According to experts, in 2025, the country’s payment market volume amounted to $1.07 trillion. Over the next five years, annual growth of 16.44% is expected, and by 2030, the market will amount to $2.29 trillion. It is important to note that the vast majority of transactions are carried out using non-cash payment methods – debit and credit cards, e-wallets, and cryptocurrency. The New Payments Platform (NPP) has a significant impact on the development of contactless payments. As of April 2025, more than 25 million PayID identifiers are registered in the payment system – a number that allows you to transfer and receive funds.

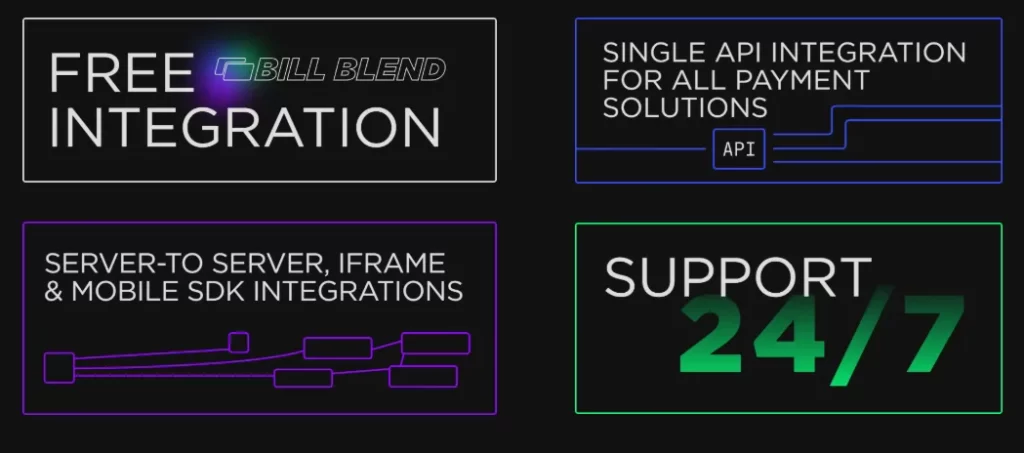

Understanding the structure of online payment methods in Australia is important for entrepreneurs who plan to work in the country or accept payments from Australians. To run an online business, you need a payment gateway to process transactions. One of the most popular in the country remains Billblend. It is a payment gateway for working with high-risk businesses. Billblend accepts payments not only in Australian dollars, but also in more than 70 currencies, including stablecoins.

In this guide, we will talk about popular payment methods in Australia and the reasons for their popularity.

Fill out the form and we will contact you

Australia is one of the world leaders in electronic payments and digital commerce. Payment technologies are developing rapidly thanks to high internet penetration rates (over 96%) and the widespread use of smartphones. Let’s take a closer look at which online payment methods in Australia are currently the most popular in the country.

Understanding the structure of popular payment methods in Australia is important for developing an online business. The growing popularity of fast transfers and digital wallet payments cannot be ignored. It is important for entrepreneurs to choose a payment gateway that supports all of these payment methods. This will allow them to satisfy the demands of both younger audiences and older customers.

Australia is actively developing advanced payment technologies that allow it to adapt to the changing conditions of international financial relations and the needs of the domestic market. All this makes monetary transactions easier, faster and safer. Here are the most notable solutions shaping the country’s modern financial landscape.

NPP is a national instant payment system operated by New Payments Platform Australia Ltd. This infrastructure processes more than 2 million transactions daily and connects approximately 72 million users. The platform was developed by Australian Payments Plus and became the basis for a number of innovative products, such as PayID and PayTo. Thanks to NPP, users can instantly send money between accounts, regardless of bank working hours.

PayID is a unique identification service that is part of the NPP. Users can link a simple identifier (such as a mobile phone or email address) to their bank account, eliminating the need to remember long BSB details and account numbers. This makes money transfers simple and convenient, even for those who rarely use banking services. By April 2025, the number of registered PayIDs exceeded 25 million, demonstrating the high level of acceptance of the technology by the population.

PayTo is a new standard for regular automatic payments developed on the NPP platform. This service is designed to replace traditional direct debits and offers customers a secure and convenient way to make regular payments, such as utilities, subscriptions and rent. PayTo guarantees transparency and control over regular payments, allowing them to be easily managed directly from the bank’s personal account.

More than 70% of Australian companies successfully use QR codes to accept payments. Buyers scan the code with their smartphone and instantly make a payment through their bank’s mobile app or digital wallet. This technology speeds up customer service and reduces the cost of equipment for retail outlets.

