Online payment methods in Germany

Germany has long been a leader in financial innovation and economic stability. The current stage is characterised by the rapid growth of e-commerce and online payments, which have become an important part of everyday life for most citizens. The annual volume of digital payments in Germany exceeds €50 trillion, highlighting the significance and scale of this sector.

Despite the traditional conservatism of German consumers, caused by mistrust of new technologies, the modern market requires active expansion of the use of online payment methods in Germany. The share of card payments is growing, the popularity of e-wallets is increasing, and new forms of online payment are emerging. The perception of old payment methods, such as SEPA bank transfers and prepayment, is also changing, while remaining the main payment channels for a large number of buyers.

When analysing current trends, it is important to understand not only the characteristics of the most used payment methods in Germany, but also the decision-making processes of consumers, their motivations and concerns. It is the competent selection and support of the optimal set of online services that will ensure the success of a business in Germany.

What is an online payment method

Germany online payment methods involve the transfer of money via digital communication channels. A distinctive feature of such methods is remote execution, which excludes the physical participation of the parties to the transaction. There are several categories of online payments:

- SEPA bank transfer. A standard and fast way to send money within the European zone.

- Card payments. The use of physical or virtual cards, including credit and debit cards.

- E-wallets. Storage and use of card information through intermediary platforms such as PayPal, Google Pay, Apple Pay.

- Alternative methods. New forms of online payments, such as the BLINK system, which is popular in Poland and is beginning to spread in Germany.

Each category has its own advantages and disadvantages that affect its attractiveness and convenience for businesses and consumers.

Popular online payment methods in Germany

Let’s take a closer look at each category of popular payment methods in Germany and analyse their advantages and disadvantages.

SEPA bank transfers

The SEPA system is a single European mechanism that ensures fast interbank payments within the Eurozone. It is available to individuals and legal entities, supporting both individual and bulk transactions.

Advantages of SEPA:

- free or low-cost transfers;

- speed of transactions;

- accessibility and recognition among consumers.

Disadvantages of SEPA:

- limited area of application (Eurozone countries);

- need for confirmation of the sender and recipient.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Card payments

Credit and debit cards remain popular payment methods in Germany. Card payments are supported by hundreds of thousands of online and offline platforms, making them a convenient form of payment for both everyday purchases and expensive purchases.

Advantages of card payments:

- widespread use and acceptance in most shops;

- fast payment processing;

- high level of security (protection against fraud).

Disadvantages of card payments:

- additional fees for international transactions;

- potential losses due to stolen card details.

E-wallets

E-wallet services such as PayPal, Apple Pay and Google Pay offer convenient storage of card information and payments with minimal delay. These Germany payment systems occupy a large part of the market, meeting the needs of active online users.

Advantages of e-wallets:

- ease and speed of use;

- no need to re-enter card details;

- trust and popularity among young people.

Disadvantages of e-wallets:

- dependence on network connection to the bank or account;

- some users are concerned about the transfer of personal information to third parties.

Alternative methods

Some consumers prefer alternative forms of payment, such as BLINK, designed for fast transfers without intermediate steps. Such systems are used by small groups of users looking for non-standard solutions. Some users also choose to pay with cryptocurrency, especially stablecoins.

Advantages of alternative methods:

- increased transfer speed;

- minimal commission.

Disadvantages of alternative methods:

- low prevalence and limited support infrastructure;

- insufficient user awareness of features and capabilities.

Distribution of payment methods in e-commerce

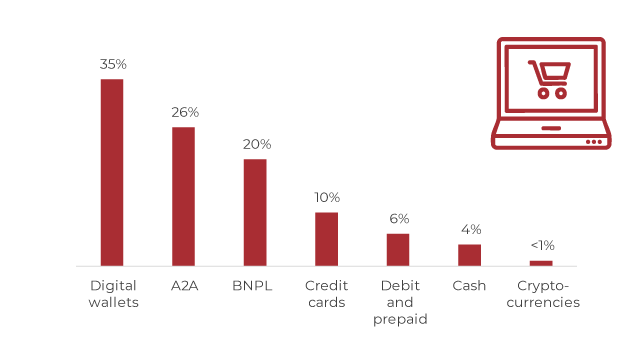

Most popular payment methods in Germany are similar to the global trend, where digital wallets are taking the lead. Wallets already account for 35% of all transactions, and by 2030, their share is projected to grow to 43%. A2A transfers are in second place. Currently, their share is 26%, with projected growth to 27%. Among digital wallets, PayPal, Google Pay and Karna are the most popular.

The following options came next:

- BNPL (buy now, pay later) – 20%;

- Credit cards – 10%

- Debit cards – 6%;

- Cash – 4%;

- Cryptocurrency – less than 1%.

Despite the decline in popularity of credit cards, the total volume of transactions will grow. In 2023, turnover was $10.4 billion and is forecast to grow to $12.1 billion by 2028.

