In today’s fast-evolving digital economy, businesses face increasing pressure to streamline operations, reduce costs, and deliver seamless customer experiences – especially when it comes to payments. Legacy payment systems, built on outdated architectures and batch-based processing, are struggling to keep pace with the demand for real-time, secure, and scalable transactions. This is where Payment-as-a-Service (PaaS) emerges as a transformative solution.

PaaS is a cloud-based model that allows businesses to outsource their entire payment infrastructure to specialized providers. Instead of building, maintaining, and updating in-house systems, companies can leverage a fully managed, API-driven platform that handles everything from transaction processing and fraud detection to compliance and reporting. According to McKinsey, companies that actively adopt cloud-based and API-driven financial platforms achieve higher operational efficiency and are able to bring new products to market faster.

In this comprehensive guide, we’ll explore what PaaS really means in 2026, why it’s replacing traditional payment hubs, and how your business can benefit from adopting a modern, agile payments architecture.

What Is Payment-as-a-Service (PaaS)?

Payment-as-a-Service (PaaS) is a cloud-native, subscription-based model that provides businesses with a fully managed payment processing infrastructure. Unlike traditional systems that require significant upfront investment in hardware, software, and compliance, PaaS delivers payment capabilities as an on-demand service.

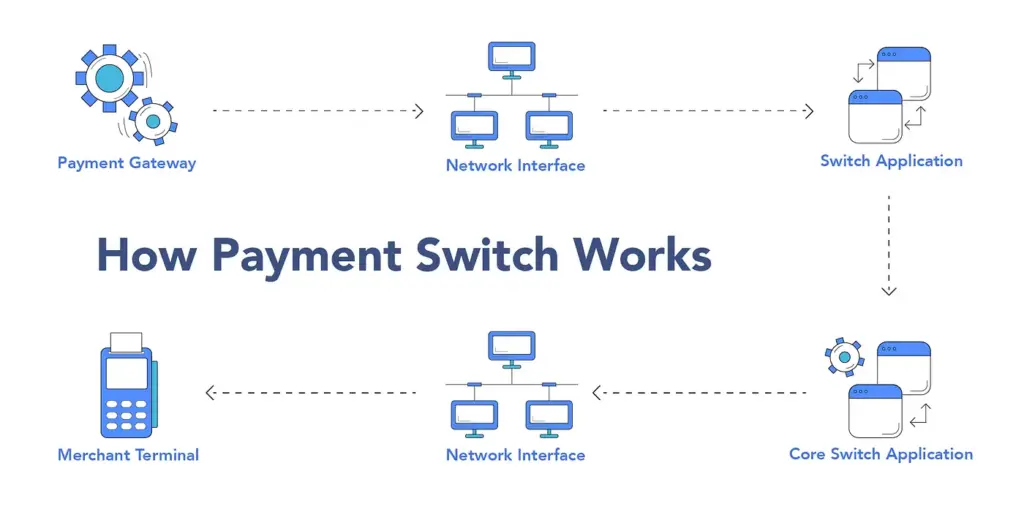

Key components of a typical PaaS platform include:

- Payment gateway integration

- Real-time transaction processing

- Fraud detection and risk management

- Multi-currency and cross-border support

- Automated reconciliation and reporting

- Regulatory compliance updates (PCI DSS, GDPR, PSD2/3)

- Open APIs for seamless integration with existing systems

According to Mordor Intelligence, the global PaaS market is projected to reach $14.52 billion in 2025 and grow to $58.77 billion by 2030. This growth is driven by digital transformation, the rise of instant payments, and the increasing demand for scalable fintech solutions.

