Online payment methods in Turkey

Modern businesses in Turkey are facing a rapidly changing digital environment where traditional payment methods are rapidly losing popularity. Until recently, credit cards dominated online commerce, accounting for about 47% of all transactions.

However, by 2030, this figure is expected to drop to 32%, giving way to new technologies and payment methods. At the same time, there is a real boom in digital wallets, whose share will almost double, accounting for a third of the market.

Why are changes in Turkey’s online payment methods important for business? Because understanding and adapting to new customer preferences in a timely manner is key to a company’s success and competitiveness. In our article, we will discuss the main trends in detail, analyse the most popular online payment methods in Turkey, and explain why it is vital for every entrepreneur to keep their finger on the pulse of these changes.

Current trends in e-commerce in Turkey in 2025

E-commerce in Turkey is growing fast and becoming a key driver of the country’s economy. By 2025, online sales are expected to reach an impressive $93.54 billion, with almost three-quarters of purchases made via smartphones and tablets.

Key technology trends

Among the most notable technology trends are:

- Augmented and virtual reality. These technologies allow shoppers to interact with products remotely, examine them in detail and test them in a virtual space.

- Artificial intelligence. Used to personalise offers and improve customer service.

- Biometrics and alternative payment methods. Biometric identification is growing in popularity, and new payment options are emerging, including cryptocurrencies.

Changes in consumer behaviour

Shoppers are becoming more demanding and are focused on:

- instant gratification;

- the simplest and fastest possible ordering process;

- a personalised approach from the brand;

- environmentally friendly products and packaging, and a low carbon footprint.

Logistics of the future

The logistics sector is also undergoing a transformation, with innovative approaches such as delivery by unmanned drones, which significantly reduce waiting times and improve service quality.

Companies that adapt to new conditions and audience needs in a timely manner gain significant competitive advantages and are able to achieve success in Turkey’s dynamic digital market.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Popular payment methods in Turkey

Payment methods in Turkey reflect a combination of traditional approaches and the active introduction of new technologies, which is due to economic conditions, cultural characteristics and the influence of external factors.

Credit cards and instalments

Credit cards are one of the most popular payment methods in Turkey. About half of the population regularly uses them to make purchases, preferring the convenience and accessibility of credit.

Moreover, a significant portion of online transactions (about 80%) are made using credit cards, with the majority of them (up to 65%) paid in instalments. This popularity is due to high inflation and the ability to spread expenses over time.

Cash payments

Despite the widespread use of cashless payments, cash continues to play an important role in the country’s economy. Approximately a quarter of the population prefers to pay for goods and services in cash, especially in small retail outlets and remote regions where cashless payment infrastructure is less developed.

Growing popularity of prepaid cards

Prepaid cards are growing significantly in popularity, especially among those who want to control their spending and avoid debt. This trend is reinforced by economic difficulties and uncertainty.

Development of mobile and digital payments

Mobile payments and contactless technologies are rapidly gaining market share.

Various mobile apps and services are actively used to make quick and convenient transfers, payments and cash withdrawals. The transition to digital wallets and QR codes is particularly popular among young people, in line with the global trend towards digitalisation in the financial sector.

Currency preferences

High inflation (over 20%) is driving interest in foreign currencies such as the US dollar and the euro, which are widely accepted alongside the national currency, the Turkish lira.

Many residents and tourists prefer to keep their savings and make large transactions in foreign currency in order to minimise financial losses due to exchange rate fluctuations.

The country is moving steadily towards further digitalisation of payments, while maintaining the importance of traditional payment methods.

What businesses need to accept payments in Turkey

Online commerce in Turkey continues to grow at an impressive rate, and providing customers with a convenient and secure payment method is essential for running a successful business. One of the most important components of a successful strategy is choosing the right payment gateway and Turkey payment methods.

The need for a payment gateway

A payment gateway is specialised software that acts as a link between your online store and the banking system. The main task of a payment gateway is to process transactions, protect confidential customer data and ensure fast and secure money transfers.

Without a high-quality payment gateway, no online store can operate effectively. That is why choosing the right solution is so important.

