Online payment methods in the UK

Digital payments are becoming increasingly popular among British consumers, as they allow for quick and convenient payment for goods and services online. Modern technologies ensure high transaction processing speeds, enhanced security, and user convenience. However, choosing the right payment methods UK requires an understanding of the characteristics of each solution, including its advantages and disadvantages.

In this article, we will look at:

- the definition of online payments;

- how online payment systems work;

- the characteristics of popular online services;

- the benefits for businesses;

- the best payment methods in the UK;

- problems with processing online transactions;

- future trends.

This article will serve as a useful guide for those who want to expand their business and offer their customers different payment methods in UK.

What is an online payment system?

An online payment system is a set of technical tools and processes that enable the processing of electronic financial transactions. These systems allow customers to make purchases easily and securely over the Internet, providing businesses with access to international markets and increased sales conversion.

Today, the market is saturated with various online services, such as:

- digital wallets;

- credit and debit cards;

- bank transfers;

- buy now, pay later;

- cryptocurrencies.

Each system has its own specific features and is suitable for different types of businesses. The choice of the right service depends on the size of the business, the type of products sold, and customer needs.

Please note that most used payment methods UK require a gateway, such as Billblend. The gateway acts as an intermediary between the payment system and the buyer. Without it, purchases cannot be made, as the gateway processes the details provided by the user. The service then verifies the information and sends a response confirming the transaction or refusing to debit the funds.

QR code payments

The online payment process consists of several stages:

- Initiation. The customer selects a product or service and initiates the purchase.

- Method selection. The system allows the customer to choose a convenient payment method (card, wallet, bank transfer).

- Verification and processing. The customer's data is transmitted through a secure gateway, verified by the bank and processed by the system.

- Сonfirmation. After successful verification, the customer receives confirmation of the completion of the transaction.

- Funds transfer. The funds are transferred to the seller's current account at the time specified in the contract.

Modern services strive to minimise the number of steps and speed up the process, increasing buyer confidence and reducing the risk of cart abandonment.

During the transaction, all data is encrypted and cannot be accessed by third parties. This protects both the user and the payment system. Depending on the UK online payment methods selected, rules for approving transactions may be established, such as entering a code from an SMS or a special application.

Do you have any more questions?

Fill out the form and we will contact you

*By submitting this application, you consent to the processing of your personal data in accordance with the privacy policy.

Key features of online payment services

When choosing a service, it is important to consider a number of key features.

Security

The security of customer data should be a priority for any service. Reliable providers use data encryption, two-factor authentication and fraud protection.

An example of a reliable service. Billblend is an innovative company offering a high level of data protection for transactions and modern risk analysis tools.

Efficiency

Efficiency is about the speed of processing and minimising failures. Services that support instant card verification and automatic order status updates increase customer satisfaction.

For example, Billblend provides fast integration with e-commerce sites and simplifies the setup process.

Support for multiple payment methods

By offering a variety of payment methods, businesses increase the likelihood of completing a transaction. Popular methods include bank cards, e-wallets, mobile apps, and even cryptocurrency.

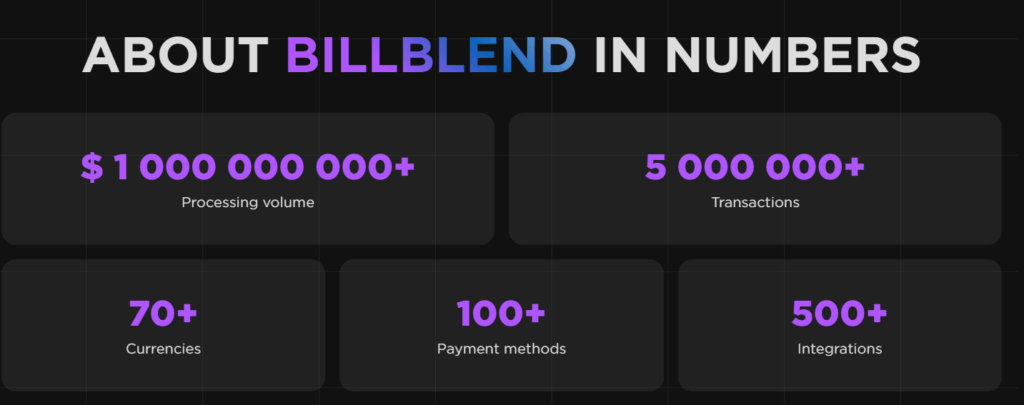

With Billblend, you can choose to work with multiple currencies and payment methods at once. The gateway supports over 100 methods and 70 currencies, including cryptocurrency transactions.