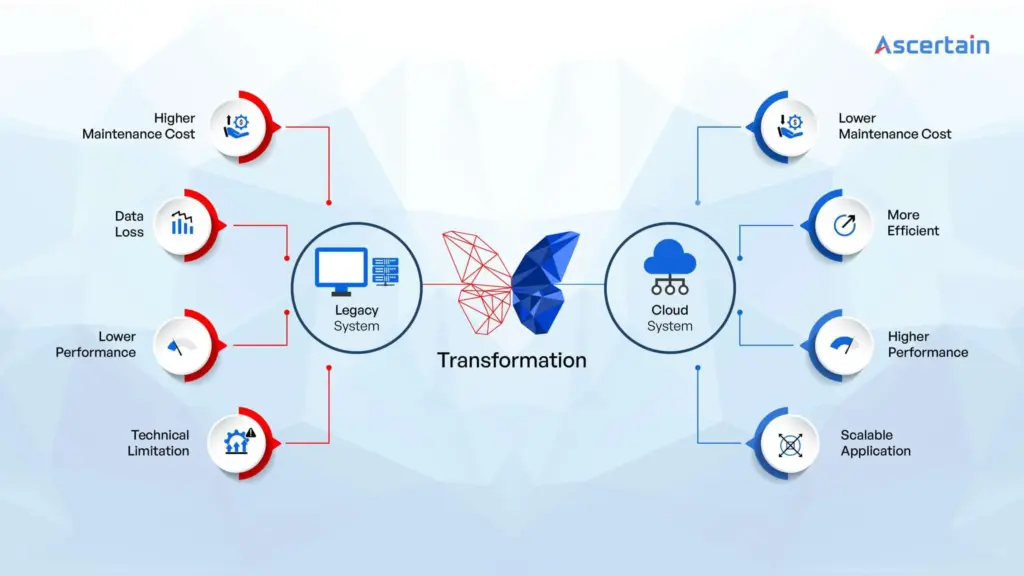

The Problem: Why Legacy Payment Systems Are Failing

Many businesses still rely on monolithic, on-premise payment hubs that were built decades ago. These systems come with significant drawbacks:

| Legacy Payment Hubs | Modern PaaS Platforms |

|---|---|

| High upfront costs ($1M–$25M+) | Low entry cost, pay-as-you-grow pricing |

| Long deployment time (months to years) | Rapid integration (weeks, not months) |

| Batch processing delays | Real-time, 24/7/365 processing |

| Limited scalability | Elastic, cloud-native scalability |

| Manual compliance updates | Automated, quarterly compliance releases |

| High technical debt | Microservices-based, easy to upgrade |

Key Pain Points for Businesses:

- Technical Debt: Legacy systems are costly to maintain and difficult to adapt to new payment methods (e.g., digital wallets, BNPL, cryptocurrency).

- Slow Time-to-Market: Implementing new features or entering new regions can take years.

- High Total Cost of Ownership (TCO): Includes hardware, software licenses, maintenance, and in-house expertise.

- Compliance Risks: Keeping up with evolving regulations (PSD3, AML, KYC) requires continuous effort.

- Limited Innovation: Older systems struggle to support AI-driven fraud detection, IoT payments, or embedded finance.

Core Advantages of Adopting a PaaS Platform

Switching to a Payments-as-a-Service model offers tangible benefits across operational, financial, and strategic dimensions.

Cost Efficiency

Eliminate capital expenditure on infrastructure. Move to a predictable subscription-based or transaction-based pricing model, reducing TCO by up to 30–50% compared to legacy hubs.

Scalability & Elasticity

Cloud-native architecture automatically scales to handle peak loads (e.g., holiday sales, flash promotions) without over-provisioning resources.

Enhanced Security & Compliance

PaaS providers invest heavily in PCI DSS Level 1 compliance, tokenization, end-to-end encryption, and real-time fraud detection. Compliance updates are rolled out automatically.

Faster Innovation & Integration

Open APIs and microservices allow quick integration with e-commerce platforms, ERP, CRM, and accounting software – accelerating time-to-market for new payment features.

Real-Time Processing & Reporting

Support for instant payments, real-time analytics, and granular reporting helps businesses optimize cash flow and improve decision-making.

Focus on Core Business

Outsourcing payment operations lets your team concentrate on product development, customer experience, and growth strategies.

How Modern PaaS Platforms Leverage AI & Advanced Technologies

The next generation of PaaS goes beyond basic processing. Here’s how advanced technologies are reshaping payment services:

AI-Powered Fraud Detection

Machine learning models analyze transaction patterns in real time, reducing false positives and identifying sophisticated fraud attempts that rule-based systems miss.

ISO 20022-Native Messaging

Rich, structured data enables better reconciliation, improved compliance, and enhanced customer communication – especially critical for cross-border and B2B payments.

