Local Payment Methods in India for 2025

The Indian e-commerce market is growing fast and shows huge potential for growth. Already, over 160 million people in the country are actively shopping online, despite regional and social differences in internet access. Digital transformation is gradually spreading to more and more regions, opening up new opportunities for business.

Key features of the online commerce market in India:

- Market growth and scale. As of 2024, the current market volume is approximately $129,1 billion. It is projected to grow to $137 billion by 2027. Indian shoppers spend more than $20 billion annually on foreign platforms.

- Payment methods. Traditional bank cards are used in only 23% of online transactions. Cash accounts for an insignificant share (5%) of online purchases. Digital payments prevail, accounting for 72%. PayTM, Amazon Pay, and Google Pay are popular platforms. The state-run electronic payment system UPI is widely used.

- The predominance of mobile technologies. More than 60% of all online payments are made from mobile devices. High-quality mobile adaptation of services and websites is extremely important. Internet audience and its structure. The total number of Internet users exceeds 390 million. There is a marked inequality in Internet access between urban and rural areas. There is a significant gender imbalance: men account for 33% of the Internet audience, compared to 22% of women of the total proportion of residents.

- Features of the banking system and payment instruments. The number of debit and credit cards issued exceeds 900 million. The leading card systems are international Visa, MasterCard and domestic RuPay. Online banking, direct debit (UPI) and e-wallets are rapidly growing in popularity.

These key points will enable you to effectively navigate the Indian online commerce market and successfully develop your business in this region. Key indicators of the Indian e-commerce market.

Indicator | Value |

Market volume in 2023-2024 | $510 billion |

Forecast volume by 2030 | $300 billion |

Annual total purchases from foreign sellers | Over $20 billion |

Percentage of mobile transactions | Approximately 60% |

This infographic clearly demonstrates the key aspects of India’s payment ecosystem, highlighting the rapid development of digital payment methods and the importance of the mobile segment in the country’s online commerce structure.

Do you have any more questions?

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Features of the Indian payments market

The Indian e-commerce market continues to grow rapidly, reaching impressive scales and becoming one of the largest in the world. According to experts, by 2030, online sales in India will exceed $300 billion.

To successfully integrate into this promising niche, it is essential to understand local characteristics and consumer preferences regarding payment methods. We have prepared a detailed guide to help your business make the right strategic decisions and choose the best payment methods in India, taking into account the needs of your potential customers.

Key trends in the development of the online payment market in India

The Indian online payment ecosystem is undergoing a digital renaissance, becoming a global leader in digital financial technology. Below are the key trends shaping the modern online payment industry in India

Growth and leadership in the global market

India ranks first in the world in terms of the number of real-time digital payments, accounting for 48.5% of the global volume of such transactions. The total volume of money transfers in 2024 amounted to $129.1 billion, making the country the absolute leader in this category.

Over the past two financial years, the total number of transactions reached 164 billion, with a total value of $510 billion, demonstrating the enormous scale and activity of the market.

The phenomenal success of UPI (Unified Payments Interface)

The UPI system, launched by the National Payments Corporation of India (NPCI), has revolutionised the payments industry:

- UPI's share of the digital payments market reached 71% in the 2024 financial year.

- In just five years, the number of transactions through UPI grew from 92 crore to 8,375 crore, showing a compound annual growth rate (CAGR) of 147%.

- The value of transactions increased from 1 lakh crore to 139 lakh crore, demonstrating a CAGR of 168%.

Mobile payments are becoming the norm

A quarter of India’s population (about 26.6%) regularly makes purchases using a smartphone, preferring mobile apps and QR codes to traditional bank cards.

The development of mobile online payment methods in India has been made possible by government initiatives such as the Pradhan Mantri Gramin Digital Saksharta Abhiyaan (PMGDISHA) digital literacy programme, which aims to improve computer literacy in rural areas.

Gradual shift away from cash payments

There is a downward trend in the share of cash in circulation: annual cash growth declined from 9.9% in the 2021-22 financial year to 7.8% in 2022-23. This trend has continued over the last two years, but to a lesser extent.

Consumers are increasingly choosing online payment methods in India, reducing their use of traditional paper money.

Improving financial literacy and government participation

The Reserve Bank of India (RBI) is actively promoting digitalisation through educational programmes and information campaigns, such as ‘RBI Says’ or ‘RBI Kehta Hai,’ broadcast through various media channels. These initiatives help the population feel confident and secure in the transition to digital forms of payment.

Improving financial literacy and government participation

Despite rapid growth, the industry faces cybersecurity challenges.

The number of incidents related to financial technology has risen sharply from 53,117 cases in 2017 to 1.32 million in January-October 2023, highlighting the importance of choosing reliable and proven payment solutions. Over the past two years, there has been an increase in the number of fraudulent transactions.

