Payment Orchestration: Key Benefits for Businesse

Today’s e-commerce market is growing rapidly and global online sales are expected to reach $9.4 trillion by 2026. To stay ahead of the competition and gain share in this huge market, businesses need to implement innovative solutions that can optimise payment processes and improve customer experience. One such solution is payment orchestration, a tool that helps businesses manage their payment operations more efficiently and scale in international markets.

What is payment orchestration

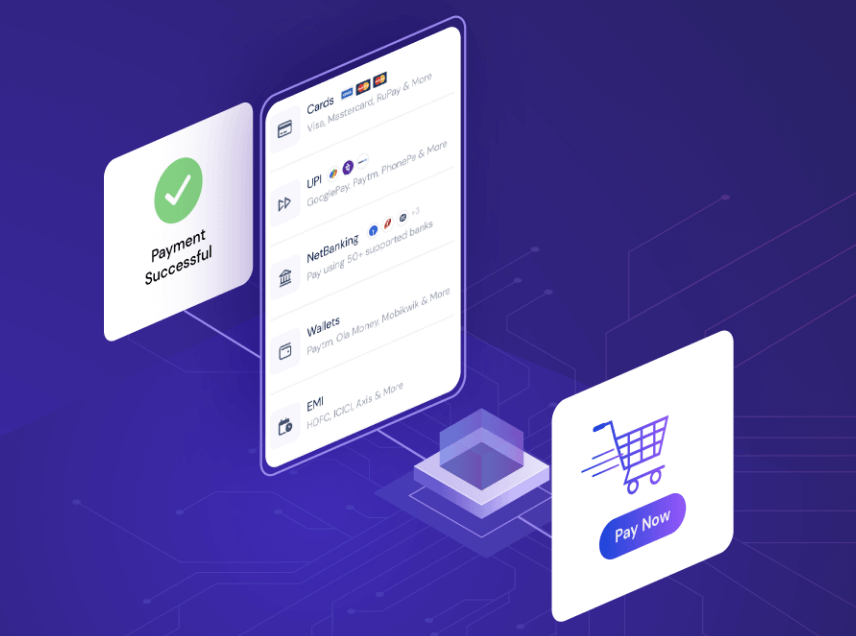

Payment orchestration is an integrated system for managing all stages of the payment process, from transaction authorisation to settlement. This technology allows companies to be more agile and respond quickly to changes in market conditions, ensuring compliance with legislation and smooth business development in new territories.

How payment orchestration works:

- A customer places an order. The customer adds items to the basket and proceeds to the payment stage, selecting a convenient payment method.

- The data is sent through the payment gateway. The payment gateway encrypts the customer's card information and transmits it to the acquiring bank via the payment processor.

- Payment authorisation. The acquiring bank contacts the issuing bank to verify and approve the transaction. If the payment is rejected, the system automatically routes the request to an alternative payment channel, minimising the risk of rejection.

- Transaction Completion. If the payment is successful, the issuing bank returns the authorisation code and the payment is considered complete.

What is payment orchestration

The ability to make purchases online is no longer a luxury, but a necessity. People value their time and comfort, so they prefer to make orders directly from home or office. And if your online shop does not offer online payment option, you risk losing potential customers.

In addition, online payment has a number of benefits for your business:

- Time savings. You no longer need to spend time processing cash or cheques - everything happens automatically.

- Expanding your sales geography. You can take orders from anywhere in the world where you have internet access.

- Increased customer loyalty. The possibility of fast and convenient payment makes the purchase process pleasant and memorable for the customer.

BillBlend: Your guide in the world of cross-border payments

Payment orchestration platform BillBlend offers a powerful payment organisation solution that combines high security standards, transparency and flexibility. That’s why BillBlend is chosen by leading companies:

- Global coverage. Supports over 150 currencies and works in hundreds of countries.

- Minimal fees. Payment route optimisation to reduce transaction costs.

- Multi-level security. Client data protection using modern cryptographic standards.

- Interactive analytics. Tools to analyse and monitor all aspects of the payment process in real time.

- Full customisation. Ability to customise payment pages to meet the unique requirements of your brand.

Examples of success with BillBlend

Payment orchestration benefits for businesses will be revealed by examples of successful integrations and problem solving.

PIX Payments: simple PIX payment process in Brazil. The optimised payment flow led to a significant increase in transaction success rates, reaching an impressive 90%. The ability to transfer funds instantly improves the user experience by eliminating delays and complications.

Another successful case study of transaction processing implementation is available in the Turkish financial market. The client received a convenient system for accepting credit card payments, which reduced fraudulent transactions, refunds and increased customer retention.

Conclusion

Discover new growth horizons with BillBlend. Our team of experts is ready to help you integrate orchestration solutions into your business and take it to the next level. Contact us for a free consultation and find out how we can help you achieve your goals. Learn more about the capabilities of BillBlend’s payment orchestration providers. Start growing today.

Answers to common questions

What is payment orchestration?

Payment orchestration is the process of centrally managing all stages of payment processing within a company. It involves integrating and coordinating different payment systems, service providers, and payment methods to ensure optimal and secure transaction processing. The main goal of orchestration is to increase efficiency, reduce costs and improve customer experience, giving businesses the flexibility and ability to scale across international markets.

What are the benefits of payment orchestration for businesses?

Payment orchestration helps to increase revenue, reduce payment processing costs, improve customer experience, optimise transaction routes and simplify integration with different payment service providers. It also provides real-time analytics and improves payment acceptance rates.

What is an example of payment orchestration?

An example of payment orchestration is an e-commerce platform that integrates multiple payment gateways and services into a single service. This setup allows customers to choose their preferred payment method – be it credit cards, digital wallets or bank transfers – all through one unified system. It’s a smart way to streamline the payment process, making it easier and more efficient for both businesses and their customers.

How do I get started with BillBlend?

To get started with BillBlend, contact our team of experts for a free consultation. We can help you integrate our solutions into your business and help you achieve your goals.