Blockchain for Transparency & Efficiency

Some providers (like Paystand) use blockchain to create tamper-proof audit trails, enable smart contracts, and reduce intermediary fees – particularly valuable for B2B and supply chain payments.

IoT & Omnichannel Payments

PaaS platforms support emerging channels: in-car payments, smart devices, social commerce, and voice-activated transactions.

Embedded Finance & Banking-as-a-Service (BaaS)

PaaS providers increasingly offer integrated financial services: business accounts, card issuing, lending, and treasury management – all within a single ecosystem.

Key Trends Shaping PaaS in 2025–2030

- Hyper-Personalization: AI-driven payment experiences tailored to user behavior, location, and risk profile.

- Globalization with Localization: Support for regional payment methods (Pix, UPI, iDEAL) and compliance with local data laws.

- Sustainability-Driven Payments: Carbon footprint tracking per transaction, green payment initiatives.

- Quantum-Resistant Encryption: Preparing for post-quantum cybersecurity threats.

- Decentralized Finance (DeFi) Bridges: Integration between traditional finance and blockchain-based payment rails.

Top 6 PaaS Providers 2026

| Provider | Key Strengths | Ideal For |

|---|---|---|

| Stripe | Developer-friendly APIs, global reach, extensive third-party integrations | Startups, SaaS platforms, online marketplaces |

| Adyen | Unified commerce, in-depth analytics, multi-currency processing | Large enterprises, omnichannel retailers |

| Finastra | Cloud-native banking solutions, compliance-ready, strong partner ecosystem | Banks, financial institutions, corporates |

| Paystand | Blockchain-based B2B networks, zero-fee models, automated receivables | Manufacturing, wholesale, supply chain |

| Alacriti | ISO20022-native platform, instant payments hub, focus on credit unions | Banks, insurers, financial services |

| BillBlend | Customizable payment flows, high-risk business support, white-label solutions | High-risk verticals, subscription services, fintechs |

How to Choose the Right PaaS Provider: A Checklist

- Does the platform support your required payment methods and currencies?

- Is it compliant with regulations in your target markets?

- What level of customizability and API access is offered?

- How does the provider handle fraud, chargebacks, and disputes?

- What are the pricing models and total cost of ownership?

- Does it offer real-time reporting and data portability?

- Is the platform built on microservices and cloud-native architecture?

- Does the provider have experience in your industry (e.g., healthcare, crypto, gaming)?

Conclusion: Is PaaS Right for Your Business?

Payment-as-a-Service is no longer a niche offering – it’s becoming the standard for businesses that value agility, security, and scalability. Whether you’re a startup looking to launch quickly, an enterprise aiming to modernize your payment stack, or a high-risk business needing specialized support, PaaS provides a future-proof foundation.

By choosing the right provider, you can reduce costs, accelerate innovation, improve customer satisfaction, and stay ahead in the rapidly evolving payments landscape of 2025 and beyond.

Ready to explore how a modern PaaS platform can transform your payment operations? Contact BillBlend today for a personalized consultation and demo.

Frequently Asked Questions (FAQ)

What is the role of AI in PaaS?

AI enhances fraud detection, automates customer onboarding (KYC), personalizes payment experiences, optimizes authorization rates, and provides predictive analytics for cash flow management.

How does PaaS benefit high-risk businesses?

High-risk verticals (gambling, crypto, adult) benefit from specialized underwriting, advanced risk tools, chargeback mitigation, and compliance frameworks tailored to stringent regulations.

Can I switch from a legacy hub to PaaS without disruption?

Yes. Most providers offer phased migration, API-led integration, and sandbox environments to ensure a smooth transition with minimal downtime.

What’s the difference between PaaS and a traditional payment processor?

Processors focus on transaction routing; PaaS offers an end-to-end, cloud-based platform that includes compliance, reporting, risk management, and value-added services.

How does PaaS support global expansion?

Look for providers with local acquiring partnerships, multi-currency settlement, support for regional payment methods, and compliance with local data laws (GDPR, CCPA, etc.).

Is PaaS secure enough for enterprise use?

Reputable PaaS providers adhere to PCI DSS Level 1, SOC 2, and ISO 27001 standards, employ encryption and tokenization, and undergo regular third-party audits.