Optimisation

Optimised interfaces improve user experience and reduce cart abandonment. The ease of placing an order and the absence of unnecessary fields significantly affect the success of transactions.

Multi-currency

For companies operating in the international market, support for multiple currencies is critical. The ability to convert currencies directly during the payment process increases the attractiveness of the site for foreign customers.

Billblend supports international transactions and automatically converts currencies, eliminating inconvenience for customers.

Reporting and support

Reports and analytics help entrepreneurs track sales, identify weaknesses, and improve processes. The availability of qualified support services contributes to the rapid resolution of emerging issues.

The Billblend platform provides detailed statistics and reports, helping business owners analyse financial performance.

Who can benefit from online payments?

Any business operating in a digital environment can benefit from implementing traditional and alternative payment methods UK. Let’s look at the key categories:

- E-commerce. Companies that sell goods and services through online stores benefit most from integrating high-quality payment systems.

- High-risk business. Companies that work in the sports betting or gambling industry, poker rooms, casinos, gaming sites, and other areas. Billblend specializes in this area, so it knows all the features of payments for high-risk trading accounts.

- Subscription services. Businesses offering subscriptions to products or services benefit from the automation of regular payments.

- Retail stores. Integrating online payments helps offline stores develop their online presence and attract new customers.

- Consultants and freelancers. Using payment acceptance platforms improves the customer experience and speeds up the receipt of money.

Online payout options are suitable for virtually any type of business seeking to increase profits and improve customer service.

The five best payment methods in the UK

Shoppers in different countries prefer different methods. In some places, national services play an important role, while in others, international platforms are used. We have identified the five most used payment methods in the UK. We will discuss them in more detail below.

Debit and credit cards

Traditional forms of cashless payments remain the most popular in the UK. According to a Zilch survey, about 66% of the population prefers to pay by card. Major market players such as Visa and Mastercard offer numerous additional options to enhance the convenience and security.

Digital wallets

Electronic wallets such as Apple Pay, Google Pay and PayPal are gaining popularity due to their ease of use and increased protection of personal data. They allow you to store your card and passport inside your mobile device, simplifying the payment process.

BNPL (Buy Now, Pay Later)

Buy Now, Pay Later solutions have become popular among young people and middle-aged people who prefer to spread their expenses over a comfortable period of time. For example, the Klarna service allows you to purchase expensive goods with the option of paying off the debt in equal instalments.

Bank transfers and direct debits

Bank transfers remain the traditional way to transfer large sums of money and are especially popular among small and medium-sized businesses. Direct debits are convenient for regular payments of bills, subscriptions, and utilities.

Open Banking

This technology provides access to bank account information through secure API interfaces, allowing you to make fast and reliable payments directly from your bank account. For example, using bank apps allows you to instantly pay bills, book tickets or buy products through an online store.

Each UK payment method has its own unique characteristics and target audience, which entrepreneurs must take into account when developing a strategy to promote their business.

Common problems with online payment processing

Despite the growing popularity of UK online payment methods, there are some difficulties that businesspeople face:

- High commissions. Some providers charge high interest rates for each transaction, reducing the entrepreneur's income.

- Security issues. Data breaches lead to financial losses and loss of customer trust.

- Technical glitches. Periodic server failures can slow down transaction processing and cause customer dissatisfaction.

- Lack of flexibility. Limited currency or country support makes it difficult to conduct international business.

The future of online payments in the UK

Technological developments will continue to shape the landscape of different payment methods in the UK in the coming years. Future trends will include:

- the increasing role of mobile devices;

- enhanced security measures and the fight against cybercrime;

- an increase in the number of users of alternative payment methods in the UK and BNPL solutions;

- the growth in the use of open banking technologies and instant transfers.

These changes will lead to increased efficiency and accessibility of online payments, creating new opportunities for businesses. Using a quality service such as Billblend will allow your business to grow confidently in today’s economy, attracting more customers and increasing profits.

Frequently asked questions

What are online payments?

This is an electronic form of payment that allows buyers to make payments via the internet without leaving their homes.

What types of online payments are there?

There are several types: bank card, digital wallets, direct transfer, BNPL services and open banking technologies.

Why is it important to choose the right payment method?

The right choice affects conversion rates, customer loyalty and overall business profitability.

What are the pros and cons of credit cards?

The advantages include familiarity and reliability, but high fees reduce profits.

Which service is right for my business?

To choose the best service, it is recommended to conduct a comparative analysis of the offers on the market, taking into account the needs of your audience and the specifics of your business.