Online payment methods in Brazil

Online payment methods in Brazil Brazil ranks first in Latin America in terms of GDP. With a population of 215 million, the country is actively

Home page » Blog

Online payment methods in Brazil Brazil ranks first in Latin America in terms of GDP. With a population of 215 million, the country is actively

Online payment methods in Germany Germany has long been a leader in financial innovation and economic stability. The current stage is characterised by the rapid

Online payment methods in the UK Digital payments are becoming increasingly popular among British consumers, as they allow for quick and convenient payment for goods

Online payment methods in the Philippines The Philippines is a rapidly developing e-commerce market that is attracting the attention of entrepreneurs and investors from around

Popular payment methods in Australia In Australia, your payment strategy can make or break your business. The market has leapt from relying on cash to

Most Popular Payment Methods in Europe for 2025 Recent years have seen a real revolution in online payments. Traditional methods such as bank cards are

Innovation in Payments Technology Modern technology is rapidly changing the landscape of global commerce, and payment innovations are playing a key role in this transformation.

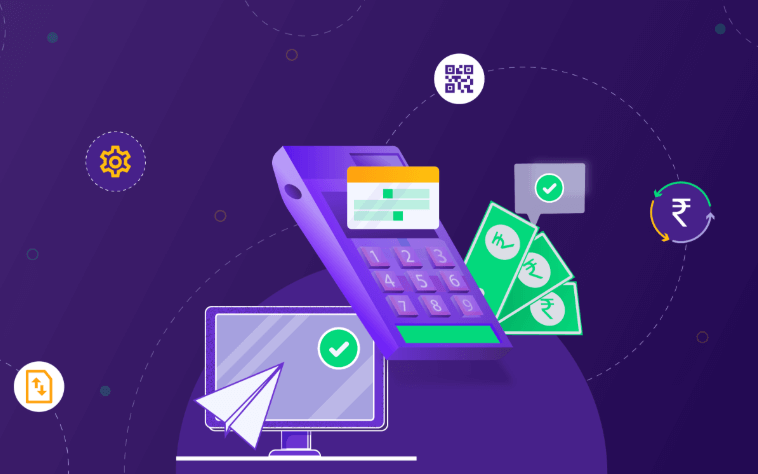

Local Payment Methods in India for 2025 The Indian e-commerce market is growing fast and shows huge potential for growth. Already, over 160 million people

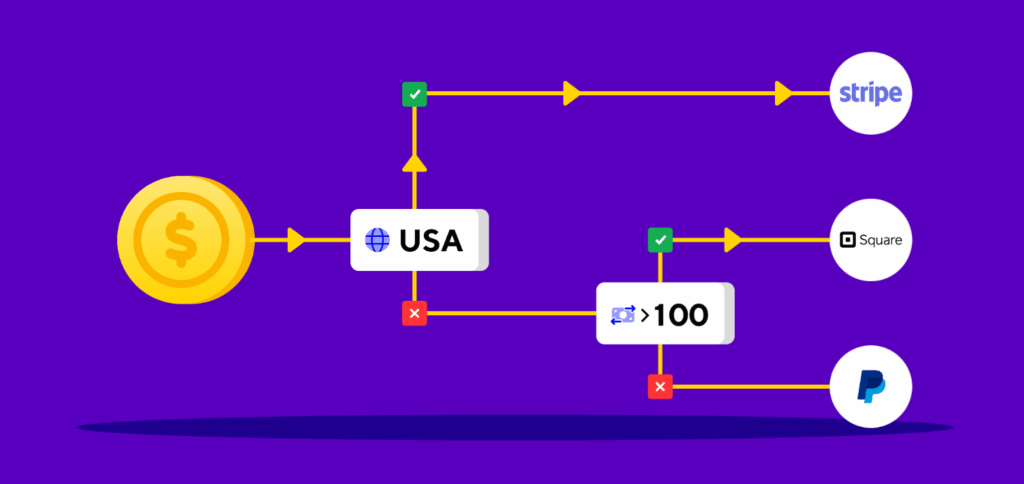

Payment Processor It’s hard to imagine a successful business today without advanced online payment solutions. Adding the ability to accept payments in different currencies and

Online Payment Methods in Malaysia Malaysia is one of the top 3 richest countries in Southeast Asia. Over the past five years, there has been

Integrated Payment Solutions Today, electronic payments have become an integral part of our world, playing a key role both in business and in everyday life.

