Payment Routing: How it Works

Payments are an integral part of modern online business. Customers can use them to pay for services and goods or top up their balance in games, casinos, marketplaces and much more. One of the key elements that enable such a wide variety of services is payment routing. In this article, we’ll look at what it is, how the service works, the benefits it brings and how it solves business problems.

What is payment routing and cascading?

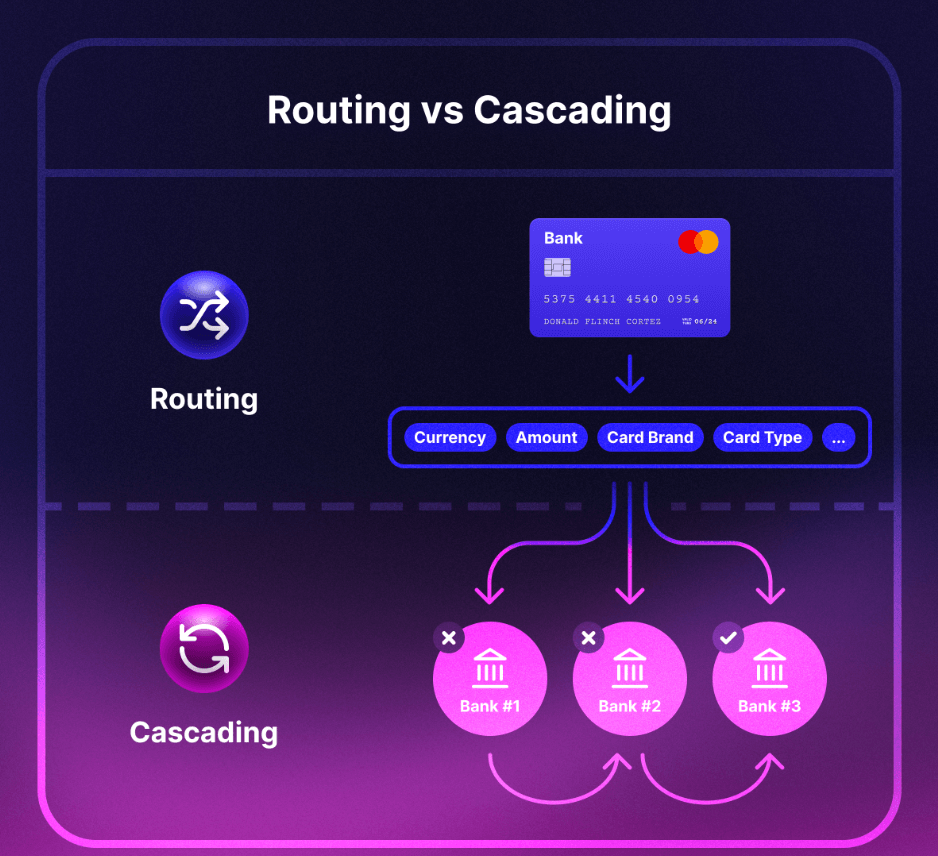

In routing payments , there are two main services that complement each other by providing businesses with the most convenient ways to make transactions. These are payment routing itself and payment cascading.

Why companies need cross-border payment gateways

Transaction routing is the process of channelling a payment from a customer’s bank account or credit card through various intermediary links until it reaches the merchant’s account. This process involves selecting the most cost-effective, safe and secure route for each transaction based on pre-defined rules.

Definition of cascading payments

Cascading payments are an advanced form of payment routing where transactions are automatically routed through multiple payment gateways or providers in sequence. If one gateway fails or rejects a transaction, the system tries another option, ensuring high success rates and reducing failed transactions.

Benefits of payment routing and cascading

The use of modern technology improves business efficiency. By using BillBlend’s routing, transaction failure rates are reduced and transactions are completed faster, positively impacting the user experience.

The main benefits of using this service are:

- Cost optimisation. Automatically selecting the cheapest payment provider for each transaction allows businesses to save significantly on fees.

- Increased transaction success rates. With payment cascading, even if one payment method fails, the transaction is redirected to the next, increasing the chances of successful completion.

- Transaction security. Advanced routing algorithms ensure compliance with security standards such as PCI-DSS while reducing fraud risks. In addition, businesses can set up to accept transfers from different categories of customers - new customers and those who have previously used. This allows for additional verification for newcomers that regular customers don't need.

- Scalability. As your business grows, payment routing allows you to process an increased volume of transactions without losing speed or reliability.

This has a positive impact on the overall turnover of financial transactions.

How payment routing works

A universal algorithm describing the sequence of router actions:

- Transaction initiation. The customer initiates a payment using the preferred method (credit/debit card, e-wallet, etc.).