Biometric methods of identity verification (fingerprint, face and voice recognition) are widely used, providing increased security and convenience for users. Most major banks and payment apps offer this option to their customers, reducing the need to enter passwords and PIN codes.

Process automation and fraud prevention have become possible thanks to the use of AI solutions. Machine learning helps identify suspicious transactions in real time, reducing the risk of losses for consumers and organisations.

Although cryptocurrencies still occupy a small share of the market, blockchain is actively used to optimise international transfers and increase the transparency of financial transactions. Australians are showing considerable interest in crypto wallets and investments in digital assets, which is stimulating the development of relevant legislation and infrastructure.

In Australia, cryptocurrency is permitted as a legal tender. In 2026, a bill regulating AML and CTF security standards is expected to come into force. Australia plans to implement the Crypto Asset Reporting Framework (CARF) to improve tax reporting on crypto asset transactions, with the aim of exchanging information between tax authorities by 2027.

The concept of tokenising personal data is gaining popularity, protecting users’ confidential financial information. At the same time, Strong Customer Authentication (SCA) requirements are being introduced, in line with European PSD2 standards, increasing the security of online payments.

Open Banking gives third parties access to users’ financial data with the permission of the data owners themselves, stimulating competition and the emergence of new financial services. The Australian Payments Association (AP+) consolidates the efforts of market participants to further improve the national payment infrastructure.

Payment technologies are transforming Australians’ financial behaviour, making payments faster, safer and more convenient. Developments such as NPP, PayID, PayTo, QR codes, biometrics, artificial intelligence and blockchain are helping to improve economic efficiency and quality of life for citizens. Australia continues to be a leader in the adoption of cutting-edge financial technologies, setting the tone for global trends in payments.

Billblend is a leader in payment solutions for businesses. We integrate financial products into various platforms, offering consumers and businesses a convenient, personalised and seamless e-commerce experience. This allows you to increase customer engagement, expand your business reach and optimise your offerings with reporting data.

The choice of online payment methods in Australia is determined by a number of factors reflecting the characteristics of technological progress, regulatory policy, business behaviour, and personal consumer preferences.

The high degree of digitalisation in society has a significant impact. Wide Internet access (about 96% of the population) and the widespread use of smartphones have made digital payment solutions, such as mobile wallets and QR codes, extremely attractive and convenient for most Australians.

Government regulation plays a key role. Legislative initiatives aimed at protecting consumer rights and improving security strengthen confidence in modern payment instruments. Examples include the Central Bank Digital Currency (CBDC) project and reforms limiting additional fees for using different types of cards.

The business community is also actively contributing to the introduction of new payment technologies. Services such as Buy Now, Pay Later (BNPL), which offer convenient interest-free instalment plans, have become particularly popular. Such solutions increase the appeal of online shopping and simplify the process of making expensive purchases.

The business community is also actively contributing to the introduction of new payment technologies. Services such as Buy Now, Pay Later (BNPL), which offer convenient interest-free instalment plans, have become particularly popular. Such solutions increase the appeal of online shopping and simplify the process of making expensive purchases.

Individual consumer preferences have a significant impact on the choice of payment methods in Australia. The younger generation traditionally gravitates towards digital solutions such as contactless payments and mobile apps, while the older population often remains committed to the traditional use of credit and debit cards. The most important criterion for all consumer categories is transaction security, which is ensured by modern biometric authentication and data encryption technologies.

The Australian payments market is undergoing a period of rapid change, characterised by a mass shift from traditional cash payments to digital technologies. High internet penetration and widespread smartphone adoption have created the ideal conditions for the rapid spread of innovative payment solutions. Among the many new products, Billblend stands out as a service that provides users with a convenient solution for managing accounts and making payments in a single interface. Its integration with various service providers makes life much easier for consumers, saving them time and resources.

The Australian payments market is undergoing a period of rapid change, characterised by a mass shift from traditional cash payments to digital technologies. High internet penetration and widespread smartphone adoption have created the ideal conditions for the rapid spread of innovative payment solutions. Among the many new products, Billblend stands out as a service that provides users with a convenient solution for managing accounts and making payments in a single interface. Its integration with various service providers makes life much easier for consumers, saving them time and resources.

The future of online payment methods in Australia looks promising: digital wallets are expected to further strengthen their position, services such as ‘Buy Now, Pay Later’ are expected to grow in popularity, and the volume of cross-border e-commerce is expected to increase. Active government support for innovation and consumer protection create a solid foundation for the sustainable development of the industry.