Recurring Payments: Definition, Types and Examples Recurring payments are a form of automatic payment where the customer agrees in advance to have a fixed amount

Online Payment Methods in Mexico Mexico is the second largest e-commerce market in Latin America, behind only Brazil. Analysts from ClearSale predicted the market to

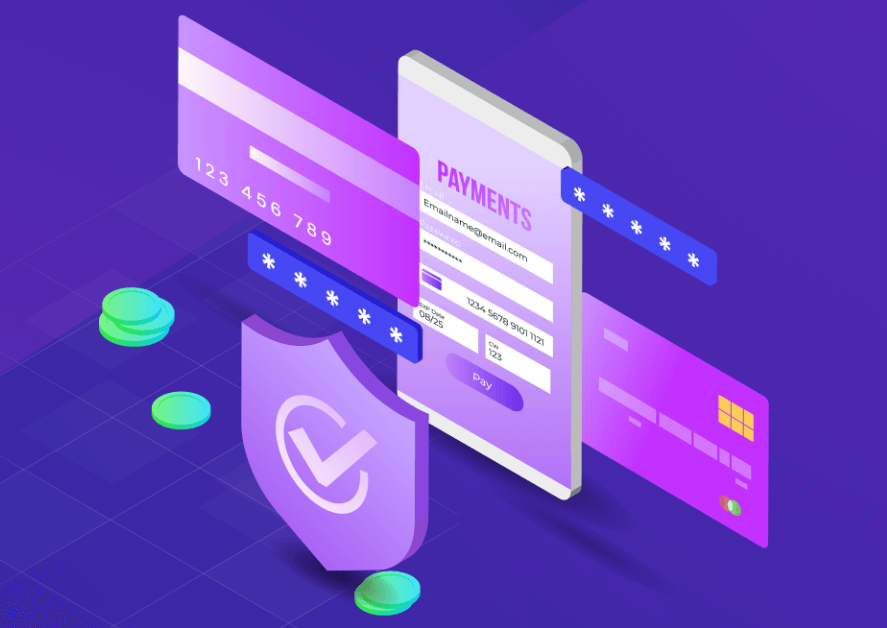

Payment risk management is a strategy that helps identify, assess and mitigate potential risks associated with payment processing.

End-to-end payment processing is a process that encompasses all stages of payment processing, from the moment a customer enters their payment details to the receipt

Online payments have made shopping more convenient and faster, but for entrepreneurs an important question arises: how to efficiently organise payment acceptance?

Payments are an integral part of modern online business. Customers can use them to pay for services and goods or top up their balance in

The world is becoming increasingly interconnected, and borders are no longer a barrier to business. Companies seeking to open new markets and expand their trade

A card payment processor is an integral part of the modern financial ecosystem, acting as a link between banks and businesses that accept credit and

Singapore is one of the most technologically advanced countries in the world, where electronic payments have become an integral part of everyday life.

Today’s e-commerce market is growing rapidly and global online sales are expected to reach $9.4 trillion by 2026.

Every modern business strives to optimise its financial operations. Business-to-Business (B2B) payments play an important role in the success of any company.

Crypto Payment Gateway for High Risk Business Crypto Payment Gateway for High Risk Business is a secure payment processor that effectively serves risky businesses. It

Discover Alternative payment methods The e-commerce industry is changing rapidly. New trends come and go, new audiences emerge, and customer expectations change. Given the changing