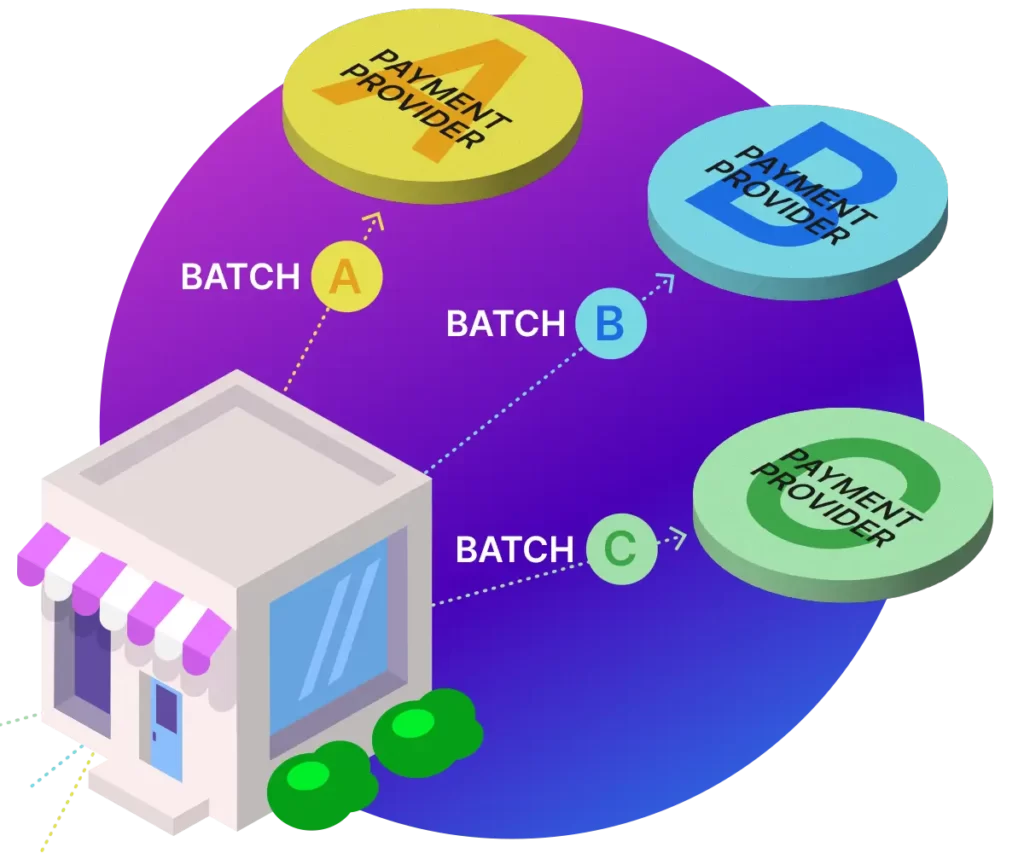

- Routing decision. Based on specified rules (cost, availability, location, etc.), the payment processor selects the optimal path for the transaction. For example, by geo-customer or selected currency.

- Processing. The selected payment gateway processes the transaction and passes it to the acquiring bank.

- Closing the transaction. Once approved, funds are credited to the merchant's account via the selected route.

Cascade payments are activated only if the transaction is rejected at any of the stages.

There are several principles of cascading payments:

- Sequential. This is the simplest method. If the selected route resulted in a transaction rejection, the buyer's data is sent to the second one and so on until all routes are completed or the transaction is approved.

- Reservation. The sequence of actions is already defined in the system, and it can be different from the one defined in the first option.

- Dynamic. This is the most advanced technology, in which cascading payments evaluate the load on each gateway and assess the probability of failure, which allows you to choose the most successful sequence of actions.

Regardless of the operating principle chosen, the very essence of the solution does not change. Cascading allows you to resend customer data if the first gateway fails.

BillBlend solution: Optimising payments with routing and cascading

At BillBlend, we’ve taken payment routing to the next level. Our artificial intelligence-based algorithms analyse past data, current market conditions and user behaviour to determine the best route for each transaction. Additionally, our proprietary cascading technology minimises the number of unsuccessful transactions, increasing revenue for merchants. Learn more on our Telegram at.

By leveraging advanced technologies like payment routing and cascading, companies can achieve new levels of operational efficiency, security, and profitability.

Answers to common questions

What is the difference between payment routing and cascading:

Payment routing directs transactions to a single gateway, whereas cascading payments attempt to use multiple gateways sequentially if the first attempt is unsuccessful.

How does routing increase the success rate of transactions?

By selecting the most appropriate payment method or gateway based on factors such as availability, fees, and reliability.

Can BillBlend's routing be used for international transactions?

Yes, we support multi-currency transactions and offer optimised routing for international use.

Is payment routing secure?

Routing uses encryption, tokenisation and strictly adheres to security protocols such as PCI-DSS.

Does BillBlend support cascading payments?

Yes, BillBlend offers dynamic cascading functionality to increase transaction success rates while reducing costs.

How can I integrate the services into my business?

BillBlend, offers readily available APIs and plugins that are compatible with popular e-commerce platforms.