Most used payment methods in India

Modern Indian consumers prefer fast, convenient and secure payment methods. Let’s take a closer look at the most used payment methods in India.

UPI (Unified Payments Interface) system

Key figures:

- Market share: 62% of all digital transactions

- Popular apps: Google Pay, PhonePe, Paytm, BHIM

- Advantages: instant transfers, low fees, ease of use, accessibility even for small merchants via QR codes.

- Examples of use: paying for taxis, utilities, purchasing tickets and goods in stores.

Electronic wallets

Key indicators:

- Popular services: Paytm, Amazon Pay, PhonePe, Google Pay

- Active users: millions of registered accounts

- Convenience: no need to enter card details, quick registration and balance top-up.

- Where they are used: restaurants, cafes, shops, food delivery, online stores.

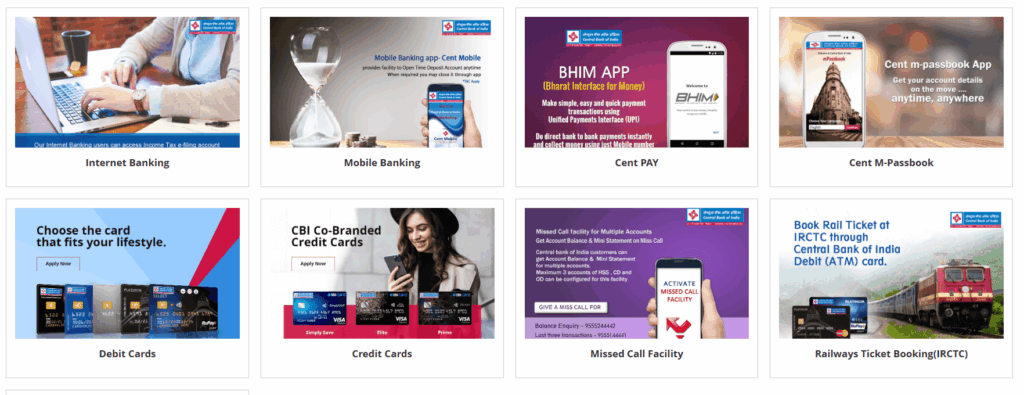

Bank cards (Credit & Debit Cards)

Key features:

- Popular brands: Visa, Mastercard, RuPay (national card)

- Use: more commonly used for large purchases and booking hotels and airline tickets.

- Limitations: Many Indian cards are for domestic use only and require additional setup for international transactions.

Internet banking

Key features:

- Purpose: Popular for regular and large payments such as utilities, taxes, and rent.

- Integration: supported by all major banks and payment gateways.

Cash on delivery (COD)

Key features:

- Relevance: still used in small towns and remote areas where trust in digital payments is lower.

- Disadvantages: high probability of returns, additional logistics costs and banknote verification.

Why does a business need a payment gateway

A payment gateway plays a key role in the successful operation of an e-commerce business. Here are some important aspects that explain why it is necessary to use one:

- Expanding payment acceptance options. A gateway allows you to accept popular payment methods in India, including credit cards, e-wallets, internet banking, and QR codes, which increases the likelihood of a customer completing a transaction.

- Improving customer convenience and loyalty. Modern users expect a quick and easy payment process. A user-friendly interface and different payment methods in India increase customer satisfaction and drive sales growth.

- Transaction security. A high-quality payment gateway protects customer personal data and prevents fraudulent transactions, reducing business risks and strengthening customer trust.

- Process automation and cost reduction. Using a payment gateway minimises manual labour, reduces errors and lowers payment processing costs.

- Receiving analytical information. Many payment gateways provide detailed statistics on transactions, helping businesses improve their sales strategy and increase the effectiveness of marketing campaigns.

- Compliance with local market characteristics. Specialised payment gateways are adapted to local legislation and consumer behaviour, which is critical for successful entry into a new market.

Why Billblend.io is the ideal choice for your business

If you are looking for a modern and technologically advanced payment gateway that can meet the demands of discerning customers and ensure your business remains competitive, take a look at the innovative Billblend.io project. This unique product combines popular payment methods in India with support for a wide range of digital solutions, providing your customers with maximum convenience and security when making transactions.