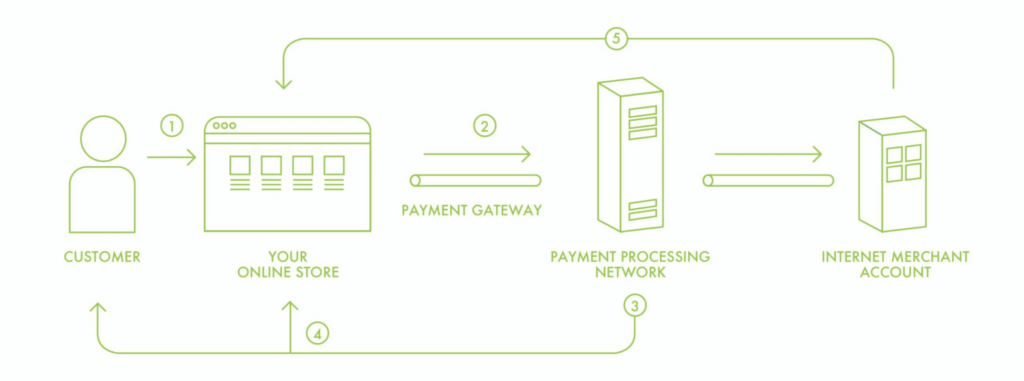

How a payment gateway works

The payment gateway works like this:

- The customer picks a product or service and goes to checkout.

- The system sends the buyer to the payment page provided by the chosen payment gateway.

- The buyer enters their credit card details or other payment method.

- The data is sent via an encrypted channel directly to the issuing bank for authentication;

- The bank confirms or rejects the transaction;

- The result of the transaction is returned to the buyer and the seller;

- The funds are credited to the store's account after all banking procedures are completed.

All these steps take less than a second, so payment confirmation is pretty quick.

Criteria for choosing a payment gateway

When choosing a payment gateway for your business in Turkey, consider the following key factors:

- Supported payment methods – make sure the gateway supports the most popular Turkey online payment methods, such as credit cards, e-wallets, instalment payments and cryptocurrencies.

- Ease of integration – choose solutions that have ready-made plugins for popular e-commerce platforms, as this will save you time and resources on development.

- Commissions and service costs – compare the rates of different providers, paying attention to fixed fees, transaction percentages and monthly fees.

- Security and PCI DSS compliance – make sure that the gateway you choose complies with international security standards and protects your customers' personal data.

- Withdrawal speed – assess how quickly the provider transfers money to your bank account.

- Quality of customer support – check reviews and ratings to ensure that the support service is accessible and professional.

Billblend – the best solution for businesses in Turkey

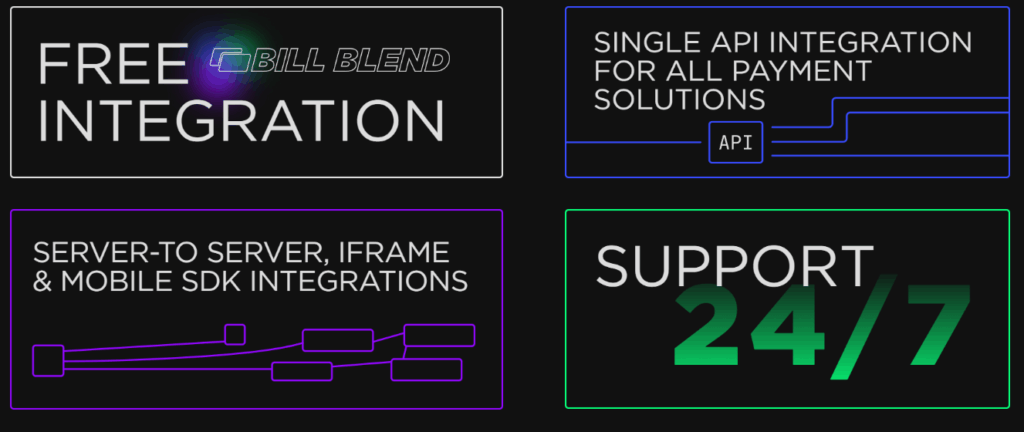

One of the best solutions for businesses in Turkey is the Billblend payment gateway. Here are a few reasons why this provider deserves special attention:

- Versatility. Billblend supports a huge number of popular online payment methods in Turkey, including credit cards, e-wallets, instalment payments and cryptocurrencies.

- Easy integration. We offer ready-made modules for most well-known e-commerce platforms, which makes installation and configuration easy.

- Competitive prices. Transparent and affordable pricing plans make it a great choice for businesses of all sizes.

- High level of security. Billblend guarantees reliable protection of customer personal data and compliance with all regulatory requirements.

