic practices ease every moment of financial contact. Looking into the future, these systems will become more intelligent, faster and more highly interconnected with the addition of AI, blockchain, and real-time networks.

This means businesses have to adjust their payment approach to accommodate the seamless mobile app payments customers expect. The trick – as individuals – is how to benefit from this convenience without jeopardizing safety; always bear in mind the number one rule: use the “Goods and Services” or protected means of payment, for anything transactional. Knowing the types, security measures and trends covered in this guide enables you to take part in this financial revolution with confidence.

FAQ: Your P2P Payment Questions Answered

How do P2P payments work step-by-step for a first-time user?

- Download a reputable app (e.g., Venmo, Cash App).

- Sign up and verify your identity (phone/email).

- Link your bank account or debit card.

- Find a friend using their username, phone, or QR code.

- Enter the amount, add a note, and hit “Pay.”

- Authenticate with a PIN or fingerprint. The money is sent.

Are P2P payments secure? Can my money be stolen?

The platforms themselves are highly secure, using bank-level encryption and authentication. The most common vulnerability is user error. You are your own best security layer: never send money to strangers via “Friends and Family,” enable two-factor authentication, and treat your payment app like your wallet.

What are the best P2P apps for international transfers?

For sending money abroad, specialized services often beat general P2P apps:

- Wise: Typically offers the best exchange rates and low, transparent fees .

- PayPal: Extremely convenient and widespread, but currency conversion fees can be high.

- Cryptocurrency (via a wallet like Coinbase): Using stablecoins like USDC can be very fast and low-cost, but requires both parties to understand crypto.

What's the difference between Zelle, Venmo, and PayPal?

- Zelle is for speed and bank integration (US only). It moves money directly between US bank accounts in minutes with no fees. No purchase protection .

- Venmo is for social, casual payments (US only). It's great for splitting bills with friends and has a social feed. Offers purchase protection for eligible transactions.

- PayPal is for universality and purchase protection. It's accepted by millions of online merchants worldwide and offers strong buyer/seller protection policies. Works internationally.

Can I use P2P payments for my small business or side hustle?

Yes, but with caveats. It’s excellent for freelancers, market vendors, or service providers due to its low barrier to entry . Crucially, always use the “Goods and Services” or “Business” option to get transaction records and protection. Be aware of tax implications (platforms may issue 1099-K forms) and transaction limits on personal accounts.