Key benefits of Billblend.io:

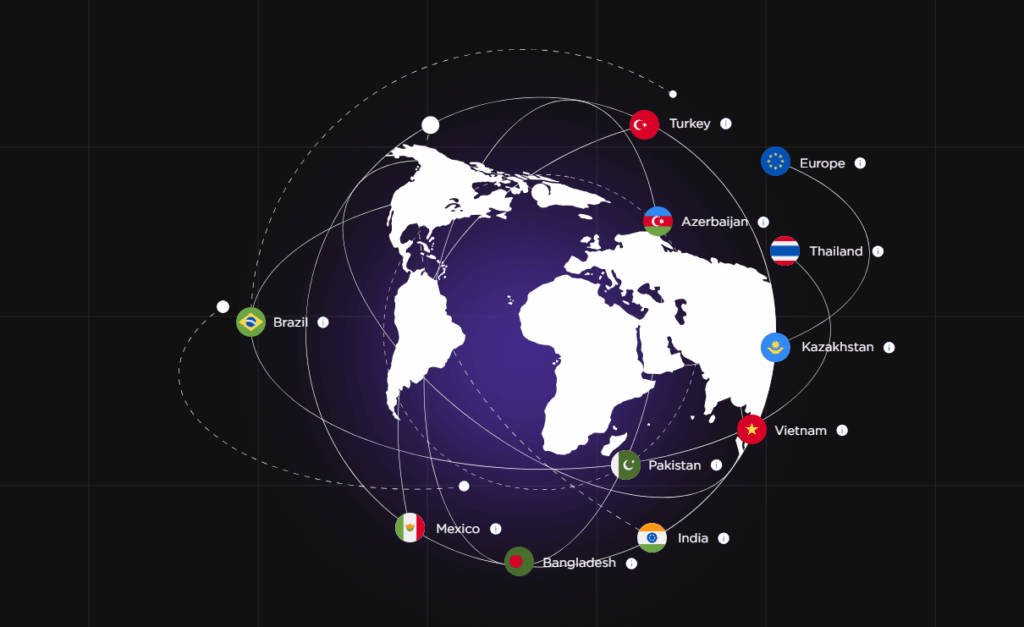

- Versatility and wide coverage. Supports over 100 payment methods and 70+ currencies, including all popular payment methods in India, such as UPI, Google Pay, PhonePe, PayTM, and IMPS.

- Fast transaction execution. Allows you to send and receive funds instantly at any time of the day.

- Cost-effectiveness. Transparent and competitive rates allow you to save on transaction fees.

- Easy integration with your business. Easily connects to accounting and CRM systems, automating processes and simplifying record keeping.

- Continuous support. A team of professionals is available to assist you at any time of the day, ensuring the smooth operation of your business.

- Maximum security. Uses advanced encryption technology to protect customer data, ensuring the highest level of transaction security.

- Global capabilities. Support for multi-currency transactions and international transfers opens the door to expanding your business on the global stage.

Billblend.io is the ideal solution for companies seeking to offer their customers the best quality service and strengthen their market position.

Want to increase sales and win the loyalty of the Indian audience? Start implementing effective payment solutions tailored to your business right now. Choose a high-quality payment gateway and attract new customers today. Leave a request for a free consultation.

Recommendations for choosing a payment gateway in India

When choosing the optimal payment solution, it is recommended to pay attention to the following criteria:

- different payment methods in India;

- minimum commissions and transparent rates;

- reliability and compliance with security standards (PCI DSS);

- quality of technical support and response speed;

- flexibility of configuration and ease of integration.

Practical tips for successful implementation

Conduct preliminary tests of the selected payment gateway on a small group of customers. Regularly monitor statistics on successful and unsuccessful transactions. Use analytical tools to identify weaknesses and improve the customer experience. Stay up to date with changes in legislation and regulatory requirements.

Learn more about our service and how we can help your business grow faster and more efficiently. Just follow the link to our commercial offers page and choose the best solution for your company. Good luck with your business development in India!

Frequently asked questions

What is a payment gateway?

A payment gateway is an online service that provides secure data transfer between a merchant and a buyer’s bank by authorising and processing transactions. It helps accept various payment methods, protect customer personal data, and ensure the reliability of financial transactions.

Why is it important to choose a reliable payment gateway?

Choosing a high-quality payment gateway ensures customer data security, improves payment convenience, increases conversion rates, and allows you to enter international markets by accepting various currencies and payment methods.

What factors influence the choice of a payment gateway?

The main criteria are security (PCI-DSS compliance), ease of integration with existing systems, support for international payments, transparency of fees, and availability of 24/7 technical support.

What payment methods are popular in India?

The most popular are UPI (Google Pay, PhonePe, Paytm), e-wallets (Paytm, Amazon Pay), bank cards (Visa, Mastercard, RuPay) and internet banking.

What makes the Billblend payment gateway stand out?

Billblend is an innovative gateway that combines traditional payment methods with the ability to accept cryptocurrencies and automatically convert them into stablecoins. It is suitable for businesses that are future-oriented and interested in digital assets.

Is it difficult to integrate the payment gateway into a website?

We offer simple APIs and plugins for popular CMS (Shopify, WooCommerce, BigCommerce). The process does not require basic programming knowledge and is accessible even to small businesses.