Online payment methods in Italy

In Italy, as in many European countries, cash payments have long held the lead, not inferior to non-cash payments. But in recent years, the situation has begun to change. With the advent of digital wallets, cryptocurrencies, and the active development of online stores, new payment methods have become popular.

According to recent reports, the digital payments market in Italy reached $56 billion in 2025. The market will grow in the coming years. By 2027, it is estimated at $82 billion. One of the interesting trends is the increase in the average spending of Italians on online purchases. If in 2025 it will be around $1007, then in 2027 it will be $1480. Given these changes, it is important for businesses operating in Italy to know the specifics of the behavior of local customers and the payment methods they prefer.

For companies operating in the e-commerce sector, understanding trends in Italy online payment methods is becoming a key factor for success. With the growing demand for high-quality and reliable digital payment instruments, businesses are faced with the need to choose the optimal methods for integrating and managing their payment systems.

What are online payment methods

Online payment methods in Italy are a variety of mechanisms that allow users to quickly and conveniently purchase goods and services through online stores and electronic platforms. Modern digital payment solutions cover a wide range of methods, from classic credit and debit cards to mobile applications, bank transfers and innovative tools such as QR codes.

Each of the payment methods in Italy has its own characteristics and advantages, depending on the level of convenience, accessibility and consumer confidence. The most important advantages of online payments are:

- Speed and simplicity. Buyers can make a purchase in literally a minute, regardless of location.

- Convenience of storing money. There is no need to carry large amounts of cash.

- Additional bonuses and discounts. Many providers offer special loyalty programmes and cashback.

- No geographical restrictions. The ability to purchase goods and services regardless of the buyer's country of residence.

However, there are a number of potential threats associated with the use of online payments, including cyber fraud and unauthorised access to personal financial data. Therefore, ensuring reliable protection and security is a priority for any business operating in the e-commerce sector.

Reasons for the displacement of cash by online payments

Traditional forms of payment, such as cash, remain popular in some regions of the world, including Italy. However, the observed decline in the role of cash is linked to the development of digital technologies and changing consumer habits. Let’s look at the key reasons driving the growth in popularity of online payments in Italy:

- Consumer protection and legislative changes. The European PSD2 directive has raised the security standards for online transactions, reducing the number of fraud cases and increasing consumer confidence in the reliability of digital payments.

- Accessibility and convenience. Thanks to the development of electronic devices and mobile banking, most Italians have easy access to their finances anywhere, anytime.

- Regulatory support. European Union policies encourage the use of innovative payment solutions, creating favourable conditions for the development of digital finance.

- Business competitiveness. Companies offering modern payment methods gain competitive advantages and attract more customers.

- Economic impact. Electronic payments reduce costs and increase the efficiency of logistics processes, reduce the cost of processing paper documents, and simplify accounting.

Online payment methods are becoming an integral part of everyday life for Italians, opening up new opportunities for small and medium-sized businesses, large retailers and international players.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Popular online payment methods in Italy

The most frequently used payment methods in Italy include both globally recognised brands and regional alternative payment methods. Many Italians prefer to use services such as:

- PayPal. One of the leaders in the digital wallet market, which has gained a large market share thanks to its ease of use and high level of security.

- Skrill. Widely used by users who appreciate the ease of transferring funds and the absence of high commissions.

- Amazon Pay. Used primarily by buyers on the Amazon platform, providing a fast and secure way to pay for purchases.

- Google Pay. Popular among Android device users, allowing instant payments directly from your phone.

- Apple Pay. Gradually gaining popularity among Apple device owners, although it still lags behind other international players.

Local players also play an important role in shaping Italy’s payment landscape. These include:

- SEPA. A European payment system that allows for fast transfers within the eurozone.

- MyBank. A local solution based on the direct transfer of funds from the customer's bank account directly to the merchant.

- BANCOMAT Pay. Uses the PagoBANCOMAT card, popular among many Italians due to its widespread use.

- Satispay. An attractive mobile app that uses the user's phone number for identification and fast payments.

Choosing the right method depends on a variety of factors, including the age of the target audience, region of residence, and the specific needs of each market segment.

Specific features of the Italian online payment market

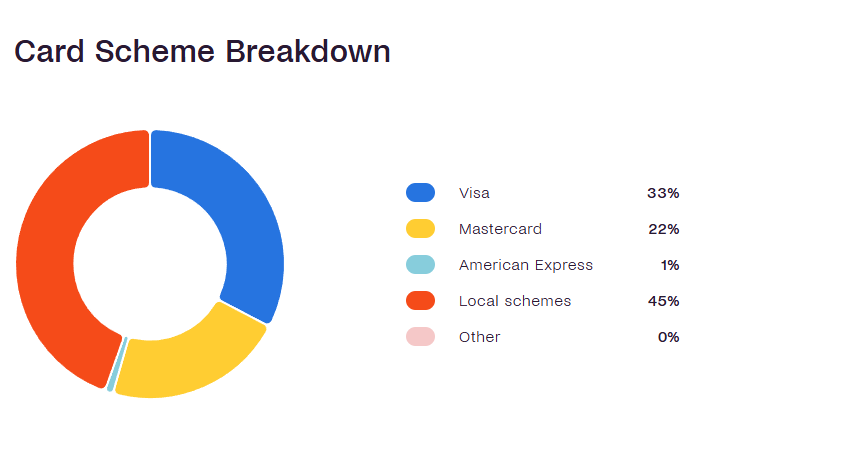

One of the key aspects of success in the Italian market is adaptation to local conditions and cultural characteristics. Local residents highly value convenience and speed of payment, trusting proven sources and well-known brands. Successful strategies require consideration of regional specifics, including preferences for certain types of card products and awareness of taxation rules and financial sector regulations.