- Fast support. Our 24/7 support team quickly resolves any issues and helps you troubleshoot problems.

Using the Billblend platform will provide a reliable foundation for building an effective and profitable online business model in Turkey. Get a free personal consultation from Billblend experts right now and learn how to optimise your payment acceptance system in just one business day.

How to integrate a Turkish payment gateway into your website: a simple guide

Modern entrepreneurs are faced with the need to choose the best way to integrate a payment gateway into their website. The right solution will not only speed up the process of launching online sales, but also ensure convenience and security for your customers. Let’s look at two main integration options and decide which one is right for you.

Option 1: Quick integration via plugins

If you use popular e-commerce platforms such as WooCommerce, Shopify or Mijnwebwinkel, the best solution is simple integration via a specially designed plugin. Most leading payment providers offer ready-made plugins that can be installed in minutes and require minimal configuration.

The advantages of this type of integration are obvious:

- minimal involvement of a technical specialist;

- quick deployment (just a few hours);

- no need for in-depth technical knowledge.

This is the ideal option for small and medium-sized businesses that want to start selling as quickly as possible without significant investment.

Option 2: Flexible integration via API

If your online store has its own architecture or has high requirements for the design and functionality of the payment process, then integration via API is the best choice. This method will require the involvement of qualified programmers and will take a little longer, but it will give you complete freedom and control over the order and payment process.

The main advantages of integration via API:

- full control over the appearance and functionality of the payment form;

- the ability to implement unique payment scenarios;

- maximum customisation to individual business requirements;

This approach is ideal for large projects where uniqueness and maximum functionality are important.

Please note that in addition to the technical integration itself (via a plugin or API), you will also need to have a verified account with your chosen payment provider. Only then will you be able to fully accept payments from customers.

Your choice of integration method depends on a number of factors:

- the software used for your online store;

- the desired level of flexibility and customisation;

- available technical resources and budget.

Many platforms, such as Shopify and WooCommerce, work exclusively with certified plugins, which limits the choice of payment systems. Other platforms, such as Magento, allow the use of both plugins and APIs, providing more room for manoeuvre.

Virtually any payment service supports integration via API, so you always have a wide range of options to choose from.

Billblend's unique offering

We offer incredibly convenient and simple integration via API. The solution is highly reliable, fast, and supports a wide range of popular payment methods relevant to the Turkish market.

In addition, if you have any questions or difficulties during the integration process, our professional support service is ready to help you at any time of the day, providing round-the-clock support and advice.

Start using modern payment methods today. Billblend is a modern multi-currency gateway that will help you quickly and easily implement effective payment solutions.

You are just a few steps away from getting started: free consultation and service testing.

Conclusion

E-commerce in Turkey is developing rapidly, setting new standards for convenience, security and technology for businesses. Success in this market is determined by the ability to quickly adapt to changes and offer customers the best payment solutions.

Billblend is a reliable partner ready to provide modern Turkish entrepreneurs with an innovative multi-currency platform with easy integration and professional round-the-clock support. Start working with Billblend today and get a free consultation to take your business to a new level of efficiency and customer trust.

Answers to frequently asked questions

What payment methods are most popular among Turkish consumers?

The most common are credit cards, instalment payments, e-wallets and mobile payments. Interest in cryptocurrencies and alternative financial instruments is gradually increasing.

How difficult is it to integrate payment solutions into an online store in Turkey?

Integration can take place in two main ways: through ready-made plugins (quick and easy) or through API interfaces (more flexible but requires more developer involvement). The complexity depends on the platform chosen and the desired level of customisation.

What recommendations are there when choosing a payment provider?

It is recommended to focus on the provider’s reputation, the range of payment methods covered, the level of security (PCI DSS compliance), the cost of services, and the quality of customer support. It is particularly advantageous to work with providers such as Billblend, which offer a modern multi-currency platform and high-quality 24/7 support.

What legal aspects are important for businesses accepting online payments in Turkey?

It is necessary to take into account the regulator’s requirements regarding licensing, compliance with security standards, and the storage and transfer of customer personal data. It is recommended to consult with lawyers specialising in e-business issues in advance.

What are the prospects for the online payment market in Turkey in the near future?

Further growth in the share of mobile payments, an increase in the number of alternative payment methods, the strengthening of domestic payment systems and the continued active introduction of innovative technologies such as biometrics and artificial intelligence are expected.