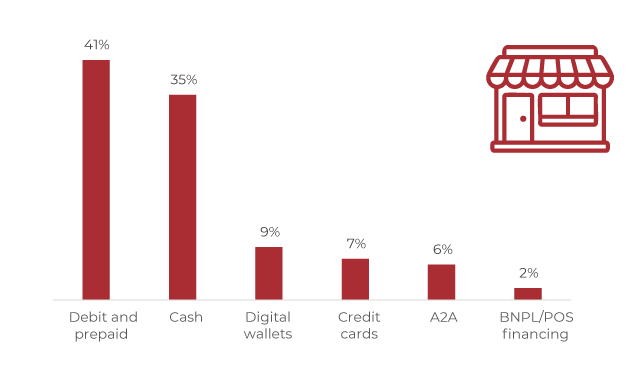

It should be noted that digital wallets are not yet widely used in retail trade. Here in Germany, debit and prepaid cards are in first place with a share of 41%, while 35% of transactions are carried out using cash. Digital wallets are in third place, accounting for 9% of transactions.

Advantages of online payments for businesses

The use of online payment methods in Germany offers significant advantages for businesses:

- Sales growth. Providing the most used payment methods in Germany attracts more customers and reduces the number of abandoned purchases.

- Reduced administrative costs. The automated online payment process frees employees from routine tasks such as paper processing and manual accounting.

- Opportunity for international expansion. Accepting payments in different currencies and cryptocurrencies allows companies to enter the international market and expand their customer base.

- Attracting a young audience. Teenagers and young adults prefer high-tech solutions such as PayPal and Google Pay, which increases the competitiveness of the business.

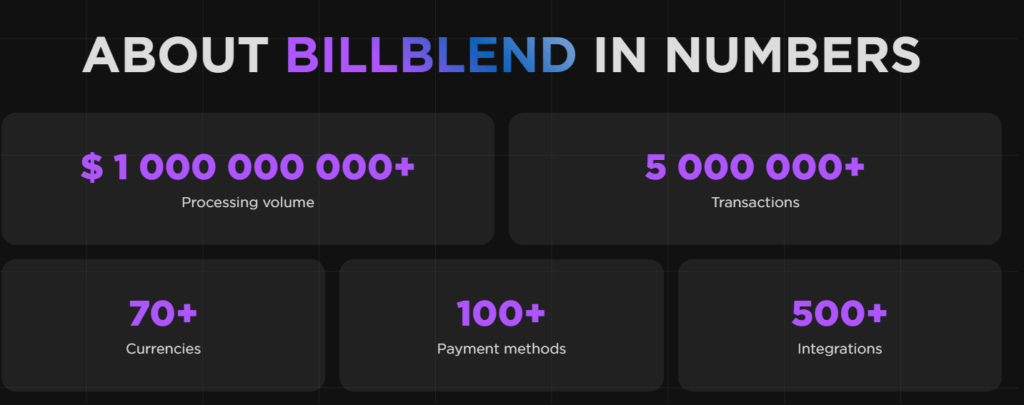

It is especially valuable to use a single service such as Billblend, which combines more than 100 payment methods, including support for various currencies and cryptocurrencies. Such a platform helps to speed up the launch of a new product on the market and reduce the cost of integrating individual systems.

The issue of security plays a huge role in consumer perception. Data breaches can lead to a loss of trust and a decline in sales. German laws impose strict requirements on payment security, with severe penalties for violations.

Billblend uses its own algorithm to monitor payment security. It allows you to:

- detect fraudulent transactions before they are completed;

- reduce the percentage of chargebacks, which is especially valuable if you work in a high-risk industry.

Find out more about integrating Billblend into your website or app with a free consultation. You will receive a personalised offer that takes into account the specifics of your business, support for popular payment methods in Germany, and your current turnover.

The future of online payments in Germany

More and more young shoppers prefer the convenient and intuitive interfaces provided by e-wallets and mobile devices. The gradual replacement of traditional methods with new forms of the German payment system will place an additional burden on the infrastructure and require investment in the modernisation of security systems.

Major players such as PayPal and bank cards will continue to shape the market, dictating standards and introducing new functionalities. The consolidation of efforts by banks and the technology sector will lead to the formation of a unified ecosystem that facilitates effective interaction between businesses and consumers.

Germany online payment methods are becoming a crucial component of the modern economy, determining the success or failure of businesses. Success depends on the ability to respond promptly to changes in consumer preferences and offer them convenient and secure payment methods. The use of specialised services, such as Billblend, can significantly facilitate the process of integrating and managing the most popular payment methods in Germany, improving overall business performance and strengthening its position in the market.

Answers to frequently asked questions

What types of online payments are popular in Germany?

The main payment methods in Germany are SEPA bank transfers, cards (debit and credit), e-wallets (PayPal, Google Pay, Apple Pay) and alternative methods.

What are the benefits of implementing online payments for businesses?

The main advantages are increased turnover, simplified payment procedures, savings in time and staff resources, and access to the international market.

What are the risks associated with online payments?

The main threat is related to data security breaches, which lead to a loss of customer trust and additional costs to restore reputation.

Should traditional bank transfers be abandoned in favour of online payments?

Completely abandoning traditional bank transfers is hardly advisable, as this form remains an important part of the payment ecosystem.

What is the role of small businesses in the era of online payments?

Small businesses can use modern technologies such as Billblend to successfully compete with large corporations and attract young consumers.

What measures are being taken to protect users?

Modern payment services such as Billblend use artificial intelligence and cryptography to detect and prevent fraud attempts.