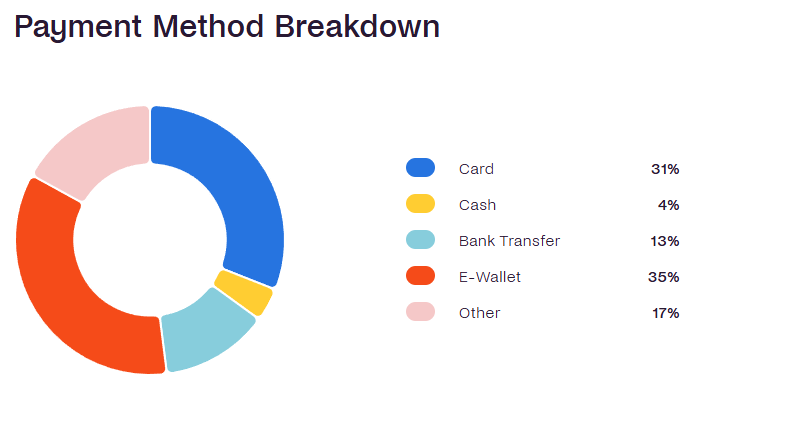

Overall, cards and e-wallets account for 66% of the total market for online payment methods in Italy – 31% and 35% respectively. This is followed by bank transfers and cash payments, with other payment methods accounting for 17% of the total number of transactions.

Italy is distinguished by its unique consumer culture and financial habits. Many shoppers are accustomed to receiving goods immediately after payment and expect similar conditions when shopping online. Thus, timely delivery and quality assurance have a significant impact on the choice of payment method.

Another important factor is the attitude towards risk and data privacy. Many Italians are sceptical about new technologies, so special attention is paid to the transparency and clarity of the ordering and payment process.

When entering this market, a company must carefully study local preferences and adapt to them, otherwise the risk of losing a significant share of potential profits increases many times over.

Online payment security issues and solutions

One of the main concerns of consumers when it comes to online shopping remains the security of personal data and the risk of fraud. To minimise risks, customers are increasingly choosing platforms that guarantee reliable protection of their accounts and confidentiality of information.

Modern payment systems use multi-level data protection, implement SSL/TLS protocols, two-factor authentication, and algorithms for analysing suspicious activity. For example, the Billblend payment gateway is a reliable tool designed specifically to reduce risks and increase the efficiency of online sales by providing a wide range of payment management features.

The advantages of using Billblend are as follows:

- easy integration with existing websites and e-commerce platforms;

- high degree of payment processing automation;

- comprehensive solutions for combating fraud and refunds;

- support for numerous payment methods in Italy, which increases the chances of attracting more customers.

You can find out more about connecting Billblend for transaction processing by filling out a simple form for a free consultation on the website.

Conclusion

The current situation in the Italy online payment methods market shows steady growth in the volume of transactions made via the Internet, an increase in the popularity of alternative forms of payment, and the emergence of new technological solutions. This is facilitated by European Union regulations, growing consumer expectations regarding the convenience and security of transactions, and the efforts of payment solution developers and providers to create universal and secure systems.

E-commerce companies must take market specifics into account when choosing suitable payment methods in Italy and developing effective product promotion strategies. Investing in modern technologies and specialised tools, such as Billblend, will allow you to create a competitive product that attracts a large number of loyal customers and strengthens your brand’s reputation.

Frequently asked questions

What are the most common online payment methods in Italy?

The most popular online payment methods in Italy are PayPal, Skrill, Amazon Pay, Google Pay, as well as local solutions such as SEPA, MyBank, BANCOMAT Pay and Satispay.

Why is digital payment more convenient than traditional cash payments?

The advantages of digital payments include fast transaction processing, reduced time and resource costs, additional bonus programmes, and reduced risk of theft.

What are some recommendations for ensuring the security of online transactions?

Use reliable and proven payment gateways, enable two-factor authentication, make sure the store’s website has an HTTPS certificate, and regularly update your device’s software.

What influences a customer's choice of payment method?

The key factors are brand awareness and trust, ease and convenience of use of the chosen tool, affordable fees, and the possibility of a refund in case of disputes.

What is the best way to integrate a reliable payment gateway into an online store website?

The best solution is to integrate a specialised payment solution, such as Billblend, which will ensure high-quality service and reliable protection of your customers’ data.

Should I be concerned about potential issues with the tax authorities when making online payments?

Yes, you must comply with Italian tax legislation and keep accurate records of income and expenses. Proper configuration of the payment system will automate the reporting process and simplify interaction with the tax authorities.